In a speech earlier today, Bank of Japan (BOJ) Governor Haruhiko Kuroda said that he and his gang aren’t contemplating on deepening their recently-implemented negative interest rate policy. Apparently, they’re confident that the quantitative and qualitative easing, as well as the negative interest rates, would be enough to bring inflation to the BOJ’s 2.0% targets.

Are they right to be confident over the economy’s performance? Let’s take a quick look at Japan’s major economic factors and see for ourselves!

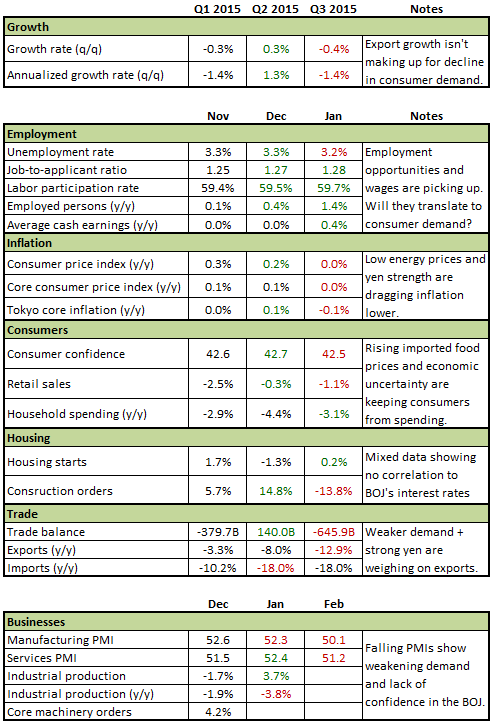

Growth

Q4 2015 growth contracted by 0.4%, worse than Q3 2015’s 0.3% growth.

Annualized figure also missed estimates at -1.4% after rising by 1.3% in Q3 2015.

Private consumption (60% of GDP) fell by 0.8% and shaved off 0.5% from the GDP. Ditto for consumer demand, which fell by 0.5% and shaved off 0.5% from the GDP.

Preliminary estimates are showing a 1.4% contraction for Q4 2015 thanks to a slump in consumer spending and exports.

Growth in exports simply isn’t making up for decline in consumer demand.

Employment

Unemployment rate fell from 3.3% to 3.2% in January, the lowest in three months.

Job-to-applicant ratio improved from 1.27 to 1.28, the highest in 24 years. That’s 128 positions available for every 100 job seekers, yo!

Solid offers in the hotel, restaurant, and medical and welfare sectors keep job demand afloat.

Real wages are rising as employment and earnings pick up while inflation remains subdued.

Inflation

CPI and core CPI remained flat in January after growing by 0.2% and 0.1% in December respectively.

Tokyo’s core inflation, considered a leading indicator, marked a second consecutive decline of 0.1% in February.

Food costs grew at a slower pace while energy and transportation costs dragged. On the flipside, recreation and clothing prices provided small boosts.

The BOJ wants corporate profits to grow to drive up wages and prices but low energy prices and a strong yen are dragging on consumer prices.

CPI and core CPI remained flat in January after growing by 0.2% and 0.1% in December respectively.

The BOJ currently expects inflation to reach 2.0% in H1 2017.

Businesses

Manufacturing PMI fell to the lowest since June 201, as output grew at its weakest pace in 10 months and international demand on new orders declined.

Services PMI fell to its lowest since August 2015, as business activity and new orders slowed down.

Business confidence has been steady at 12 in Q4 and Q3 2015 after falling from 15 in Q2 2015.

Core machinery orders in December boosted by expected demand for Q1 2016.

In 2014 the service industry accounted for 65% of Japan’s GDP while the manufacturing sector contributed 21%.

Start-of-year optimism and front-loading of inventories are starting to fizzle out in February.

Falling PMIs and production show weakening demand and lack of confidence in the BOJ.

Consumers

Retail sales dropped by another 1.1% in January, its third consecutive monthly decline.

Consumer spending dropped by 3.1% in January from a year earlier, and marked a FIFTH consecutive monthly decline.

Household spending in January was dragged by unusually warm weather, which lowered charges for heating, electricity, and water and spending for winter clothing.

Yen’s current weakness is boosting imported food prices and keeping consumers cautious about spending.

Trade and Housing

Japan’s trade went back to a deficit in January after a sharp drop in exports caught up to the declines in imports.

Exports declined for a fourth month in a row, thanks to declines in shipments to trading partners like China, U.S., and South Korea.

Imports fell to a nine-month low, its 13th consecutive decline.

Weaker demand from major economies like China and a strong yen are weighing on Japan’s export industry.

Upside surprise in housing starts contrasted with the abrupt decline in construction orders in January.

Want a real snapshot of all those points above? Here’s a neat chart for ya!

What’s next for Japan?

After looking at the factors above, we can certainly understand why the BOJ would want to step up its efforts in stimulating activity in the economy.

Though employment prospects continue to improve (especially in the services industry), the job opportunities just aren’t translating to economic activity.

The BOJ’s biggest problem right now is fighting a self-fulfilling deflationary mindset where consumers and businesses expect inflation to remain subdued, which prevents businesses from investing and raising wages and consumers from spending their moolah. The yen’s recent strength isn’t helping either, as it’s raising the cost of imported foods and making Japan’s exports more expensive in the global markets.

Do you think the BOJ’s current plans of continuing to buy assets and implementing negative interest rates are enough spur businesses and consumers into spending? The BOJ seems to think so, judging by Kuroda’s recent speech of their current plans being enough to send inflation back to 2.0%. Unfortunately, many market players aren’t convinced and, until we see improvements over the next couple of months, it looks like the BOJ is still on an uphill battle.

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.