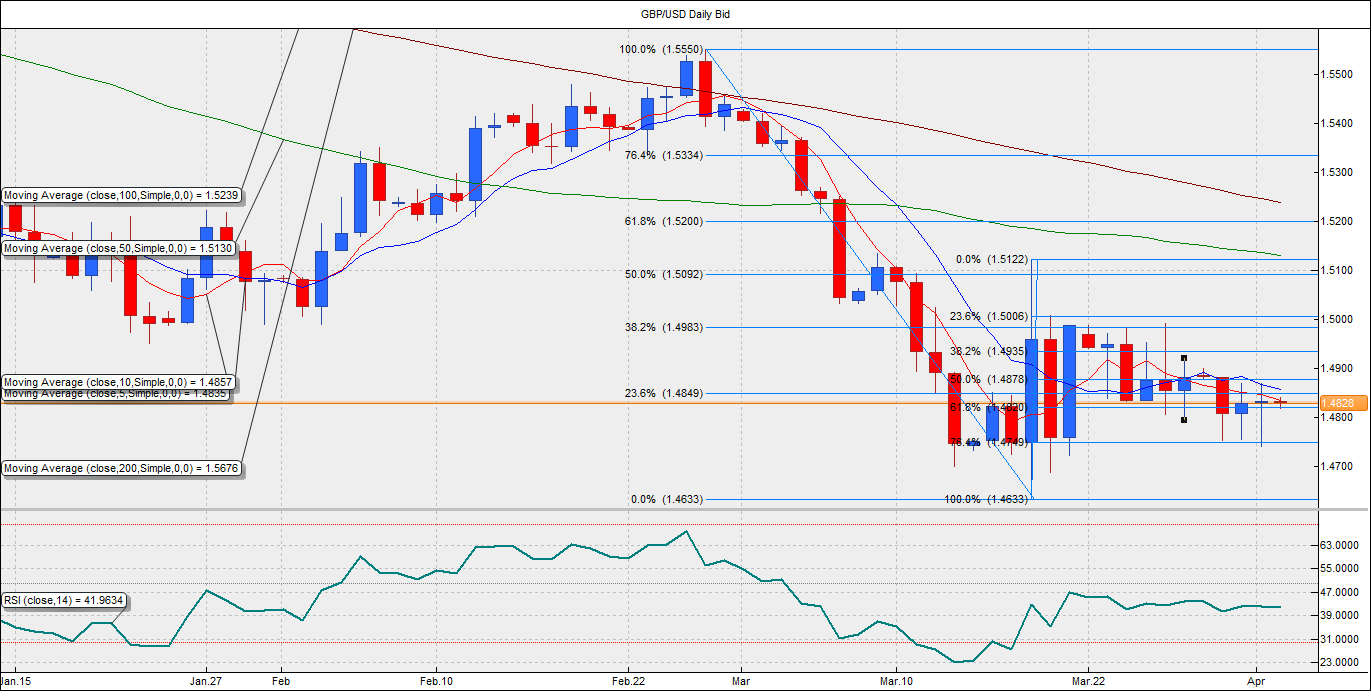

The GBP/USD pair found no support from the better-than-expected PMI report released on Wednesday as the election uncertainty continued to weigh over the British Pound. The increase in the PMI was right in line with expectations and was not good enough to shift market’s attention from the political uncertainty towards upbeat economy. If the better-than-expected manufacturing PMI failed to support the GBP, it is highly unlikely that a better-than-expected construction PMI could do any better. Still, the pair has managed to recover above 1.48, courtesy of a weaker-than-expected ISM manufacturing and monthly ADP employment figure released in the US. The pair could extend the gains to 1.4880 as the USD is likely to be sold ahead of the NFP, given the ADP number missed the estimates by a wide margin.

Meanwhile, on the charts, the pair has managed to sustain above 1.4820, which is the 61.8% Fib retracement of 1.4633-1.5122. We also see, the pair has bounced-back from 1.4750 levels for the third consecutive session yesterday. The recovery has also pushed the hourly RSI above 50.00 levels today. Thus, we could see the pair rise to 1.4880-4900 levels today. A break above 1.4849, which is the 23.6% Fib retracement of 1.5550-1.4633 could see a sharp rise to 1.4880-1.49 levels. On the other hand, a failure to sustain above 1.4820 could push the pair lower to 1.4790-1.4880.

EUR/USD Forecast: Immediate gains could be capped at 1.0825

The EUR/USD pair inched higher on Wednesday, supported by the PMI reports, which showed manufacturing activity at multi-month highs in the Eurozone. However, the gains were once again capped by Greek issue. Der Spiegel, a German newspaper, reported that Greece has no plans to meet the IMF's April 9 deadline. Greek Interior Minister Voutzis said that if there is no money flowing in by that date, the IMF will have to understand that they will not be able to make the payment of 360 million Special Drawing Rights (SDR) on time. However, if the deadline is hit, the EUR come under pressure. For the time being, the pair is trading at 1.0760.

On the charts, we see the pair has bounced from the 50% Fib retracement of 1.0461-1.1050 located at 1.0756. This, coupled with the bullish RSI on the hourly time frame, could drive the pair higher to its 5-DMA located at 1.08. The rally could overshoot to 1.0825, as the USD is likely to be under pressure after the ADP reported a big miss on its monthly employment number yesterday. A fresh selling pressure in the EUR could be anticipated at 1.0825, which is 38.2% Fib retracement of 1.0461-1.1050.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.