FX market developments

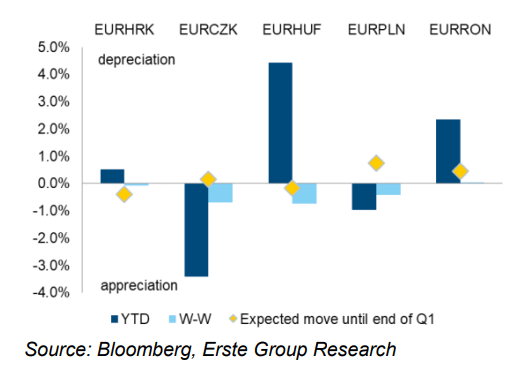

As the USD appreciated to levels not seen for nearly three years, CEE currencies also moved – but this move was, counter-intuitively, appreciation. We think this has to do with inflation reaching levels not seen for nearly a decade, and markets could think that central bankers may react. The CNB and MNB already did this; the former in a transparent fashion, the latter in a much more nontransparent way. Thanks to this, the forint nearly became the best performer last week. The Polish zloty also gained, despite the fact that the NBP is unlikely to hike. We think that the zloty, forint and koruna are all unlikely to gain in the near future, but the CZK could appreciate later this year.

Bond market developments

Bund yields finished the week close to levels where they started it, but some CEE countries showed stronger moves. 10Y HGB yields went up substantially, thanks to the MNB making it clear that they are already tightening and are willing to continue if needed. Shortterm rates also went up, which makes us think that the 3M Bubor could be around 70-80bp in the rest of 2020. Polish yields went up a bit too, but this move was much smaller. ROMGB yields continued to edge down, amid strong demand at bond auctions. We are thinking about our yield forecasts, but want to highlight that a 40% pension increase is still penciled in as of September. In the meantime, the budget deficit was already above 4% of GDP last year.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

AUD/USD recovers above 0.6750 after Australian jobs data

AUD/USD picks up a late bid and recovers above 0.6750 in Asian trading on Thursday, following the release of mixed Australian employment data. The extended post-Fed US Dollar recovery, amid a cautious market mood, could limit the pair's upside ahead of US data.

USD.JPY jumps toward 144.00 on the road to recovery

USD/JPY gains traction and approaches 144.00 in Thursday's Asian session. The uptick of the pair is bolstered by the impressive US Dollar recovery. Investors shift their attention to the US data and the Bank of Japan interest rate decision on Friday.

Gold price remains on the defensive amid the post-FOMC USD recovery from YTD low

Gold price struggles to lure buyers despite the Fed’s jumbo interest rate cut on Wednesday. A further recovery in the US bond yields underpins the USD and caps the non-yielding metal. Concerns about an economic slowdown, along with geopolitical risks, help limit the downside.

Ethereum attempts recovery following first rate cut in four years

Ethereum is trading above $2,330 on Wednesday as the market is recovering following the Federal Reserve's decision to cut interest rates by 50 basis points. Meanwhile, Ethereum exchange-traded funds recorded $15.1 million in outflows.

Australian Unemployment Rate expected to hold steady at 4.2% in August

The Australian Bureau of Statistics will release the monthly employment report at 1:30 GMT on Thursday. The country is expected to have added 25K new positions in August, while the Unemployment Rate is foreseen to remain steady at 4.2%.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.