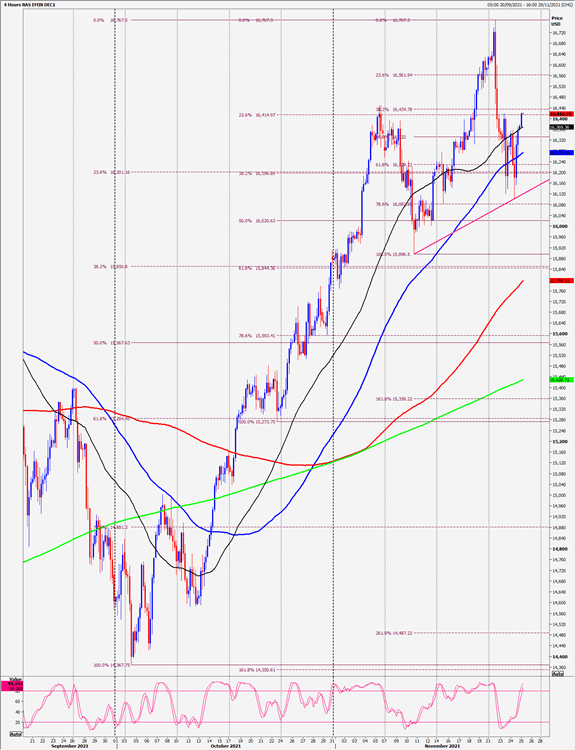

Nasdaq December longs at best support for the day at 16230/180

-

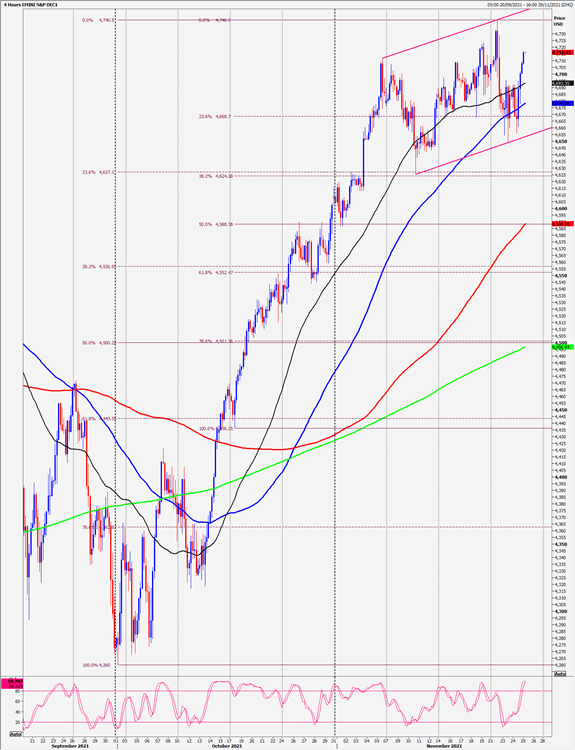

Emini S&P December bearish engulfing candle is likely to signal sideways trend so ease severely overbought conditions, although my first support at 4670/68 was not accurate because we over ran again to 4656.

-

Nasdaq December longs at best support for the day at 16230/180 worked as we held above 16100 for a bounce to first resistance again at 16400/450.

-

Emini Dow Jones December shorts at first resistance at 35850/950 worked perfectly with a high for the day here, followed by buying into longs at strong support at 35450/350 & a low for the day here. Perfect calls!!

Daily analysis

Emini S&P seeing a recovery as expected reaching very minor resistance at 4700/10 but above here retargets 4720/23 & 4735/40 then 4750.

I am still expecting the downside to be limited with first support at 4670/60. Longs need stops below 4650. Next target & better support at 4630/20. Try longs with stops below 4615. The best support at 4600/4395 this week - stop below 4385.

Nasdaq December up to 200 ticks profit on our longs as we hit first resistance again at 16400/450. Shorts need stops above 16500. A break higher targets 16550/600 before a retest of the all time high at 16630/767.

Best support for today at 16200/160. Try longs with stops below 16100! Hopefully that gives us enough room. A break lower however sees 16180/230 working as resistance to target 16030/010 before a buying opportunity at 15900/850. Try longs with stops below 15750.

Emini Dow Jones December longs at 35450/350 worked perfectly on the bounce to first resistance at 35850/950 for an easy 400 tick profit. A break above 36000 should be a buy signal targeting 36230/250.

Minor support at 35750/700 but below here targets 35600. Strong support again at 35450/350. A break lower however targets 35100/35000. Watch for a bounce from here on the first test. However a break lower meets a buying opportunity at 34800/750, with stops below 34650.

Author

Jason Sen

DayTradeIdeas.co.uk