Polish Zloty (EUR/PLN) – A barometer of Ukraine

Volatility on the PLN market remains rather low. The recent movements were caused by external factors as no crucial macro data has been published.There is not clear view about the MPC's monetary policy. On one hand the economy is stable but inflation remains low. Deflation is rather not a threat but the chances for one more interest rate hike are much higher nowadays. Probably it will not happen on the next MPC meeting but closer to the year-end. The Zloty has been gaining throughout the week despite the poor performance of global equities markets. The reason? It seems that the situation in Ukraine is stabilizing. Ukrainian bond yields have declined confirming that the threat of war is diminishing. Currencies from the region are gaining due to improved market sentiment towards eastern markets.The EUR/PLN broke the support of 4.14 on the daily chart reaching weekly lows just above 4.12. If this level is broken, the market will target 4.09. If the market rebounds more than what it already did, the upward move could take the EUR/PLN even to the 4.16 resistance.

Pic.1 EUR/PLN D1 Chart

Hungarian Forint (EUR/HUF) – Higher again, with further easing coming

EUR/HUF currency rate is hesitating now around 310. Last week it reached the top of around 312, later retreating to 308. The reason for the weak currency is still the replacement of foreign currency loans. Last Friday the Hungarian Parliament voted the implementation of debt relief package, a cause for big losses for the commercial banks. According to the calculations of Moody's, around 806 billion HUF loss may hit the domestic bank sector. On Wednesday we looked into the Hungarian National Bank's statement about the last interest rate meeting and between the lines we could see some words which let us know that further easing is coming. Also reinforcing us in this idea is the CPI data, which was published Friday morning. After the latest -0,1% now it is -0,3% Y/Y, so prices remain on the downtrend, which provides more space for easing. Mr. Ferenc Gerhardt, the vice president of NBH said that interest rate won't go under 2%. Earlier we could read some wilder expectations, so now these words can provide a support for HUF. He also mentioned that 315 level of EUR/HUF is inconvenient for the National Bank, so we can expect monetary intervention if we reach it. We still don't know the end date of interest rate cuts, but as Mr. Gerhardt said NBH will inform the investors if they did the last easing step.The 10 yrs bond yield is again near its historical low (4,21%), presently at 4,28%. On the next auction high demand is estimated, but as we can see, the HUF may not be stronger meaningfully. The mixed, mostly negative mood of investors also sticked to the Hungarian parquet. If the EUR continues its downtrend and the domestic conflicts calm down, EUR/HUF can go down around 308-307 again.

From the technical perspective we should focus on the resistance of 312 and support levels, mainly 310. This one caused a strong indecisive situation, but also it is a strong resistance. We are not expecting that the Euro bulls will break it up again, but we see the Hungarian currency staying close to the line.

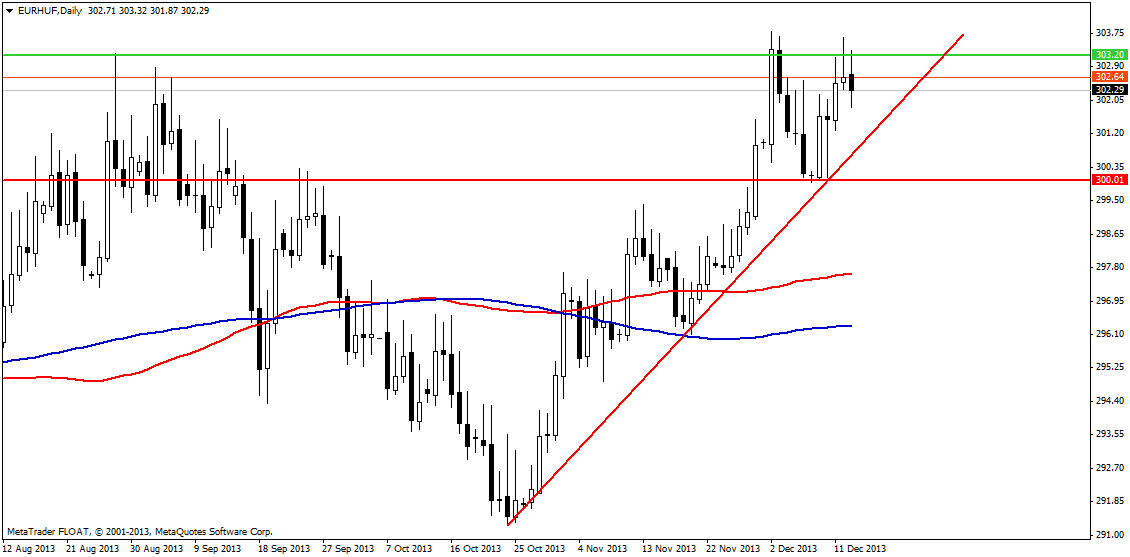

Pic.2 EUR/HUF D1 Chart

Romanian Leu (EUR/RON) – A stumble and a breakout

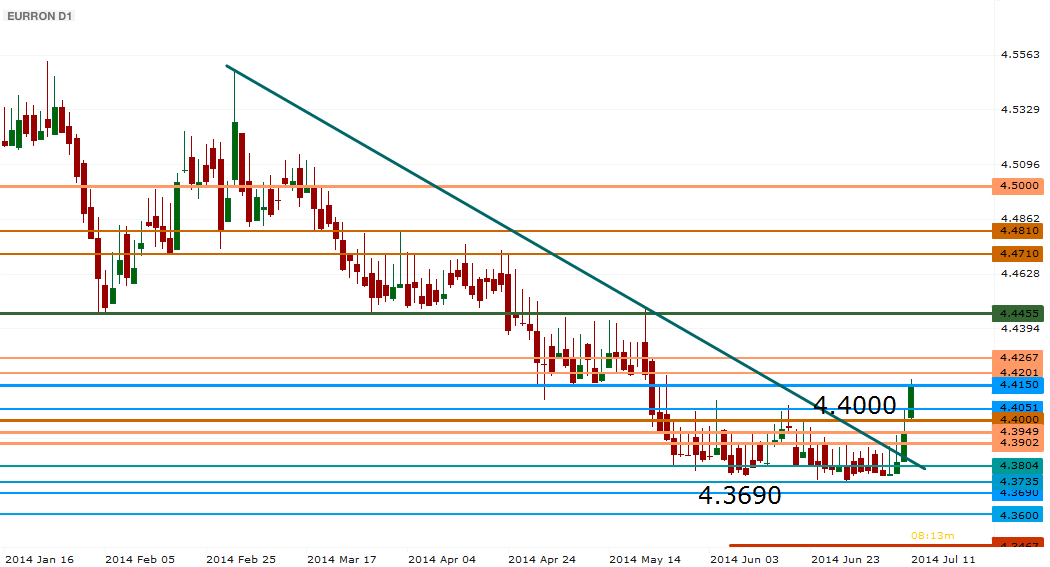

Risk that the Government may crack, according to statements from the UDMR, the ethnical Hungarian party in the present coalition has kept RON on the defensive in the last few days, with EURRON breaking 4.40. A decision taken this Friday has resolved the issue only partially, with a key figure leaving the Ministry yet the party as a whloe continuing in the alliance, which has made some investors wary of future paths. On the market data front, the CPI reached a sometime-ago-unthinkable 0.66% y/y (with another monthly decrease) whereas trade data was less than stellar. However, the industry managed a 2.6% m/m increase in May. What may worry investors is a planned wage tax cut, possibly challenging the deficit target. The uptrend of EURRON would be favored in our view only in correlation with a global risk aversion. If things settle down (not our main scenario) EURRON may slide again towards 4.40.Technical break of a downtrend led to a book reversal, and the inertia seems to favor a further push higher. The estimated resistance at 4,4265 is only an initial level to watch, especially on any close daily above 4.4150 while a stronger barrier is set up at 4.4455. Support stands at 4.4000 and 4.3804, followed by 4.3735.

Pic. 3 EUR/RON D1 Chart

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.