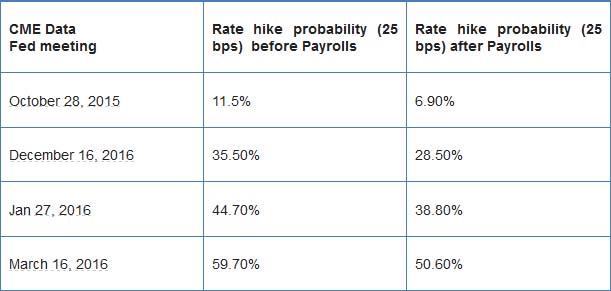

The GBP/USD pair rose to an intraday high of 1.5237 levels in the NY session on Friday after the horrible US non-farm payrolls number pushed the 2015 Fed rate hike bets out of the window. The US economy created only 142,000 jobs in September, which is 64,000 short of the consensus estimates. The average earnings data disappointed coming in at 0.0% month-on-month. The net revision for the previous two months was down 59,000. The USD quickly suffered a broad based weakness, but managed to take back prt of its losses heading into the weekend.

Fed rate hike bets drop, trouble for BOE and Pound

At a first glance, is is easier to believe that Sterling could enjoy a broad based rally. However, drop in the Fed rate hike bets also delays the BOE’s liftoff. Also the UK economic data aren’t printing well of late. Consequently, a minor rally in the GBP/USD could be followed by a major fall.

The UK September services PMI figure due today could trigger a minor rally towards 1.5330 levels. Further gains appear difficult, especially if the markets turn risk averse in the next few days, leading to a further drop in the Fed and BOE rate hike bets. In case the services PMI disappoints, Sterling could drop to 1.5 handle.

USD to remain strong against risk currencies (despite drop in Fed rate hike bets)

What works for the USD is the safe haven appeal of the treasuries; something that the UK Gilts lack. Consequently, the USD is both a risk currency as well as a safe haven and thus, Sterling and other risk currencies (EM and Asian currencies) are in for a beating as falling rate hike bets accentuates global growth concerns and leads to risk aversion.

Thus, a relief rally (on strong UK services PMI) could easily run out of steam around 1.5330 levels.

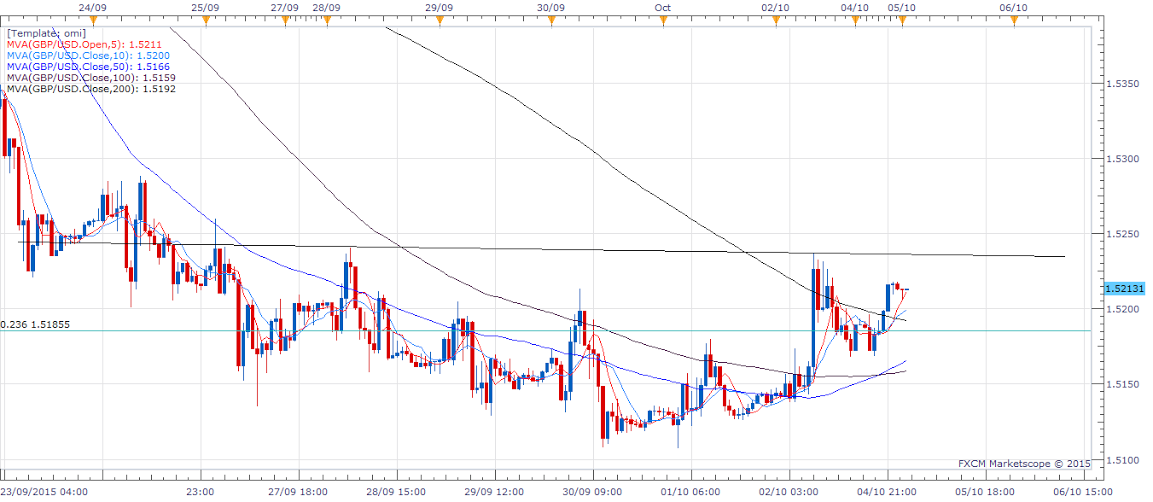

Technicals – Rounding bottom on hourly chart

Sterling’s rebound in Asia from the crucial support at 1.5170 (Sep 1 low) after the Friday’s dismal jobs data indicate the spot could take out the rounding bottom neckline on the hourly chart seen at 1.5237 levels and rise to 1.5293 (5-WMA)-1.5330. The last week’s Doji candle also indicates that bears may have run out of steam and the spot could witness a much needed technical correction. On the downside, a failure to sustain above the hourly 200-MA at 1.5193 could lead to a fresh drop to 1.5170-1.5107 levels.

EUR/USD Analysis: Non-farm payrolls miss, ECB to do more

The EUR/USD pair spiked to 1.1318, before trimming gains to end at 1.1206 on Friday. The spike was the result of the big miss on the payrolls report discussed above. However, a fall back to 1.1206 could have taken many by surprise.

ECB to do more?

The entire move during the NY session on Friday could be an indication that farther the Fed goes from the lift-off, nearer the ECB comes to more QE. This means, that a weak US data/drop in the Fed rate hike bets could push the EUR higher; but at a slower pace than other majors like CHF and JPY. However, against risk currencies like GBP and commodity dollars, the EUR could spike especially if the risk aversion becomes more intense in the days ahead.

As for today, the EZ services PMI are due to hit the wires. An upbeat figure could open doors for a re-test of Friday’s high and beyond.

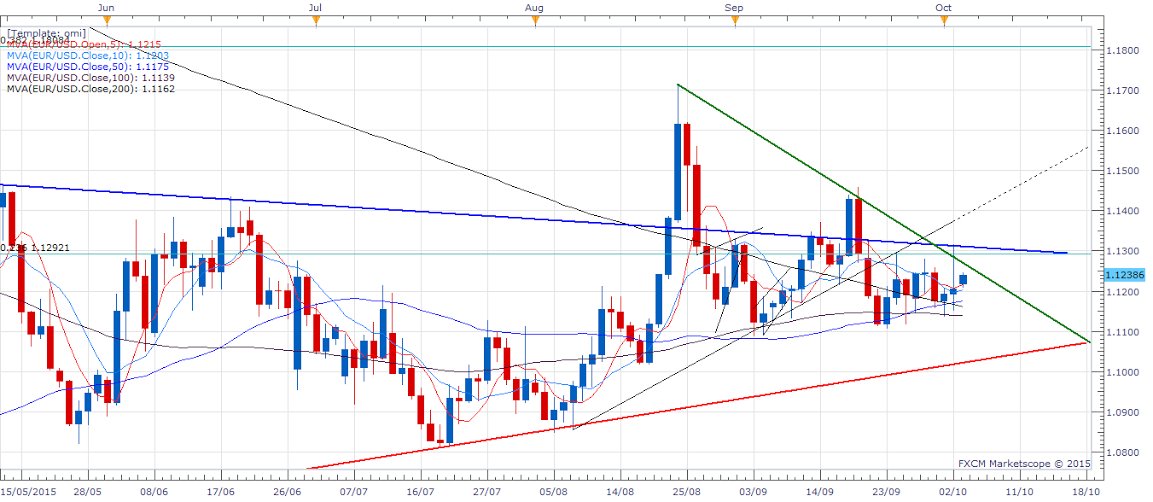

Technicals – Multiple resistance ahead

Euro’s fall back from the high of 1.1318 to 1.1206 on Friday indicates the EUR bulls are likely to have a tough time so long as the pair trades below 1.13. Heading towards 1.13, the pair faces critical resistance at 1.1271 (green line in chart) followed by 1.1296 (23.6% of larger downtrend) and 1.1310 (blue line in chart). Only a break above 1.1310 could open doors for a rise to 1.1390 (dotted line in chart). On the downside, a failure to sustain above 1.12 could push the spot back to its 200-DMA at 1.1162 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.