U.S. August NFP: 142K vs. 226K

For the month of August, the U.S. economy added only 142K jobs – its lowest monthly hiring gain for the year. In addition, the previous NFP readings suffered downward revisions, indicating that jobs growth for June and July was weaker than initially reported. Despite that, the jobless rate managed to tick lower from 6.2% to 6.1% in August.On a brighter note, average hourly earnings climbed by 0.2% as expected, reflecting a little bit of wage growth for the month. Components of the employment report also showed some progress, as the underemployment rate improved from 12.2% to 12% while long-term unemployment also edged lower.

While the August jobs report wasn’t so bad after all, it also still isn’t good enough to push the Fed in a more hawkish direction. According to Fed official Eric Rosengren, there remains a significant excess capacity in the jobs market and that it would be appropriate to keep monetary policy unchanged until the economy moves closer to full employment.

Canadian employment change: -11K vs. 10.3K

In Canada, a decline in hiring to the tune of 11K was seen instead of the estimated 10.3K increase. Although the jobless rate managed to hold steady at 7.0% in August, a closer look at the figures reveals that this was spurred by a sharp decline in the participation rate. Apparently, 20.8K Canadians exited the labor force during the month, bringing the participation rate down to 66% – its lowest level since November 2001.Meanwhile, quarterly labor productivity jumped by 1.8%, marking a faster pace of increase compared to the estimated 0.1% gain and erasing the previous 0.1% decline. This marks its fastest quarterly growth since 1998!

While this sounds like good news, note that an increase in worker efficiency suggests that businesses don’t need to ramp up their hiring efforts or increase salaries just to boost productivity. For now, average hourly wages are up 2.3% on an annualized basis in August yet most economic analysts speculate that this increase will not be sustained given the surge in labor productivity.

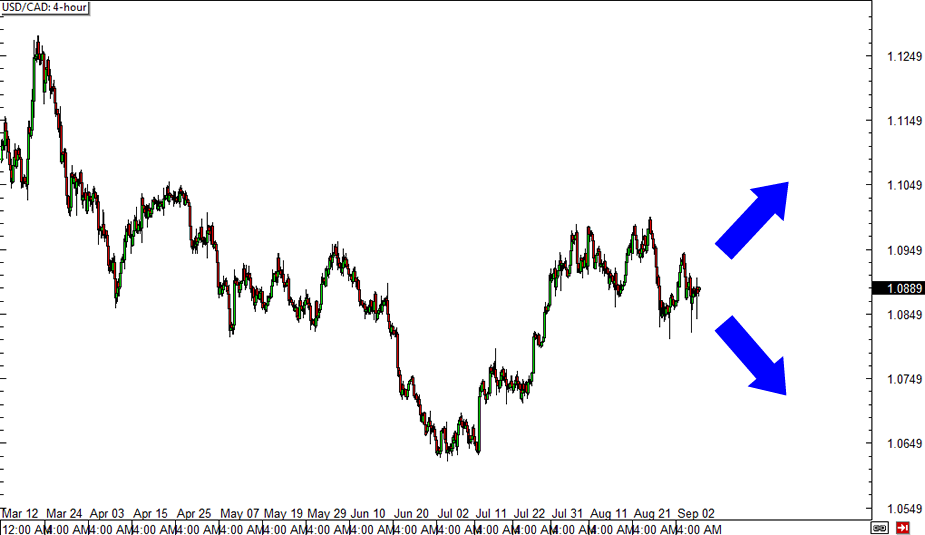

USD/CAD 4-hour Forex Chart

To sum up, even though both the U.S. and Canada printed weaker than expected headline jobs figures last week, it appears that Uncle Sam is still doing much better than his North American neighbor. While it can be argued that improvements in the U.S. eventually carry over to the Canadian economy, it looks like the path of least resistance for USD/CAD is still to the upside. Do you agree?

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.