Are ya lookin’ for an economic release to trade? If yes, then you’re in luck since the U.S. is gonna be releasing its advanced Q2 2015 GDP estimate at 1:30 pm GMT this Thursday (July 30). So gear up by reading up on the latest edition of my Forex Trading Guide.

What is this report all about?

If you didn’t sleep through your high school economics class (shame on you if you did), you already know that the GDP or Gross Domestic Product is the most comprehensive gauge of economic performance within a country’s borders, which is why it’s very important to forex traders and decision-makers alike.

The U.S. usually issues three GDP estimates for three times the fun: the advanced reading, the preliminary reading, and the final reading. The upcoming release is the advanced reading and as the name implies, it is the market’s first glimpse of the U.S. GDP, so it usually generates a lot of volatility in the forex market, especially among dollar pairs.

How did forex traders react last time?

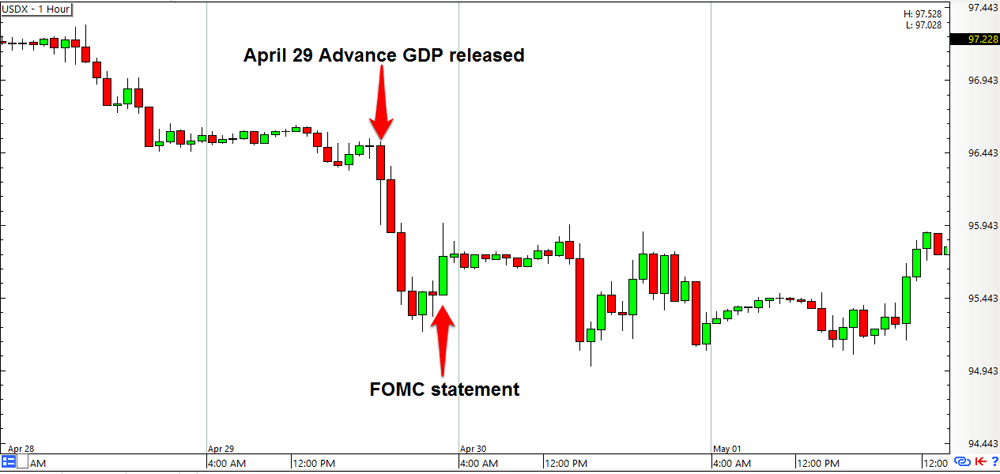

The advanced estimate for the Q1 2015 GDP disappointed forex traders everywhere (except for those who were shorting the Greenback) as the U.S. economy only printed a 0.2% growth, which was a far cry from the expected 1.0% growth and the previous quarter’s 2.2% expansion.

Due to the economic slowdown, expectations for a June Fed rate hike were crushed and doubts began to arise on whether or not the U.S. central bank would hike rates within the year, which is why forex traders dumped the Greenback pretty hard. The selloff only lost steam when the FOMC’s statement began to loom ever closer, leading some forex traders to cover their shorts ahead of the top-tier event.

As a side note, there was little seller follow-through after the FOMC statement because policymakers revealed that they’ve already seen the economic slowdown coming. More importantly, they attributed the slowdown to “transitory factors” that would be shrugged off soon, so the Committee remained open to hiking rates and most forex traders clapped their hands and supported the Greenback.

What’s expected this time?

The general consensus among market analysts is that the U.S. economy grew by around 2.5% in Q2 2015, a significant rebound after the disappointing Q1 GDP, whose third and final reading was a revised 0.2% economic contraction. According to the U.S. Bureau of Economic Analysis (BEA), the Q1 contraction “primarily reflected negative contributions from exports, non-residential fixed investment, and state and local government spending.”

In her July 15 testimony before the U.S. Congress, Federal Reserve Chairperson Janet Yellen stated that the “available data suggest a moderate pace of GDP growth in the second quarter” as “transitory factors, including unusually severe winter weather, labor disruptions at West Coast ports, and statistical noise” are “dissipated.” We’ll see, shall we?

How could the Greenback react?

As usual, the U.S. dollar is expected to appreciate against its forex rivals if the actual reading beats market expectations and might depreciate if it fails to meet expectations. Very short-term plays based on the market’s knee-jerk reaction to the data could still be viable, but longer-term plays would probably be harder to pull off because the BEA announced that the upcoming GDP estimate coincides with the annual revision process. This means that the GDP readings from all the way back in 2012 until Q1 2015 would be recalculated to reflect the most accurate data available and could possibly yield better or worse readings.

This means that forex traders will have to take any revisions and the overall GDP trend into account, which could promise greater volatility. But if the revisions continue to support a future rate hike, then we can probably expect more buyers than sellers.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.