Polish Zloty (EUR/PLN) – reacting to external data

The financial world is focused on the Fed and the decision regarding its monetary policy. It is now less likely the U.S central bank will hike interest rates in October, and the market started discounting that scenario after weaker jobs data. The USD has however been gaining against most currencies this past week and this also had effect on the PLN. On the local market we only got the Manufacturing PMI data – the reading for September was 50.9 points, which was lower than expectations. An interesting report about the Polish economy has been published by the Moody’s. According to the global rating agency, the local economy will grow by 3.5% this year and 3.4% in the upcoming year. The economic growth could be interrupted by political issues in the midterm. Also, the A2 rating perspective for Poland looks stable. Interest rates should stabilize in the future. So in the summary, a bright future awaits the economy. Again, news like this are interesting but are rather ignored by speculators. As the monetary policy of the local MPC seems pretty clear (no interest rate changes for a prolonged period of time), traders focus on external data, although, due to the weakness of the economy (still in deflation…) there are some voices that maybe the MPC will cut interest rates one more time. I do not think such scenario is possible, at least not this year. On the other hand, it is still possible that in the months ahead interest rates in the U.S would increase, despite the recent weak NFP, so markets would move accordingly.

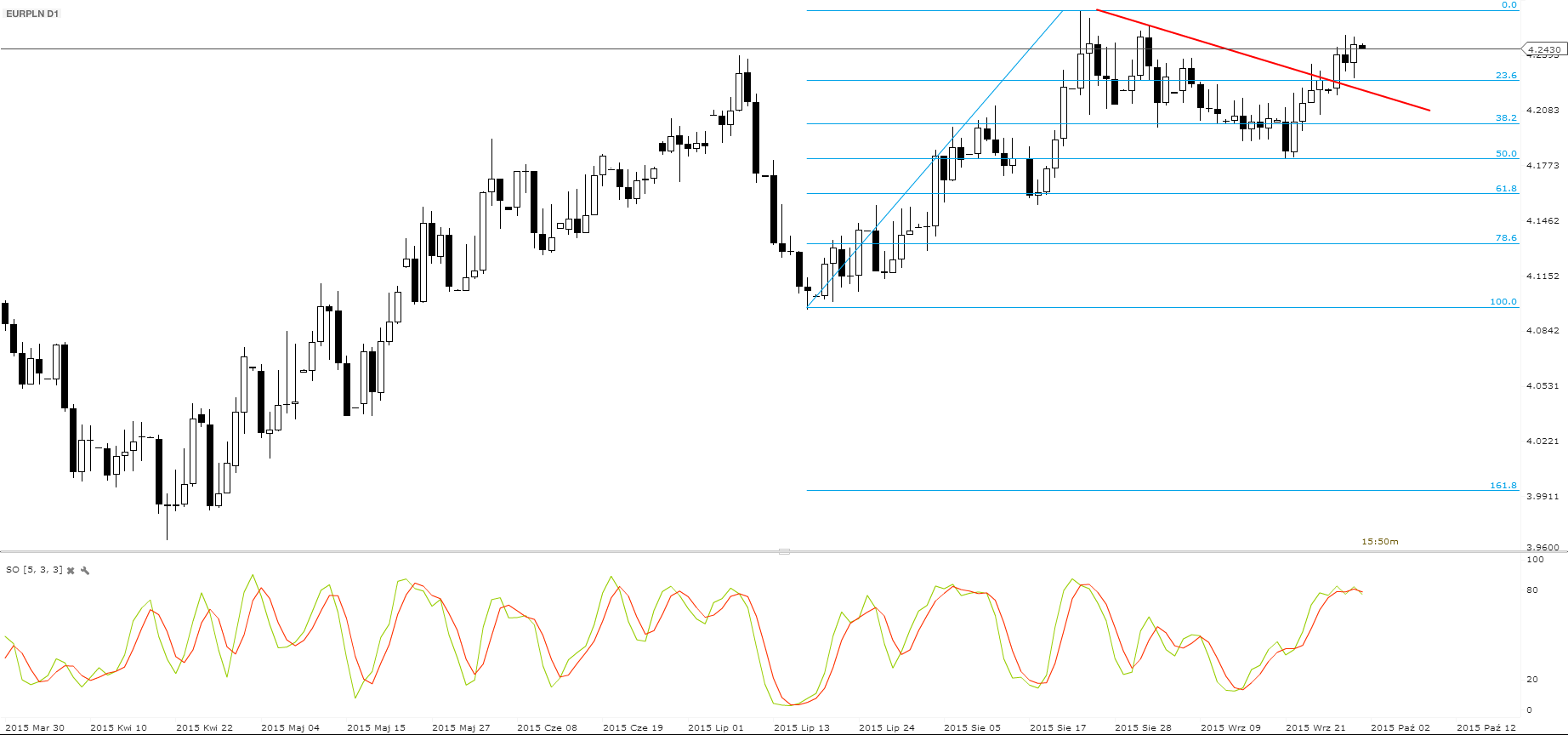

As we see on the daily chart, the EUR/PLN broke the 4.2250 resistance (and the downward short-term trendline) on Monday and reached a 4.25 weekly high. It is still possible the market will attack August highs of 4.2644. On the other hand, if the market falls (as the stochastic oscillator suggests), it will have to break the 4.2250 support in order to reach 4.20.

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Euro backflip

The economic performance of countries in the region has been improving, but the next six months will be critically important for the future of the Hungarian economy. Prime Minister Viktor Orbán’s cabinet chief said this week that the government will examine what measures are needed to keep GDP growth over 2%. János Lázár, the minister leading the PM’s Office talked about the negative impacts of Volkswagen’s emissions scandal on the Hungarian economy and the risks of China’s economic downturn. Concerning the latter issue, Lázár has announced the foundation of a new state investment fund aimed at speeding up the absorbtion of EU funds. The cabinet will review together with the Hungarian Banking Association how could corporate lending be strengthened in the first half of 2016. Next week there will be news about inflation, retail sales and manufacturing. After these fundamental infos we will be smarter; for now anyway the Forint seems stable around 312 against the Euro.

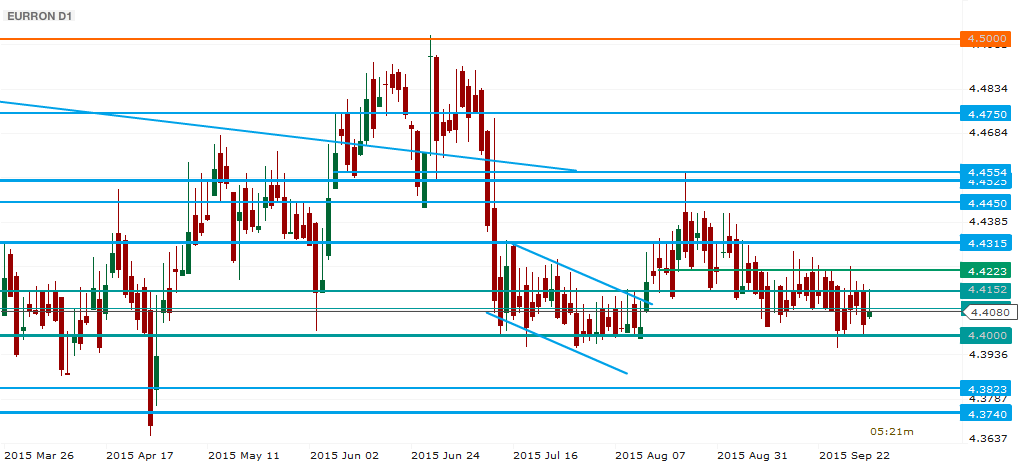

From a technical perspective the currency pair turned back this week and reached a 2 weeks low at 312. Before the NFP data Euro is hesitating in what could be a good handrail for the Hungarian currency. Under 100 EMA and the 313 resistance there are some opportunites for the Forint bulls to pull down the price to 310.

Pic.2 EUR/HUF H4 source: Metatrader

Romanian Leu (EUR/RON) – When one side is forbidden, the market awaits

There has been a series of attempts recently to break below 4.4000, but either the shyness of the market or the BR discrete action prevented such an outcome. The NBR overtly decidede to do nothing on the interest rate front, maintaining the decades-low 1.75% and also the same reserve requirements. Politically there has been a bit of noise, but the traders decided to focus on the underlying strength, shown by retail growing at a 8% m/y and with good perspectives ahead, as the more stimulative fiscal policy kicks in. A further drop in PPI, now at the lowest levels in more than 10 years did nothing to scare the market, as downside pressures are seen as temporary. There has been a proposal to sign a new preventive deal with the IMF, but without including a budget deficit target. This is difficult to be seen in practice, and would probably not be of a great help in protecting the RON downside if the sentiment shifts. For the time being, as the search for yield has not yet moved to the history books, the Leu may find it cozy to trade around 4.4000 – 4.4200.

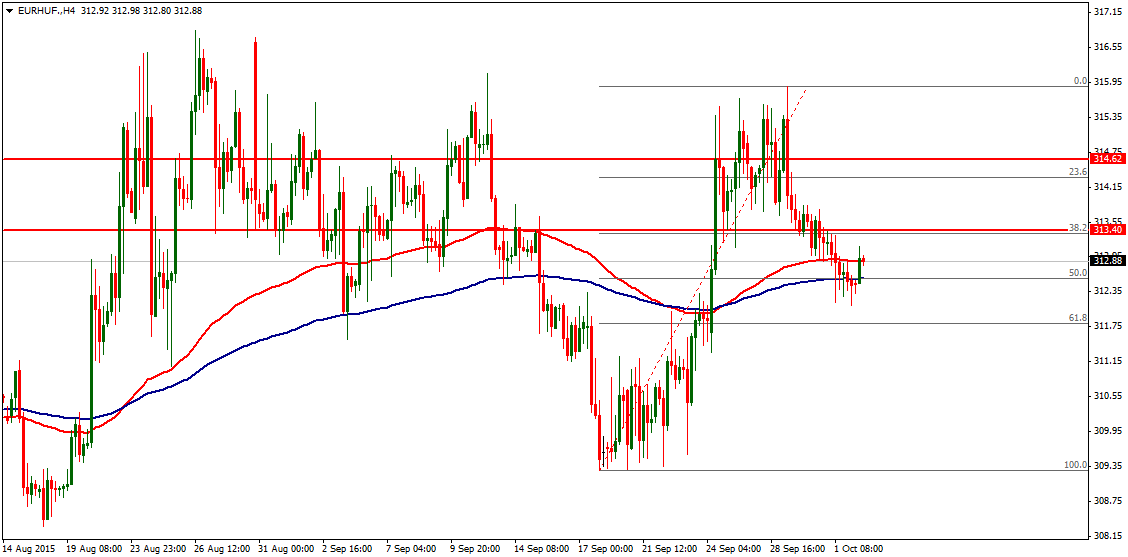

In the technical area, the vaguely sliding pattern is a type of downtrend channel, if your imagination allows for spike smoothing. On the path of least resistance may lie a test of the 4.4000 support, but the most likely scenario, technically speaking, is a range between 4.4000 and 4.4223. A slide below suport may bring forward a touch of 4.3823. On the upside (favored in the medium term) the resistance is at 4.4315 and further arund 4.4450.

Pic.3 EUR/RON D1 source: xStation

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.