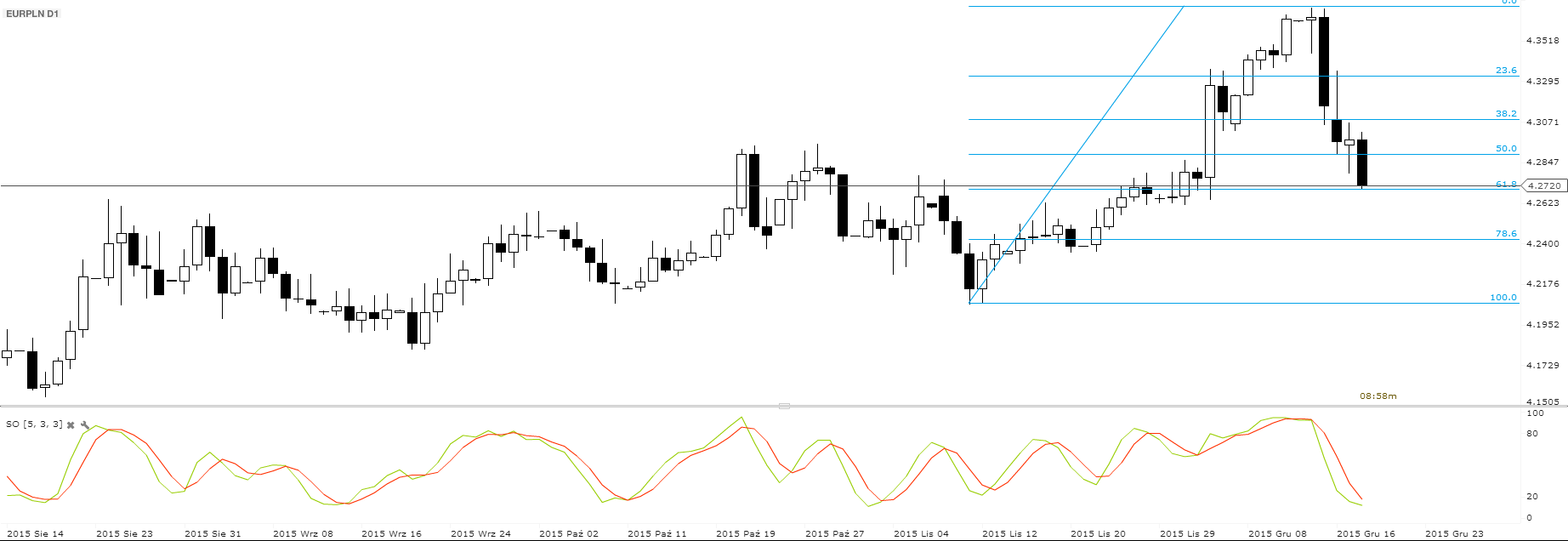

Polish Zloty (EUR/PLN) – back to 4.30

It was the week of the Fed. Interest rates were raised in the U.S by 25 bp for the first time in 9 years. Despite the fact that this move it was widely expected, it cause volatility on the markets. To be honest, I have expected the Fed will wait till new year with increasing the cost money. We got it for Christmas though. This proves that the U.S has recovered and that the economy is back on track. EM currencies reacted and most of them strongly appreciated. The Zloty kept gaining too, despite the mixed macroeconomic data from the economy. The CPI inflation in November stood at -0.6% (yearly basis), which was lower than expected. The Core CPI reading showed 0.2%, also lower than forecasts. Poland is still experiencing deflation, which was confirmed by the PPI reading, which stood at -1,8%. On the other hand, average wages grew in November move than analysts’ expectations – by 4%. Also, industrial production increased by 7.8%. The drop in retail sales by 5.9% should be made up in December. So we see that the MPC has a hard task for 2016. The thing is that most of its members will be exchanged soon and the Committee will meet in January for the last time in its current composition. There are news that the ruling party (rightist Prawo i Sprawiedliwość – Law and Justice) is looking for future members that have a tendency to be more dovish. So are interest rates cuts possible next year? Yes. The government is surprising economists with its shocking ideas so cutting interest rates to lower levels than the current 1.5% is possible. Of course, the MPC is an independent body. Its independence though, depends upon who are its members…The EUR/PLN reached its 2015 highs of 4.37 but was unable to continue higher. A strong corrective movement brought it back to the crucial 4.29 - 4.30 support (which is the 50% retracement level of the last upward impulse), which was broken and took the market down to 4.27. The stochastic oscillator is telling us this is a good time to attack higher levels (the market seems oversold) with targets of 4.30 and 4.33. If the EUR/PLN continues its downward move, the next targets for the market will be 4.24.

Pic.1 EUR/PLN D1 source: xStation

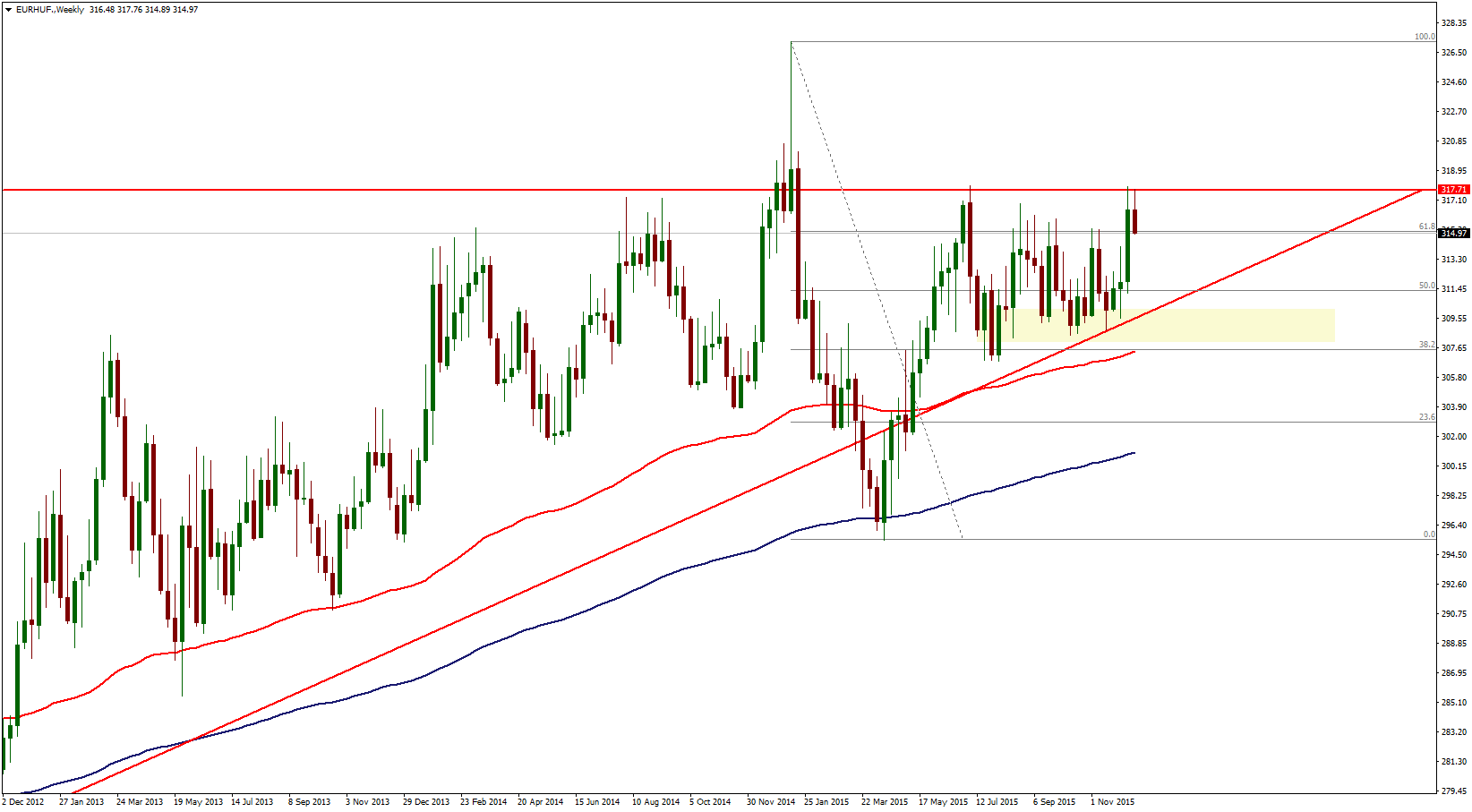

Hungarian Forint (EUR/HUF) – Forint regains its power

The National Bank of Hungary (NBH) is still considering making amendments to its self-financing program. Probably, we will have to wait for the official announcements until early 2016. Anyway, MNB’s Deputy Governor, Márton Nagy, said that the central bank’s goal remains to make sure banks buy government securities instead of "parking" their excess cash, with the primary goal being to spur the sale of long-term bonds. He also highlighted that the NBH would use the instrument of interest rate swap (IRS) more actively in the future. Additionally, the Forint got a positive impulse from macro data publications on Friday. It seems in October 2015, the volume of retail sales increased by 4.1% according to raw data and rose 4.6% adjusted for calendar effects compared to the same period of the previous year. In the January-October period of 2015, sales rose by 3.5% (yearly basis) in food, drinks and tobacco stores, by 7.8% in non-food retail trade and by 7.6% in automotive fuel retailing.Right after the FOMC statement, the EUR/HUF dropped down a little bit to 315. A consolidation pattern visible on the weekly chart what can maintain the Forint power. Using the Fibonacci retracement tool on the latest swing high and low shows that it lines up with the 61.8% Fibonacci level again. This also coincides with the 315 minor psychological mark. In a nutshell, Euro bulls lost an important battle at the 318 resistance again.

Pic.2 EUR/HUF W1 source: Metatrader

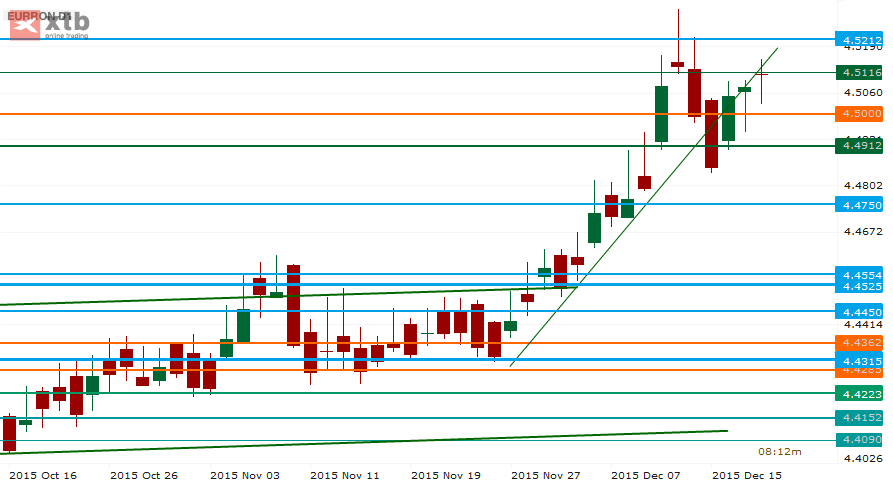

Romanian Leu (EUR/RON) – EUR not letting go

The seasonal pattern favors the RON at this time of the year.. but not this time. A short move below 4.49 did not lead to any serious follow-up. The President has asked the bank law that may bring about significant losses to the system be reconsidered. The budget however is based on a GDP growth of 4.1% and estimates (hopes, one would say) that the deficit will be below the promised 3% even in European (ESA) methodology. The total effect of higher wages and lower taxes is about 20 bn. RON, or 4.44 bn. EUR, aprox. 2.5% of GDP. With 1 year T-bills sold for a yield of less than 1%, a record low, at the latest auction, there may be not enough yield to compensate for the risks ahead. This may be an ominous sign not just for RON but for global risk sentiment and especially the capital markets in 2016.In the short-run we see however some FX flowing into the country before Christmas, meaning a push below 4.50 could happen.

Technical analysis provides now a more confusing picture. The previous spike ended with a shooting star, and the market reversed in due course. The traders have then re-tested the previous trendline, and the market is still mostly playing below that trendline. EUR/RON is now in the midst of a drawing initiative for a new range, between 4.4832 and 4.5212, and this is likely to be the playground for next week. If need be, a RON appreciation below 4.4832 may take us to 4.4750. Resistance is to be found at 4.5212, the local high at 4.5294 and 4.5350.

Pic.3 EUR/RON D1 source: xStation

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.