Now that most major economies have released their manufacturing PMI readings, let’s take a look at whether trends are improving or not and what this could mean for their respective currency’s forex price action.

But first, for the newbies just tuning in, here’s a crash course on what the PMI or purchasing managers index is all about and why it matters. Simply put, the PMI is a gauge of business conditions in an industry, be it in manufacturing or services or construction. This is based on a survey conducted among purchasing managers, asking them to rate the level of employment, new orders, inventory, deliveries and other business-related indicators during the period.

A PMI reading above 50.0 indicates industry expansion and optimism among businessmen, which is generally reflected in improving economic data later on. Conversely, a PMI reading below 50.0 indicates industry contraction and pessimism among purchasing managers, which usually translates to weaker economic figures down the line.

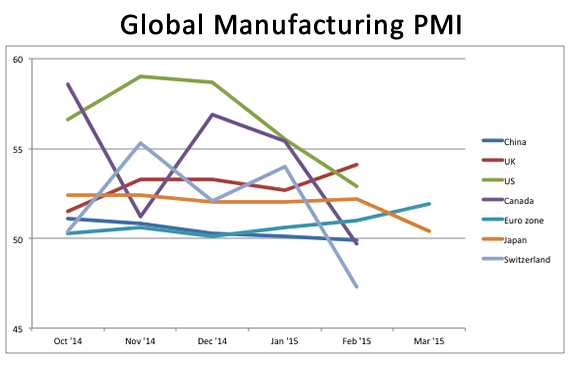

Now here’s how the manufacturing PMI readings have turned out for most major economies for the past months:

Woah, that’s a lot of colorful lines right there! Lemme break it down for y’all.

First up, let’s focus on the lines that are moving higher, as these show that the manufacturing industries in those countries are seeing a faster pace of expansion. If my eyes ain’t deceiving me, I’m seeing improvements in the U.K. (red line) and in the euro zone (turquoise line). Ha, it looks like ECB Governor Draghi was on to something when he claimed that a “sustained recovery” is taking hold in the region!

And now for the rest of the major economies which seem to be undergoing a downturn in manufacturing… Switzerland (light blue line) and Canada (purple line) appear to have suffered a sharp deterioration in manufacturing conditions, as their readings have also dipped below the 50.0 mark in February after previously reflecting industry expansion. Growth in China’s (blue line) and Japan’s (orange line) manufacturing sector has gradually slowed down while the U.S. (green line) has taken it down a few notches as well.

With the manufacturing PMI typically considered a leading indicator of economic conditions such as hiring and spending, forex price action of these currencies might be in for the same trends in the next few weeks or months. Do you think this could be the case? Or will other indicators have a bigger say in market movements?

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.