The GBP/USD pair recovered from the dip to 1.4256 in early Europe yesterday and rose to 1.4394 (hourly 100-MA) before falling back to 1.4313 levels in the Asian session today. No major data was released in US or UK. Still, Pound turned out to be one of the better performers after BOE Cunliffe said there’s no reason for the central bank to change its stance on rates. The statement sounded hawkish to the markets amid the new normal of negative rates and given the interest rate markets are indicating a rate cut in next six months.

Eyes UK retail sales report

The odds of a better-than-expected figure are high as –

As per British Retail Consortium (BRC) data, retail spending increased 3.3% in January compared with a year ago, up from a 1.0% rise in December.

BRC data also showed prices fell slightly less sharply last month mainly due to rise in food inflation.

A better-than-expected figure could send Sterling above its hourly 200-MA 1.4419. However, holding above 1.4419 would require additional support from the (positive action) in risk assets.

Cable may price-in a rebound in retail sales as expected by moving higher to around 1.4375 levels ahead of the data and hence, we could see a bout of profit taking if the actual figure matches estimates or is lower than estimates.

Meanwhile, a surprisingly weak figure could set the tone for a fresh sell-off towards 1.4250-1.42 levels.

UK public sector borrowing due for release as well

UK public sector net borrowing may not receive much attention from the markets, unless the number sees a significant drop. Last month, Sterling was extremely oversold and hence markets found a trigger to unwind shorts in the form of upbeat public sector net borrowing figure (even though retail sales figure was horrible).

EU meeting on Brexit

Outcome of the EU meeting on the UK membership in the Eurozone could decide the fate of the UK’s membership ahead of the referendum. Donald Tusk, the president of the European Council, hinted that on the big issues there remained considerable distance between all sides. A positive outcome would bode well for Sterling, as it would mean the BOE no longer faces Brexit uncertainty and may think about raising rates if the incoming data is strong.

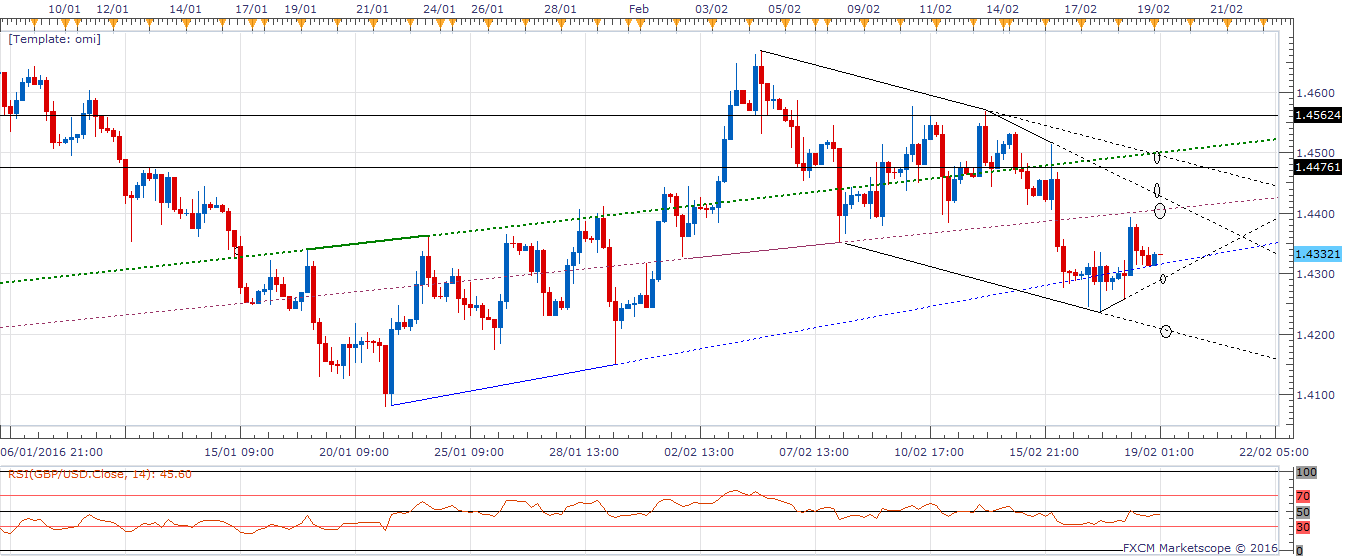

Technicals – Falling channel on 4-hr chart

Sterling’s failure to sustain above 1.4351 (23.6% of 1.5230-1.4079) on Thursday if followed by a break below rising trend line support at 1.4290 today could push the spot lower to 1.4210 (falling channel support).

A minor uptick to 1.4375 cannot be ruled out since the spot is finding support at the larger rising trend line. A break above 1.4375 could see the spot test hourly 200-MA at 1.4419.

Only a break above 1.4578 would mean the recovery from 1.4079 has resumed.

EUR/USD Analysis: Eyes EU meeting and US CPI

The EUR/USD fell to a low of 1.1071 on Thursday, before ending the day at 1.1106 levels. The rally in oil prices and an uptick in the equities kept the funding currency EUR under pressure. However, the oil prices surrendered gains in the NY session, which helped the common currency recover above 1.11 handle and move to 1.1125 levels in Asia today.

EUR/GBP under focus after EU meting

A positive (pro-EU) outcome of the EU meeting on Brexit today could trigger broad based rally in GBP. An ensuing sell-off in EUR/GBP could drive EUR/USD pair lower as well. An exact opposite market reaction could be seen if the EU meeting ends on a sour note.

Eyes US core CPI

An uptick in the core CPI could push EUR/USD below yesterday’s low. The headline figure is seen contracting 0.1% m/m. However, that is likely to be due to a sharp fall in energy prices. Ex food and Energy i.e. core CPI is seen rising 0.2% m/m from December figure of 0.1%. The markets are optimistic about a joint OPEC and non-OPEC action and have responded by sending risk assets higher this week. When viewed in this light, a drop in the headline figure may not be able to do any damage to the USD bulls. It will be the core inflation that could hurt USD if it prints below the December figure.

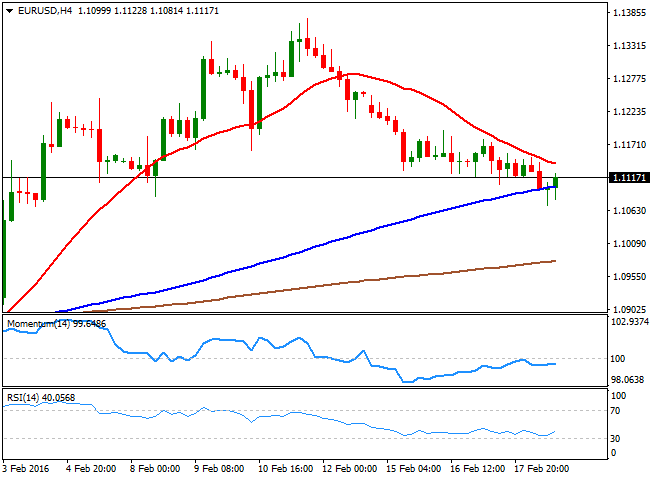

Technicals – Will it form Head and Shoulder?

Euro’s turnaround from 1.1071 followed by a break above 1.11 handle has increase the odds of a break above the hourly 50-MA at 1.1126.

If taken out, the spot could head towards 1.1210 (hourly 200-MA), given the hourly RSI has already turned positive. A failure to take out hourly 200-MA could trigger a renewed sell-off, leading to a head and shoulder formation with neckline support at 1.1068.

Meanwhile, a failure to take out hourly 50-MA at 1.11136 followed by a break below 1.1071 would open doors for a drop to 1.10 handle.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to small gains above 1.0700 ahead of data

EUR/USD trades marginally higher on the day above 1.0700 on Tuesday after EU inflation data for April came in slightly stronger than expected. Market focus shifts to mid-tier US data ahead of the Fed's policy announcements on Wednesday.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. Investors await macroeconomic data releases from the US.

Gold extends daily slide toward $2,310 ahead of US data

Gold stays under bearish pressure and declines toward $2,310 on Tuesday. The benchmark 10-year US Treasury bond yield holds steady at around 4.6% ahead of US data, making it difficult for XAU/USD to stage a rebound.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.