Pound is plunging on the news

The Pound Sterling continues plummeting against the USD; by now, it has already dropped to 1.1660.

Apart from the strong USD factor, the Pound is being significantly pressured by domestic news. Britain's energy regulator announced Friday that energy bills for households in the UK would rise by 80% in October. In response to that, the HM Treasury said that it was thoroughly working on developing new options to support households and defuse cost loading from energy price surges. However, all these words didn’t help the Pound at all.

The bearish pressure on the Pound is currently too strong to expect a quick and miraculous recovery.

Systematic issues inside the British economy might seriously escalate in the near future due to the energy crisis, making the national currency much cheaper.

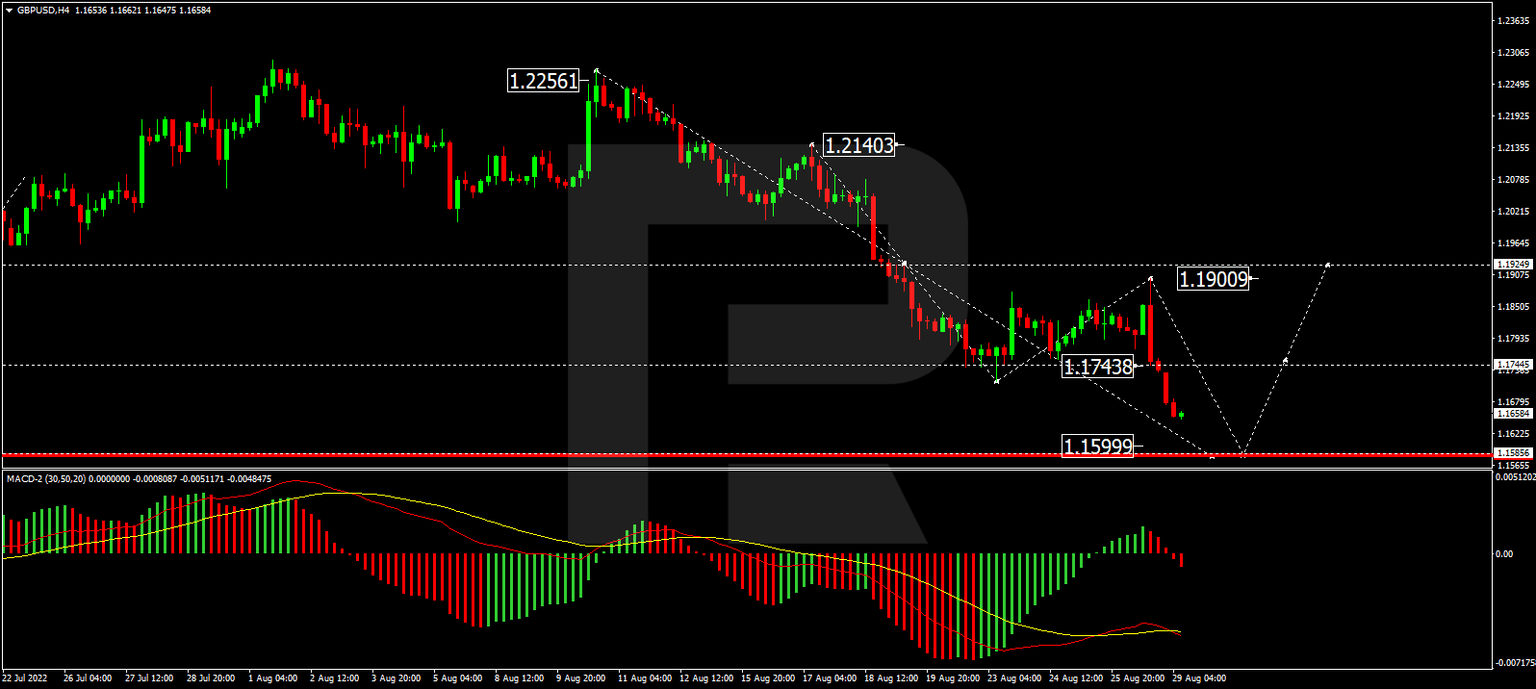

As we can see in the H4 chart, having finished the correctional structure at 1.1900 and rebounded from this level, GBP/USD is forming a new descending structure towards 1.1600. Later, the market may start another correction to reach 1.1750 and then resume trading downwards with the target at 1.1550. From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving below 0 and may continue falling to reach new lows soon.

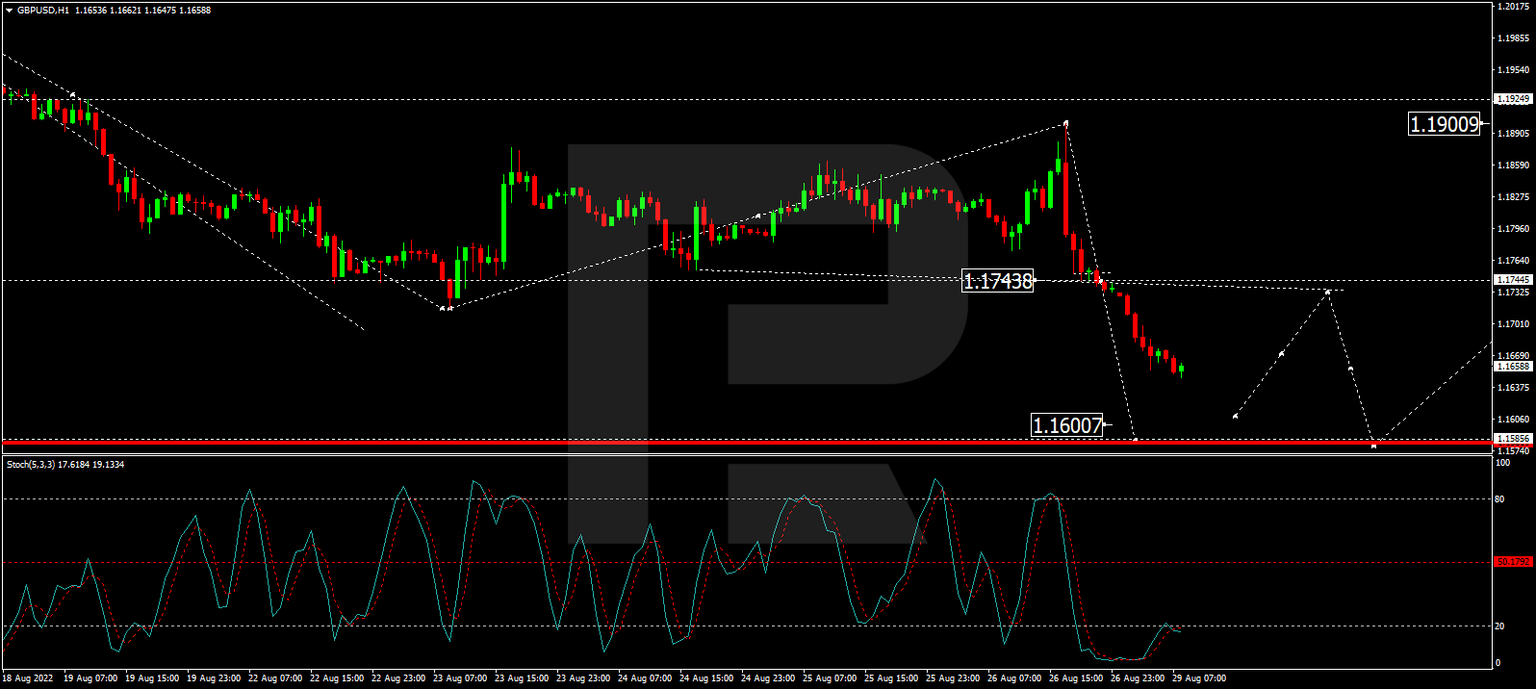

In the H1 chart, after completing the correction at 1.1900, breaking the correctional channel at 1.1744, and then forming a new consolidating range there, GBP/USD has broken it downwards and may continue falling towards 1.1600. Later, the market may correct to test 1.1744 from below and then resume trading downwards with the target at 1.1550. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: its signal line is moving below 20. In the future, it may grow to rebound from 50 and resume falling to return to 20.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.