The Cable found a renewed buying interest above 1.5340 on Wednesday and then rose to 1.5416 after the release of much weaker-than-expected US GDP data. The pair then rallied to 1.5487 before falling back to 1.5420 levels after the Fed statement. The Fed statement was slightly less dovish than expected, in a sense that the Fed remains optimistic regarding future growth and job gains despite the slowdown in the first quarter. Moreover, the slowdown was termed as “transitory”, which lent support the US dollar. Still, the June rate hike is not as good as a fantasy. However, the September rate hike is still on the table and thus the markets could bid the USD higher today. The longest streak of gains in the GBP/USD pair since 2012 could come to an end today.

The pair currently trades at 1.5418 after having run into fresh bids closer to 1.5450. The RSI on the hourly and 4-hour chart has turned lower from the overbought zone. The upward technical bias remains intact, however, a correction to 1.5339 could be seen today. A daily close below the same could open doors for more weakness to 1.5224 and 1.5153. The upward bias could strengthen more in case the pair manages to see a daily close above its 200-DMA at 1.5490. Till then, fresh bids could be expected on the rise.

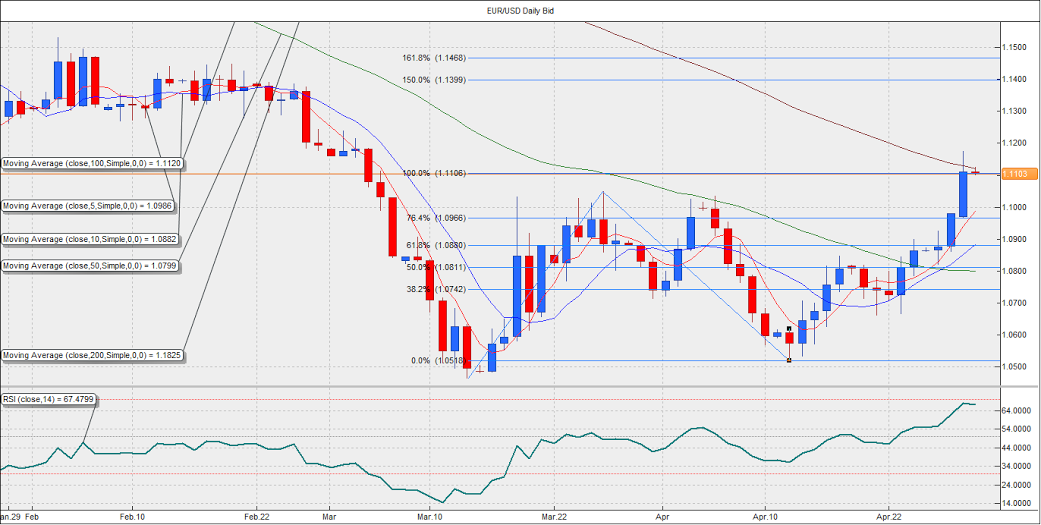

EUR/USD Analysis: USD could make a comeback

The Euro was a raging bull on Wednesday as it rallied to a 7-week high of 1.1188 after a lower-than-expected US GDP. However, profit taking ensured the gains remain capped at 1.1110 after the Fed statement. The FOMC statement was pretty much in line with the expectation, although I believe it provides just enough to buy the US dollar at current levels. The Fed acknowledged the low growth and inflation in the first quarter, however, said the slowdown was partly due to transitory factors. The Fed remains optimistic about the future growth and job gains. Moreover, the first quarter is usually the strongest in the Eurozone and weakest in the US. Thus, the USD is more likely to make a comeback from today. On macro front, the Eurozone CPI index and weekly US jobless claims are due for release. A slight improvement in the Eurozone CPI could support the EUR. However, another week of a below 300K print of weekly claims could push the EUR/USD lower.

The pair currently trades 1.1098, after being rejected at the 100-DMA located at 1.1120 earlier today. The daily close above 1.1050 has turned the short-term technical outlook bullish. However, fresh bids are seen only in case of a daily close above the 100-DMA. Given the overbought RSI on the intraday charts, a correction to 1.1050 could be seen today. A break below the same could open doors for 1.0966. A close below 1.0966 (76.4% Fib expansion of 1.0461-1.1050-1.0519) would indicate the near-term top is made and risks sending pair down to 1.09-1.092 area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.