A whole string of bank holidays to start the week with Japan off (again!) in observance of Health-Sports Day, while the US and Canada are also off for Columbus Day and Thanksgiving respectively. The most notable to Forex markets is of course the US holiday, but just remember that today sees US bond markets closed while stock markets remain open. Forex markets will likely see reduced liquidity to start the week with the possibility of erratic price action on the back of it.

The International Monetary Fund’s annual meeting kicked off over the weekend in Lima, Peru with a backdrop of rising concern over global economic health. The major headline to come out of the weekend was from the deputy governor of the People’s Bank of China, Yi Gang who noted that a persistent weakening of the Chinese Yuan would be inconsistent with the fundamentals of the Chinese economy. He went on to reinstate that China is committed to making the planned nature of the currency more market based.

While stating that they will look to continue unwinding their firm grip around management of the Yuan, Yi Gang also did his best to talk up the fundamental base in China as good news that will prevent the Renminbi from depreciating too much.

Speaking at the CFA Society Milwaukee, the weekend headlines also included the following from Chicago Federal Reserve Bank President Charles Evans:

“We think that just delaying the fed funds rate liftoff currently until about the middle of 2016 and then a gradual path would be consistent with us getting inflation back up to 2% within a reasonable period of time.”

“I would like it to move up more quickly than that, but at the moment we are thinking that that’s what appropriate policy would be.”

Normally you would assume that the Chinese are giving lip service and you can bank on guidance from the US Federal Reserve. As I said on Friday however, the Fed is suffering from a crisis of credibility and in this case I’d be more inclined to take the most steed from the Chinese comments out of Peru!

Enjoy your relatively slow start to the week, it’s just the calm before the storm.

On the Calendar Monday:

Amazing!

“Japanese banks will be closed in observance of Health-Sports Day”

JPY Bank Holiday

CAD Bank Holiday

USD Bank Holiday

USD FOMC Member Lockhart Speaks

Chart of the Day:

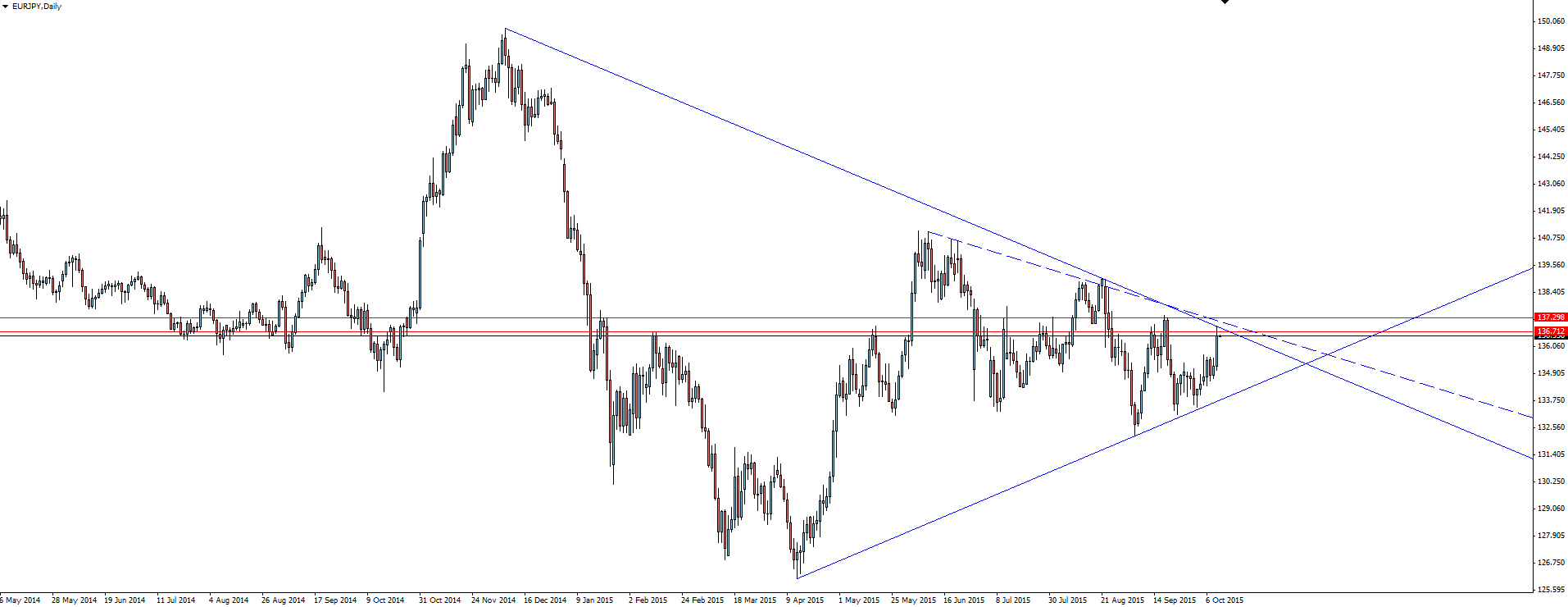

EUR/JPY is a Forex cross that I haven’t had on my watch list for a while now, but it’s time to bring it back for a look.

EUR/JPY Daily:

The daily chart has coiled into a triangle, with the most recent touch of trend line resistance coinciding with a horizontal SR zone that has been tested all over the place in the past.

These are the sorts of setups that you have to be careful fading because zooming into the hourly chart, you can see that buyers had huge momentum behind them to end the week. Now price has come into a higher time frame sell zone, I’ll be keeping an eye on the lower time frame charts for signs of momentum failing into any sort of short term confluence of resistance, but not going to pull the trigger at first sight.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.