Perspectives on inflation: How goes the fight?

My first job as an economist was at the Board of Governors of the Federal Reserve System in Washington, where I served in the research department, concentrating on the housing sector. As a particularly credit sensitive sector, the Board was especially attentive to intelligence about the health of this area of the economy. At that time (and since), one of my frustrations was the limitations of relevant data — the most important being housing starts, which offer the first glimpse of the impending activity in this sector. Unfortunately, those data are released monthly; and with every release, a seemingly interminable waiting period started until the next observations became available.

Much of the information relating to real economic activity (i.e., non-financial) operates on a similar monthly cycle. Inflationary data, however, may be marginally different in that during the course of a month, we get three relevant economic releases. First comes the publication of the Consumer Price Index, generally published during the second week of the month, followed by the Producer Price Index, and finally the Personal Consumption Price index. The various measures obviously reflect different portfolios of prices, but all provide insights as to how prices are generally changing over time.

Those interested in assessing inflation look at the percentage change in these indices over a given time period. Year-over-year price changes tend to be the most commonly referenced measures of inflation, but those calculations may be misleading. Consider, for example, the consequence of an economic shock that fosters a sharp, one-time price adjustment of a critical index component. Keeping everything else constant this change would impact the year-over-year inflation calculation for a full 12 months. On the other hand, when measuring inflation using monthly percent changes, we’d see this perturbation’s effect only for a single month. Under this hypothetical example, that price ends up being permanently higher subsequent to the price adjustment, but the year-over-year inflation measures notwithstanding, no sustained or ongoing inflation is occurring.

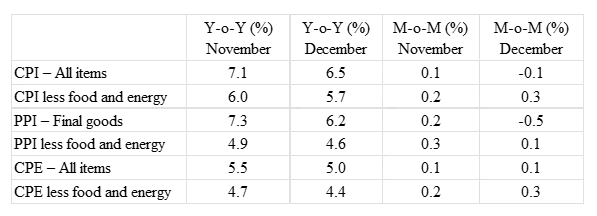

Analysts and policy makers tend to look at these three price indexes both broadly (i.e., reflecting all items) and also excluding food and energy — two critically important price categories but recognized as being particularly volatile in a way that tends to exaggerate transitory developments. Given those sensibilities, here’s a summary of what’s going on with these respective percent changes:

All of the categories of year-over-year percent changes have shown some moderation in the latest month. On a month-to-month basis, on the other hand, the story is less consistent. Even so, the highest monthly percent change recorded in December is 0.3 percent (for CPI less food and energy and CPE less food and energy). Regardless of the category, if this 0.3 percent monthly inflation rate were to persist for a full 12 months, the compounded annual inflation for that period would be 3.7 percent. Thus, even using the most elevated December month-over-month price increases, the latest data portend a considerably improved inflationary environment, relative to the latest annual measures of inflation that we’re seeing today. Still, the Fed has committed to a 2 percent per year inflationary target, so their work is not yet complete. That is, more interest rate increases are in the cards, but given the improvements in inflation that we’re seeing, the Fed may reasonably take those measures with smaller bites.

Personally, I’m sick of the bellyaching about how terrible inflation is — particularly from the chorus of saboteurs threatening to block the raising of the debt ceiling. Admittedly, inflation continues to be a problem, but the failure to recognize and acknowledge the significant progress that has been made is an unnecessary and disingenuous tactic that only fans the flames of political discord.

Importantly, success on the inflation side is distinct from relief from high prices. That is, even as inflation is slowing, consumers and businesses alike will likely be paying higher prices for a host of items that used to be cheaper; and while the frustration that people feel about paying elevated prices may be understandable, blaming current policy makers for these high prices is misplaced — particularly in the face of the progress being made on inflation. As a rule, prices adjust to supply and demand conditions, and they’ll move to new equilibria values, accordingly. This price adjustment process is fundamental to achieving most efficient allocation of recourses; and as a rule, the government shouldn’t be interfering with this market function.

Author

_XtraSmall.jpg)

Ira Kawaller

Derivatives Litigation Services, LLC

Ira Kawaller is the principal and founder of Derivatives Litigation Services.