Nonfarm Payrolls Preview: Five scenarios for the Fed, USD and stocks reactions, with probabilities

- Economists expect Nonfarm Payrolls to have risen by around 200,000 in February.

- Federal Reserve Chair Jerome Powell signaled that the fate of the upcoming rate decision hinges on this report.

- Wage growth plays a critical part in determining the outcome, given its impact on inflation.

"A decision has not been made" – Federal Reserve Chair Jerome Powell's attempt to soothe market worries about a potential 50 bps hike in two weeks has only raised expectations for the upcoming report. There are five different scenarios for the NFP report due out on March 10 at 13:30 GMT. Investors are at the edge of their seats.

Headline Nonfarm Payrolls (NFP) and Average Hourly Earnings play a critical role in determining if the Fed hikes by 25 or 50 bps. Why are wages important? When people earn more money, they spend more and push prices higher – and the Federal Reserve is now focused on pushing inflation lower.

Moreover, Powell and his colleagues at the Fed stressed that they are focused on "non-housing core services inflation" – or prices that are related to services people provide and their costs. The economic calendar indicates an expected increase of 0.3% MoM in Average Hourly Earnings, the same as last month.

Earnings have been fluctuating in a limited range of late, and every 0.1% deviation may make a difference:

Source: FXStreet

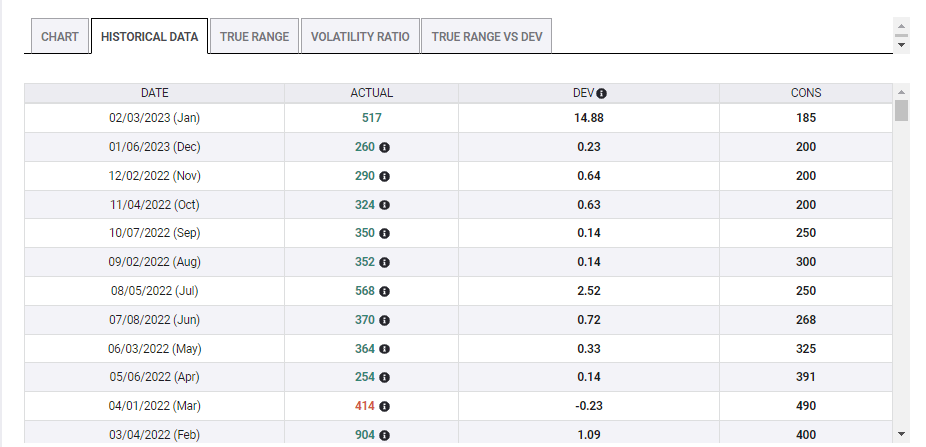

Nevertheless, the headline figure remains the top influencer on markets after it stunned investors last time with a superb leap of 517,000. This time, economists expect an increase of roughly 200,000.

The NFP surprised to the upside in 11 out of 12 reports

Source: FXStreet

Such an outcome would indicate a return to standard labor market expansion – it would be in line with pre-pandemic growth. The Fed wants the labor market to cool down, even desiring a temporary loss in jobs if needed to combat inflation.

The five scenarios below cover all the plausible cases, and they are based on my notion that a big surprise in job growth – to either side – is more significant than wages. Nevertheless, other extreme scenarios cannot be ruled out.

Here goes:

Five scenarios for Nonfarm Payrolls

1) Another surge in jobs

In case the US reports an increase of over 300,000 positions in February, it would imply the labor market is on fire and that the Fed needs to raise rates by 50 bps.

The US Dollar would rise on rate hike expectations, and stocks would likely suffer significant losses. In case wages fall short of expectations, we could see some solace for equities – paying lower wages strengthens the bottom line of companies. Nevertheless, I expect stocks to end the day lower.

Probability: low. It is hard to imagine another whopping jobs report, but anything can happen with the NFP.

2) As expected jobs figures, strong wages

An outcome of around 200K jobs gained and wage growth of 0.4% or higher would be painful for stocks and eventually boost the US Dollar.

The initial response in currency markets could be a fall of the Greenback in response to the headline. Investors and algorithms might respond to a neutral number as "it could have been worse." However, after such a knee-jerk move, the focus would shift to wages and send the US Dollar soaring.

Such whipsaws are common around big events. I suggest trading with care. Bond markets would lean toward a 50 bps hike, but wait for next week's Consumer Price Index (CPI) report for a final verdict.

Probability: High. Labor shortages remain acute, leading to higher wages.

3) As expected headline, neutral wage growth

An increase of around 200K and wage growth at 0.3% MoM would be in line with expectations. It would cause messy trading, and potentially some US Dollar weakness after gaining strongly beforehand. Stocks could end the day marginally higher.

Nevertheless, this choppy trading is unlikely to result in any major breakouts, nor any narrative about the Fed decision. It would only elevate the importance of the CPI report.

Probability: Medium. While economists' expectations make sense and come after all the leading indicators are in, the NFP tends to provide surprises.

4) As expected headline, weak wages

Job growth of around 200,000 and a salary increase of 0.2% would provide relief for markets. Any sign of lower inflationary pressures from the labor market would lower the chances of a 50 bps hike, sending the US Dollar down and stocks up.

Similar to the second scenario, trading will likely be choppy due to the mixed nature of the headline figure. Moreover, the final verdict for the rate decision would wait for the CPI report.

Probability: Low. As mentioned earlier, a lack of labor has likely resulted in higher, not lower wages.

5) Weak job growth

In case the US economy gained only 100K jobs or fewer, the reaction would be swift in favor of stocks and against the Greenback – reversing the moves triggered by Powell.

The US Dollar would tumble and fail to recover, while stocks could be somewhat limited in their advance if wage growth is strong, but they are still likely to rise.

Probability: Medium. It makes sense to expect weak job growth after an excellent month, yet economic indicators remain strong, making this scenario less likely.

Final thoughts

This Nonfarm Payrolls report is set to trigger more volatility than usual due to Fed Chair Powell's focus on remaining upcoming data ahead of its March 22 meeting. I urge trading with care, either lowering the leverage, or skipping the event altogether for new traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.