The GBP/USD pair fell to a session low of 1.4452 levels on Friday, before recovering slightly to end the day around 1.4498 levels. The greenback strengthened across the board after the data in the US on Friday showed a surprise drop in the unemployment rate and rise in the average hourly earnings. Both data sets were enough to overshadow the horribly weak payrolls figure.

Non-farm payroll report showed 151k growth in job market in January, lower than expectation of 192k. Prior month's figure was also revised down from 292k to 262k. Unemployment rate dropped to 4.9% versus expectation of 5.0% and that was also the lowest level since February 2008. Average hourly earnings rose an impressive 0.5% mom versus expectation of 0.3% mom.

Fed still not expected to raise rates this year

| Fed meeting | CME rate hike probability before NFP | CME rate hike probability after NFP |

| 16-Mar-16 | 8% | 8% |

| 27-Apr-16 | 12% | 16% |

| 15-Jun-16 | 19% | 29% |

| 27-Jul-16 | 21% | 31% |

| 21-Sep-16 | 25% | 35% |

| 2-Nov-16 | 27% | 36% |

| 21-Dec-16 | 34% | 44% |

The table clearly shows the rate hike bets have not improved much. March rate hike bets are unchanged at 8%. Further down the road, the rate hike bets have ticked up slightly, but overall the probability is still low.

A minor uptick in the rate hike bets is obviously due to uptick in the wages. However, those could be erased quickly if the upcoming macro data disappoints.

Hence, the USD strength witnessed on Friday could be short lived. Moreover, the dollar strength on Friday may have been due to profit taking on the USD shorts ahead of the weekend. Still, if the risk-off takes control of the markets, the British Pound may not be able to do much.

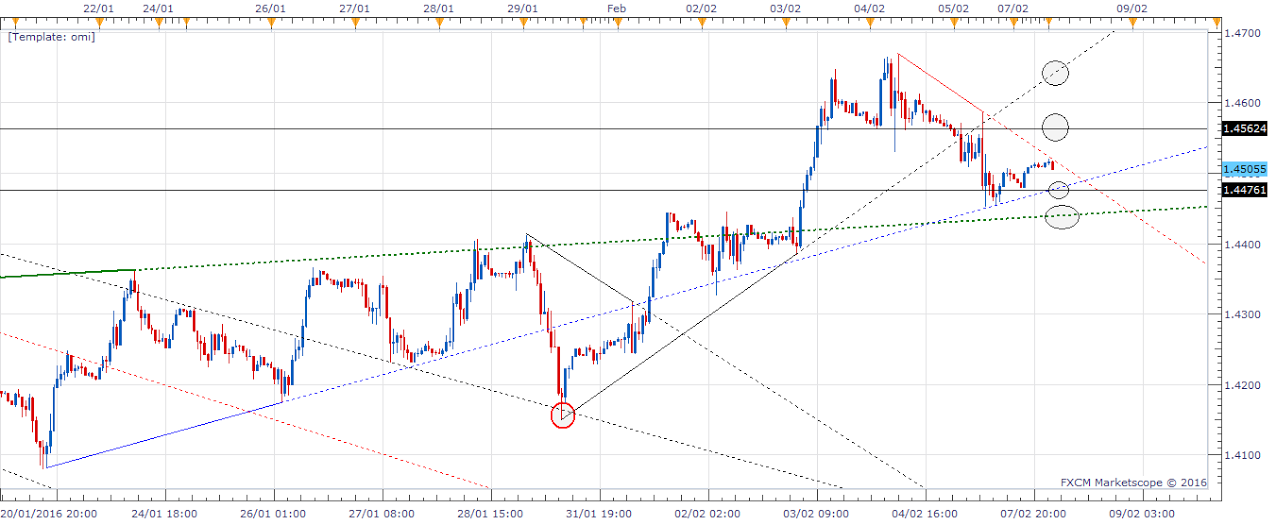

Technicals – Flirting with falling trend line resistance

Sterling’s failure to take out the falling trend line resistance (red) on the hourly chart, which is also a confluence of the Fibo levels - 1.4519-1.4516 (38.2% of 1.5230-1.4079 + 23.6% of 1.5930-1.4079) – could see the pair break below 1.4480 (daily low) and drop to 1.4443 (38.2% of 1.4079-1.4668).

The odds of a drop to 1.4443 are high, given the RSI has again turned bearish on intraday charts

On the other hand, a break above the falling trend line resistance could see the pair test 1.4563 (resistance on hourly chart). A break higher would expose rising trend line resistance currently seen at 1.4641.

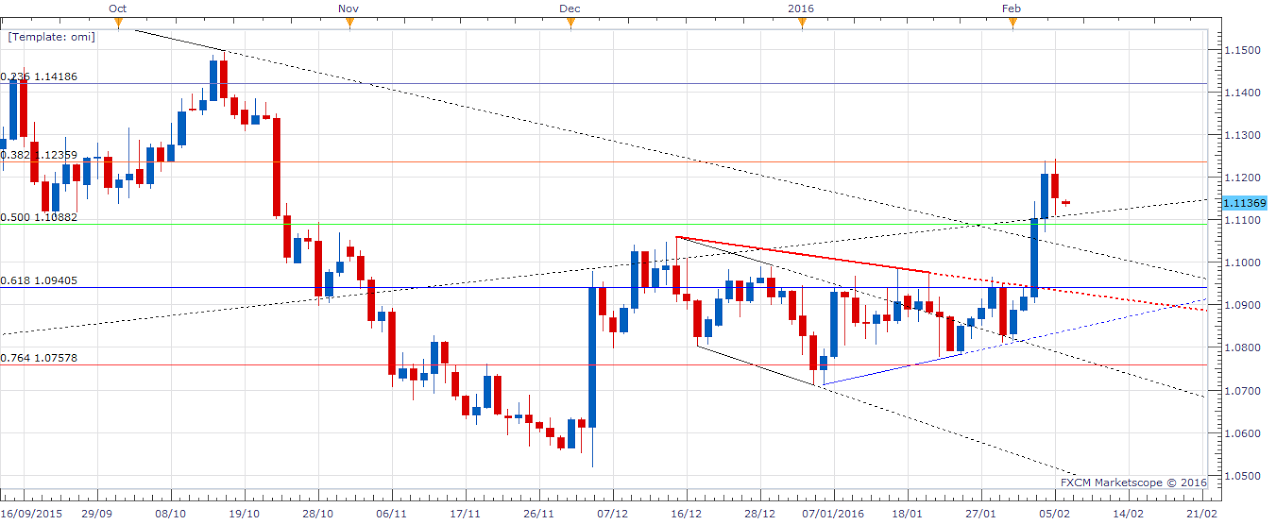

EUR/USD Analysis: Watch out for rebound from trend line support

The drop in the EUR/USD pair could turn out to be short lived as discussed above. Unlike GBP, the common currency could be buoyed further by a return of risk-off. Hence, bears should remain cautious, especially since the pair is trading close to the trend line support.

Technicals – trend line support around 1.1105

Euro’s repeated failure to take out 1.1236 (38.2% of Mar low-Aug high), led to a drop on Friday, but the downside was restricted at the rising trendline support.

The hourly chart shows a minor head and shoulder with neckline support at 1.1130. A break lower would expose 1.1070.

However, the bearish break could be a ‘fakeout’ as the pair could rebound from the rising trend line support seen around 1.1105 levels.

A rebound could see the pair test hourly 50-MA at 1.1171, which if taken out, shall open doors for a re-test of 1.12-1.1236 (38.2% of Mar low-Aug high).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.