Hey there, forex friends! If you’re looking for a likely catalyst that may give you an opportunity to pillage some quick pips from the Loonie, then look no further since Canada’s jobs report is scheduled for release this Friday (April 8, 1:30 pm GMT). If you’re planning to trade this event, then gear up by reading up on another awesome edition of my Forex Preview for Canada’s jobs report.

What happened last time?

-

Jobless rate: ticked higher to 7.3% vs. steady at 7.2% expected

-

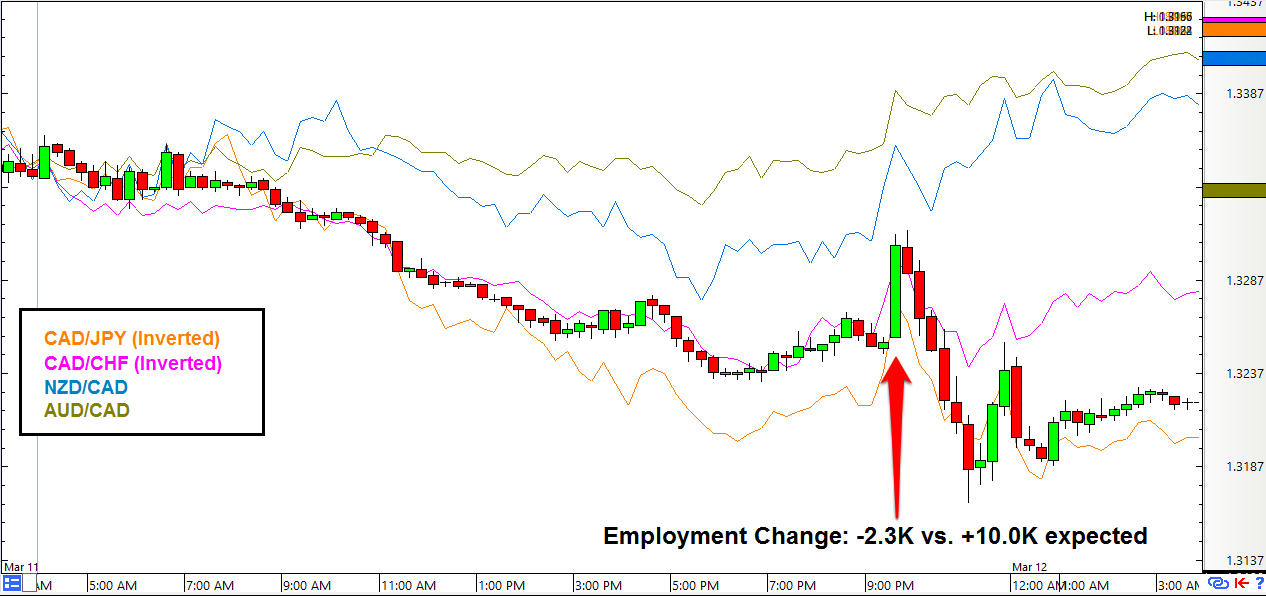

Net employment change: -2.3K vs. +10.0K expected, -5.7K previous

-

Labor force participation rate: steady at 65.9%

In my previous Forex Preview for Canada’s jobs report, I concluded that “the leading indicators seem to be more skewed towards a possible downside surprise.” That conclusion turned out to be right since Canada’s economy saw a net loss of 2.3K jobs in February instead of gaining 10.0K jobs as expected. This marks the second straight month that Canada has been shedding jobs.

Not only that, the net loss in jobs was due to full-time employment getting slashed by 51.8K, with the 49.5K gain in part-time jobs partially offsetting the decline in full-time jobs. This is bad because full-time jobs tend to pay more and offer more security than part-time jobs. Also, the labor force participation rate held steady at 65.9%, so the net loss in jobs was likely the reason why the jobless rate ticked higher to 7.3%, together with the the number of unemployed growing by 20.1K to 1,410.4K people. The jobless rate has been ticking higher by 0.1% for the third consecutive month now.

Surprisingly, the details of the report showed that it was the service sector that saw the largest decrease in jobs (-44.5K vs. +19.7K previous), with educational services (-16.9K vs. +10.4K previous) and healthcare and social assistance services (-16.9K vs. +11.5K previous) getting hit the hardest.

Also, the natural resources industry resumed shedding jobs, losing 8.9K jobs in February after gaining 1.4K jobs previously.

Overall, Canada’s jobs report was a disappointment, so Forex traders dumped the Loonie across the board as a knee-jerk reaction. Once the initial reaction was over, however, the Loonie’s forex price action began to diverge, with the Loonie clawing its way back (and then some) against the safe-haven currencies (JPY, USD, CHF) while extending its losses against its fellow comdolls (AUD, NZD).

This diverging price action was very likely due to the broad-based commodities rally and risk-on sentiment at the time, which pumped up demand for the higher-yielding comdolls. Oil benchmarks were getting a boost as well, which is probably why the Loonie was able to recover against the safe-haven currencies, so keep that in mind if you have a longer-term Loonie trade in mind.

What can forex traders expect this time?

-

Jobless rate: remain unchanged at 7.3% expected

-

Net employment change: +10.0K expected vs. -2.3K previous

For the upcoming March jobs report, market analysts expect that Canada’s economy will see a net increase of 10.0K jobs while the jobless rate is expected to hold steady at 7.3%.

Looking at the available leading indicators, the Markit/RBC manufacturing PMI report showed that the reading jumped from 49.4 to 51.5 in March, which means that the manufacturing sector is finally expanding again after seven straight months of contractions.

According to commentary from the report, “overall payroll numbers stabilized in March, thereby ending an eight-month period of falling workforce levels,” so perhaps the manufacturing sector will contribute positively to the upcoming jobs report.

The BOC’s Business Outlook Survey also reported that both investment and employment intentions are on the rise among Canadian businesses, “particularly among exporters not tied to the commodity sector and firms in service industries.” However, “the slump in the energy sector continues to weigh on employment intentions” for energy-related companies, so “planned layoffs and hiring freezes remain disproportionately high” in such businesses, which means that the natural resources industry is likely gonna be a drag again.

Overall, the available leading indicators and reports seem to support job gains in the services and manufacturing sectors, so the consensus reading looks about right. However, the more comprehensive Ivey PMI has yet to be released, so I may be revising my conclusion later depending on how the Ivey PMI’s employment sub-index turns out.

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.