The Fed’s economic views on inflation, sentiment, growth, economic drivers, and Keynesian stimulus have been proven wrong so many times, in so many ways, yet the Fed never discards its models that don’t work. Here is a beauty that shows the absurdity of inflation expectations and the price of oil.

Please consider the St. Louis Fed article What Future Oil Price Is Consistent with Current Inflation Expectations? by By Alejandro Badel, Economist, and Joseph McGillicuddy, Research Associate.

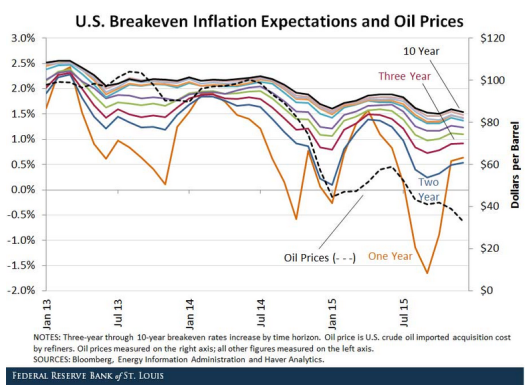

Oil prices have continued to decline over the past few months, dropping to nearly $30 per barrel by last December. This drop coincided with a fall in breakeven inflation expectations, as measured using the premium paid for Treasury inflation-protected securities (TIPS) over standard Treasury bonds.

If the fall in breakeven inflation rates reflects a fall in actual inflation expectations, and assuming this fall is largely driven by a fall in oil price expectations, then we can ask the following question: How low would future oil prices have to fall to validate current breakeven inflation rates?

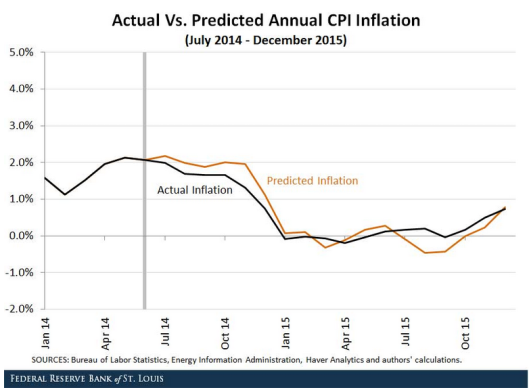

The figure below shows a backtest of our model from July 2014 to December 2015. As demonstrated by the figure, the model predicts the actual path of annual CPI inflation over this time period quite well.

Results

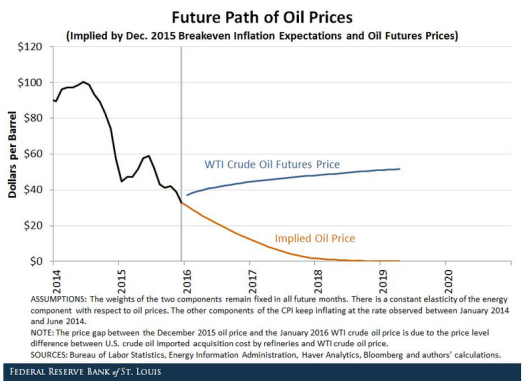

We calculated the future path of the CPI over the next 10 years (starting in January 2016) that would be consistent with breakeven inflation expectations at horizons of one year through 10 years. Then, using an annual growth rate of 2.87 percent for the “all items less energy” component and using 0.46 for the elasticity of the energy component with respect to oil prices, we backed out the future path of oil prices that would produce this future path of the CPI. The figure below displays the implied oil price series and compares it to the future oil prices implied by West Texas Intermediate crude oil futures.

Conclusion

According to our calculations, oil prices would need to fall to $0 per barrel by mid-2019 in order to validate current inflation expectations. After that, there is no oil price that would allow our model to predict a CPI path consistent with December 2015 breakeven inflation expectations. This implied path of oil prices is very different from the path of oil prices implied by futures contracts, which rises to more than $50 per barrel by mid-2019.

We state some potential explanations for our results:

Expectations for the future growth of the other CPI components besides energy may be lower than the annual rate of 2.87 percent we assumed in our model.

The recent movements in breakeven inflation expectations may have been caused by something other than the decline in oil prices. It is even possible that a third variable is driving the decline in both.

Investors may expect the relationship between oil price and the CPI energy component to change in the future. (This would be despite the strong relationship seen over the past 20 years, shown in the second figure in our previous blog post.)

Changes in the inflation risk premium for bonds that are not inflation-protected and/or changes in the liquidity premium for TIPS may be distorting breakeven inflation expectations in the last few months.

Mish Alternate Proposals

The model was dependent on China maintaining unrealistically high growth perpetually.

The model does not work well in periods of global demographic shifts (China, US, Europe)

The model does not work well in deflationary conditions.

The model does not work well in periods of global rebalancing.

Twenty years is not a long enough timeline from which to create an economic model.

The Fed’s inflation expectations model is a curve-fitting illusion. It never really worked in the first place.

All of those are possible, but I believe points 1, 5, and 6 are the key factors, with emphasis on points 5 and 6.

Fed economists are not predicting $0 oil. Rather $0 is simply what their model says it should be. Regardless of reason, we now have proof of the absurdity of their inflation expectations model.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.