Polish Zloty (EUR/PLN) – no chance for PLN appreciation?

When it seemed this week is going to be just interesting, the Bank of Japan decided to introduce negative interest rates at the same time keeping its QE program at the same level. Such move obviously has increased volatility on financial markets, which already has been high. The Zloty market though calmed although the PLN remains under pressure. After S&P’s Polish debt downgrade the previous week, this time the Fitch ratings agency warned that it might also lower its rating. The agency sees danger in increased government spending, which could increase the budget deficit to over 3% of GDP (above the EU requirements). Also, the economy might get hit if the government decides to introduce the bailout package designed to help Swiss franc denominated mortgage holders. The bank sector is already under pressure because of the expected introduction of the bank tax (which is expected to take away around 25% of the banking sector profits). If the so-called “Swiss Franc Act” is introduced, the effects on consumers and the economy can be serious. Sure, banks have been profitable and many citizens believe finally they will pay back something to the society but I still believe it is a really bad idea. If introduced, all of will have to pay for the government’s decision. In this situation, macro data publications are rather ignored by traders although we have to note that the unemployment rate has slightly increased in December to 9.8%. The Zloty kept trading in a rather narrow 4.45 – 4.50 range.After reaching 4-year highs above the 4.50 level, the market eased down and the Zloty regained some value. Still, it was unable to break the 4.45 support and it stayed in the mentioned range. What’s next? Again, hard to say. Breaking the support should pull the market back to 4.43 with the ultimate target of 4.40. The stochastic oscillator has no clear signal, although it is close to the “oversold” area. If the market turns around, we should see another test of 4.50 next week.

_20160129163845.png)

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Huge opportunity for the Forint

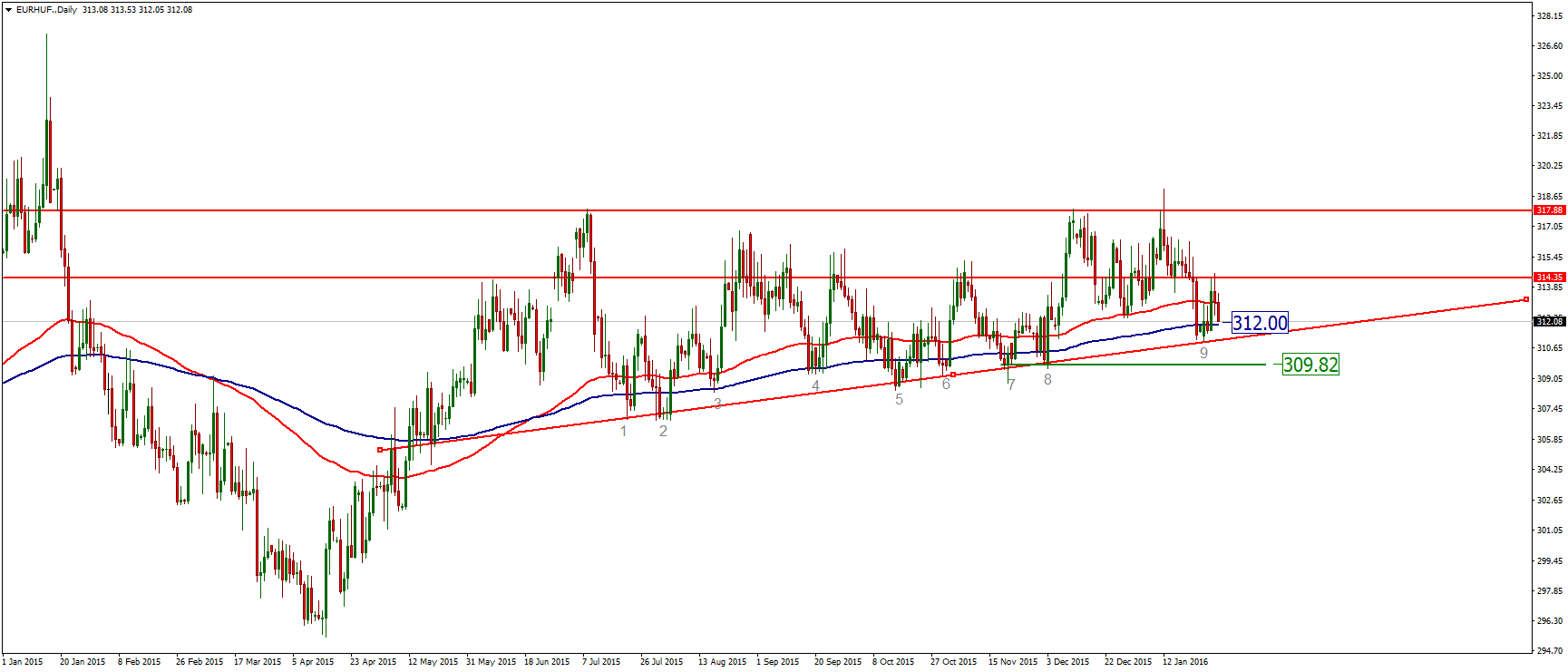

As the market and analysts expected, the Monetary Policy Council (MPC) of the National Bank of Hungary (MNB) decided to keep the bank’s key rate on hold at 1.35%. However the Monetary Council of Hungary’s central bank constantly monitors whether the resulting looser monetary conditions ensure a sustainable achievement of the inflation target. Obviously MNB also had to lower its interest rate path projection several times due to the fall in oil prices, until it decided to lower rates again after the publication of its Inflation Report in March. Hungary’s inflation could slump back to negative territory by the summer as the price of oil remains below USD 60 a barrel in the base period. Therefore the million-dollar question is whether MNB can avoid a situation where it has to resume its rate cut cycle for the third time in order to achieve its inflation target?Price of EURHUF is retracing near the area of 312 that is now an important support (200 DEMA). If the support area breaks then we would be trading with the path of least resistance toward 310 support. As long as we get lower lows and higher highs only short trades are suggested. Actually now the currency pair is really close to a possible breakdown at 312 that would be the 10th time in the past half year only.

Pic.2 EUR/HUF D1 source: Metatrader

Romanian Leu (EUR/RON) – Tantalizingly close to upper bound

The interest rates continued to move lower in the interbank market, reaching record lows on some maturities, such as 0.85% for 3 months, but with the European traders focused on more easing from the ECB, the net effect was not very clear. The local data has been mixed, with a 3.8% jump in building permits throughout 2015 and a 6% jump m/m in December, while the qualitative overview of perspectives turned dimmer in retail (from stable to decreasing) and services (from increasing to stable). Overall we continue to see a decent growth this year, significantly above 3%, but at the cost of a diminishing buffer for macro stability. Since the market errs more on the side of prudence these days, focusing on the risks, not on the growth potential (as it would have done a few years back), RON is playing defensive, and EURRON moves closer to the 2014 high of 4.55, but only at a painfully slow pace. The pressure may continue to be on the same side next week.Technical perspective suggest heavy pressure on 4.54 ahead, with the uptrend line providing support around 4.52 in the first few days of the week. Time for a decision will come soon, but option are more numerous than at first sight: the technical preference may go towards breaking 4.54 and moving in a brisk step toward 4.55 (although the record highs around 4.65 are not far away) while the second is, in our view, not a reversal to the downside, but a redrawing of the pattern in a more rectangular shape, limited by 4.516 or possibly 4.5000. A break of 4.5000 does not seem very likely at this point, and given the right stimuli, the market may gradually move a bit higher.

_20160129164127.png)

Pic.3 EUR/RON D1 source: xStation

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.