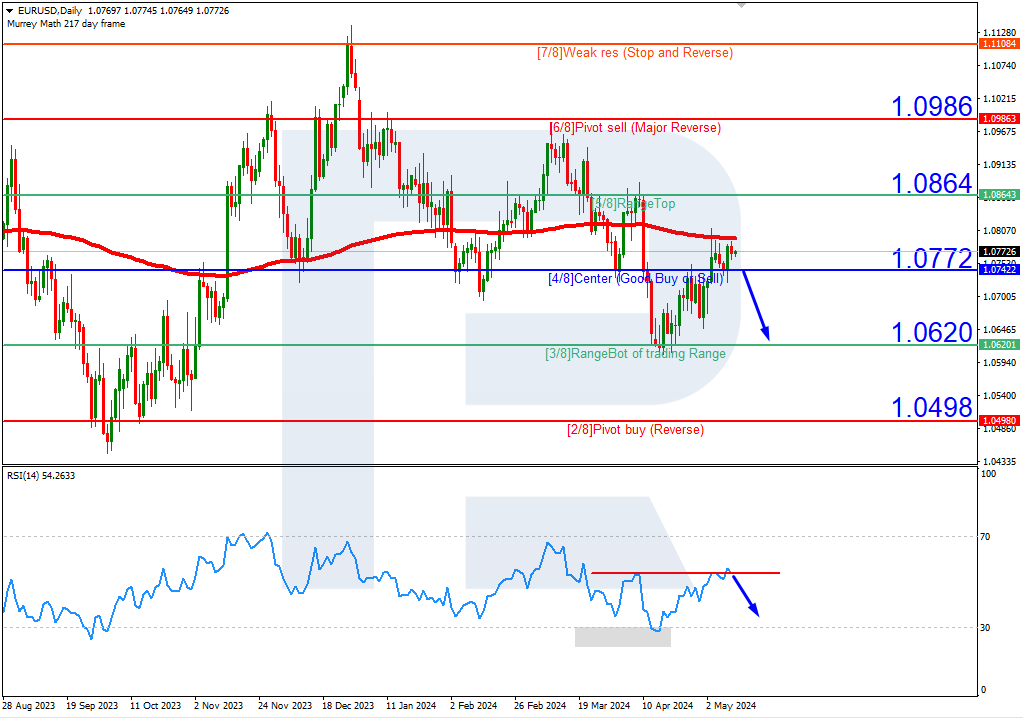

EUR/USD, “Euro vs US Dollar”

EURUSD quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI is testing the resistance line. In this situation, the price is expected to break the 4/8 (1.0772) level and decline to the support at 3/8 (1.0620). The scenario might be cancelled by surpassing the 5/8 (1.0864) level, which might lead to a trend reversal, pushing the pair up to the 6/8 (1.0986) resistance level.

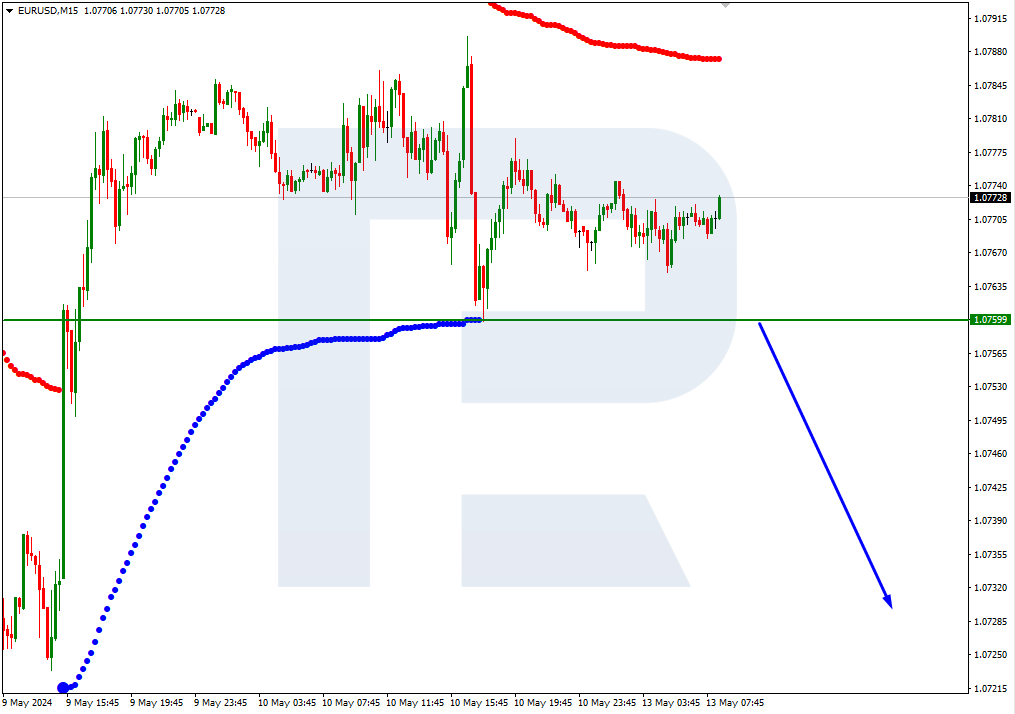

On M15, a breakout of the VoltyChannel lower line will increase the probability of a price decline.

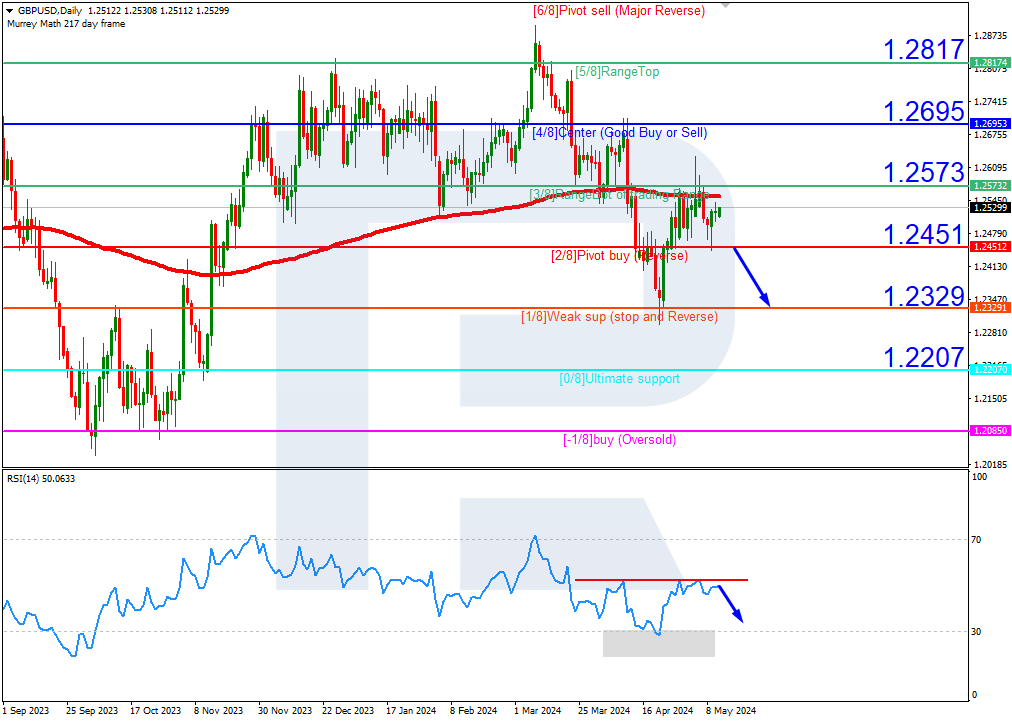

GBP/USD, “Great Britain Pound vs US Dollar”

GBPUSD quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI has rebounded from the resistance line. In this situation, the price is expected to break below the 2/8 (1.2451) level and fall to the support at 1/8 (1.2329). The scenario could be cancelled by surpassing the 3/8 (1.2573) level, which might lead to a trend reversal, propelling the pair to the 4/8 (1.2695) resistance level.

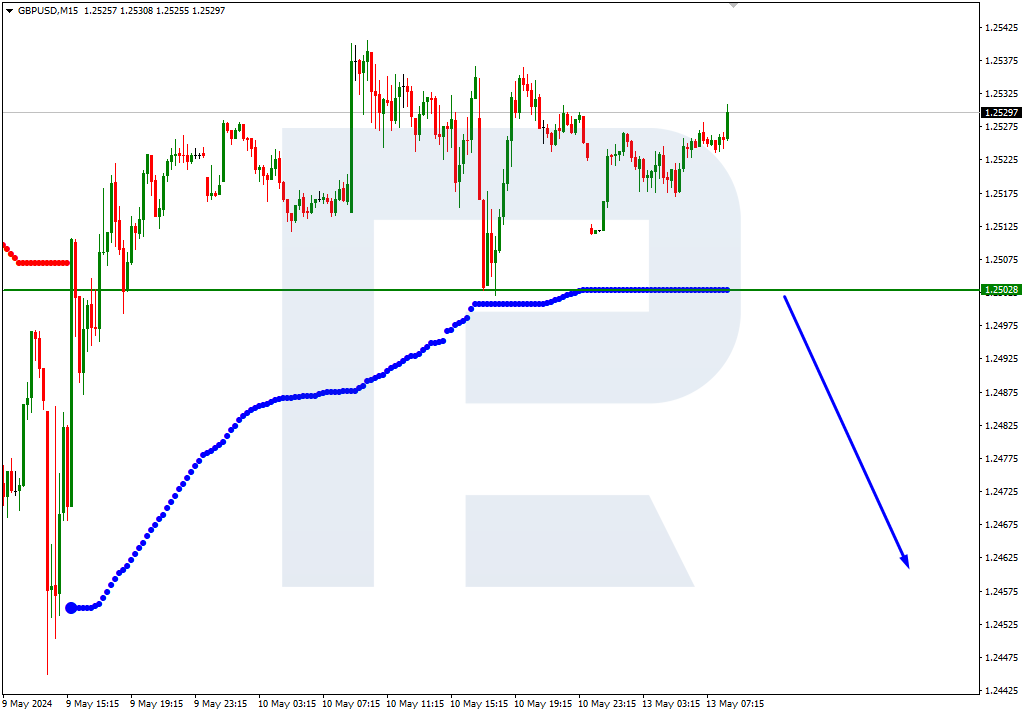

On M15, the price decline could be additionally supported by a breakout of the lower line of the VoltyChannel.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD extends slide below 1.0700 on stronger USD, EU political angst

EUR/USD stays under bearish pressure and trades at its lowest level since early May below 1.0700. Unabated US Dollar demand amid risk aversion and looming EU political uncertainty exert downside pressure on the pair heading into the weekend.

GBP/USD slumps to multi-week lows below 1.2700

GBP/USD extends its decline on Friday and trades at its lowest level in nearly a month below 1.2700. In the absence of high-tier data releases, the US Dollar continues to benefit from souring market mood, forcing the pair to stretch lower in the second half of the day.

Gold clings to recovery gains at around $2,330

Following Thursday's pullback, Gold holds its ground on Friday and trades in positive territory near $2,330. The benchmark 10-year US Treasury bond yield edges lower toward 4.2%, helping XAU/USD push higher ahead of the weekend.

Monero price poised for a downward correction

Monero price has encountered resistance at a critical level. The technical outlook suggests a potential short-term correction as momentum indicators signal a bearish divergence.

Week ahead – RBA, SNB and BoE next to decide, CPI and PMI data also on tap

It will be another central-bank-heavy week with the RBA, SNB and BoE. Retail sales will be the highlight in the United States. Plenty of other data also on the way, including flash PMIs and UK CPI.