Highlights:

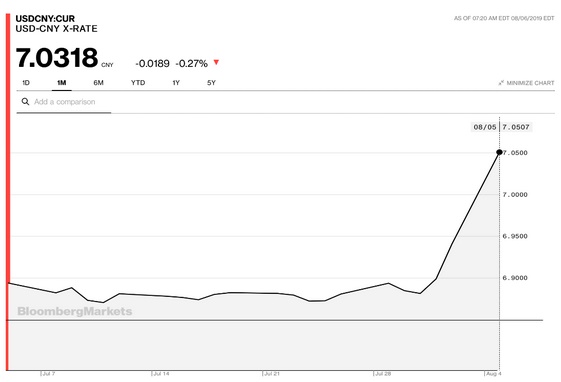

Market Recap: Markets dropped significantly yesterday as the Chinese Yuan weakened against the U.S. dollar. Although many believe China devalued their currency, they actually stopped propping it up yesterday. That is a major deflationary pulse and it was felt across asset classes. The S&P 500 was down -3.01% on the day. Oil was down -1.74%. U.S. 10 Year-Treasury note yields dropped 11 basis points, finishing the day at 1.75%.

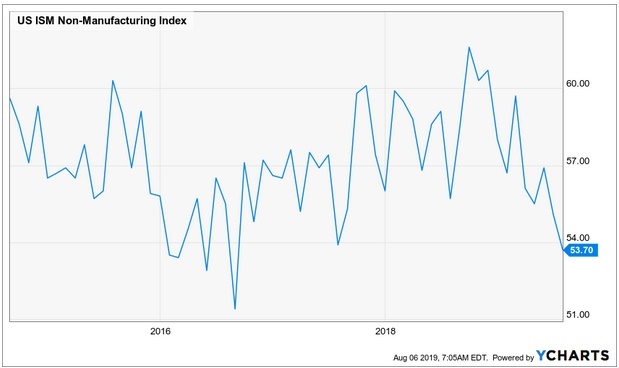

Economic Data: While markets were largely focused on trade and currency wars, the U.S. ISM Non-Manufacturing Index dropped to new lows, declining to 53.70. Despite the noise, growth has been slowing since the fourth quarter of 2018 and that affects markets.

Volatility: The VIX rallied nearly 40% yesterday. This is after a rally of over 40% last week. The VIX has broken above the May highs which may imply that the S&P 500 could challenge or break below the lows it set in June.

U.S. 10-Year Yields: 10-year yields broke to new lows and have accelerated downward. Yields are way below their 200-day moving average. How low will they go? We think over the course of the next year, a lot lower.

Emerging Markets: Emerging markets crashed through their 200-day moving average (EEM). Emerging markets failed to confirm the S&P 500 as it broke to new all-time highs. Now, emerging markets are close to testing the 2018 lows.

Chart of the Day: The U.S. Dollar rallied to new highs relative to the Chinese Yuan, as China failed to prop up their currency yesterday. If China were to fail to stabilize their currency, it could drop 30-40% according to hedge fund manager Kyle Bass. The implications of this are deflationary for the U.S.

Source: Raoul Pal

Futures Summary:

News from Bloomberg:

China moved to stabilize the yuan, bringing some relief to markets in the wake of yesterday's rout, which deepened after the Treasury Department labeled Beijing a currency manipulator. China's central bank set the daily currency fixing stronger than expected and announced a sale of yuan-denominated bonds in Hong Kong, while denying the U.S. accusation. Read this QuickTake on why the U.S. officially took the step.

North Korea fired more missiles and renewed its threat to follow a "new road" after the U.S. and South Korea began joint military drills yesterday. The Foreign Ministry said the two countries would pay a "heavy price" if they continued the exercises, which it called a "flagrant violation" of last year's pact between Kim Jong Un and President Trump.

The U.S. further sanctioned Venezuela, freezing assets and curbing immigration to increase pressure on Nicolas Maduro's regime. The steps put the country on the same footing as North Korea and Iran. National Security Adviser John Bolton speaks in Lima today at a conference of nations that see Juan Guaido as the rightful leader.

China urged Hong Kong citizens to stand up to protesters after a general strike that led to a day of traffic chaos, mob violence, tear gas and canceled flights. Beijing reiterated support for city chief Carrie Lam, defended police action and said those who play with fire will perish by it. Check out our live blog of the press event and take a look at the triad gangs linked to the protester attacks.

Bill Ackman sold his stake in United Technologies, abandoning efforts to fight its takeover of Raytheon, a person familiar said. Pershing Square also liquidated its position in payroll processor ADP, the last company where he waged a proxy fight, he told co-investors in a letter. The investment returned about 50% for those involved. He's also built a stake in another unidentified company.

WealthShield is a division of Emerald Investment Partners, an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where WealthShield and it’s representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by WealthShield unless a client service agreement is in place. Before investing, consider your investment objectives and WealthShield’s charges and expenses.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.