Getting up to Date: Monday morning and we’re ready for another big week! But first, what happened over the weekend?

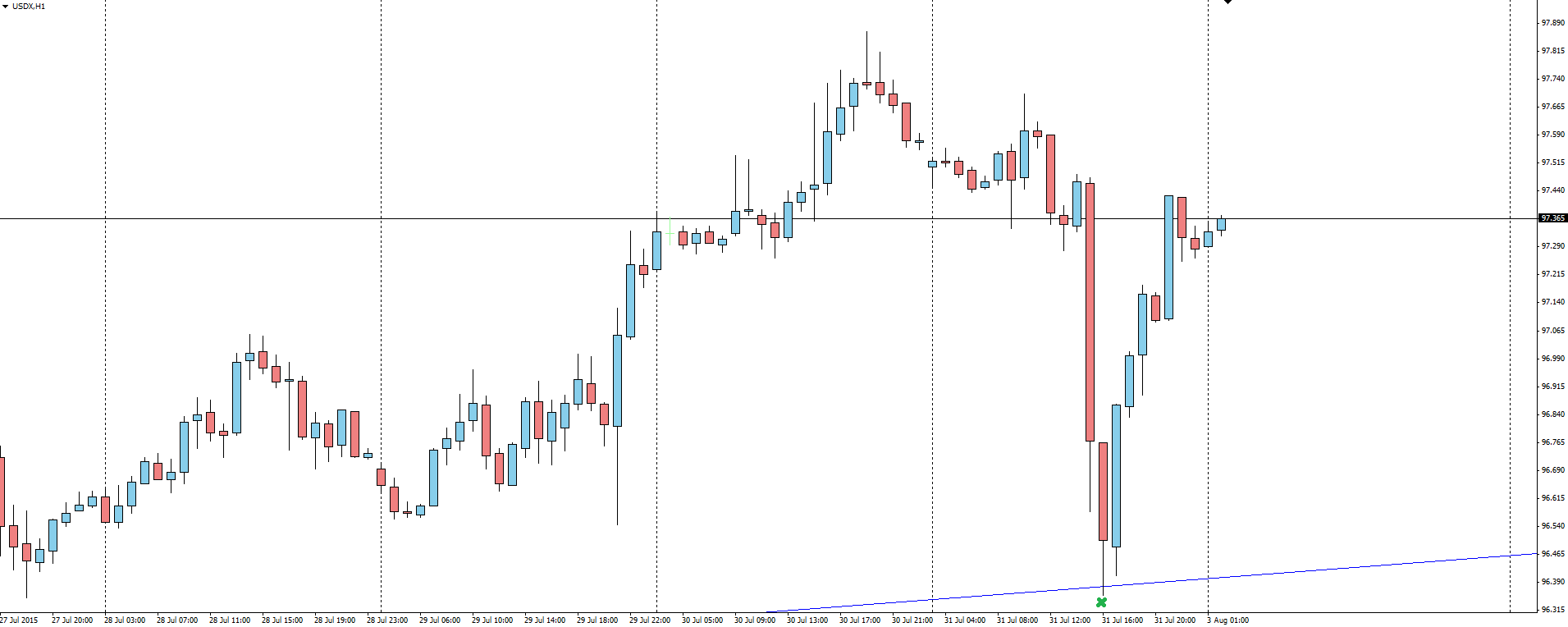

Most importantly, the USDX once again tested major trend line support but kicked off it hard in a volatile Friday night’s trading full of 2nd and 3rd tier data.

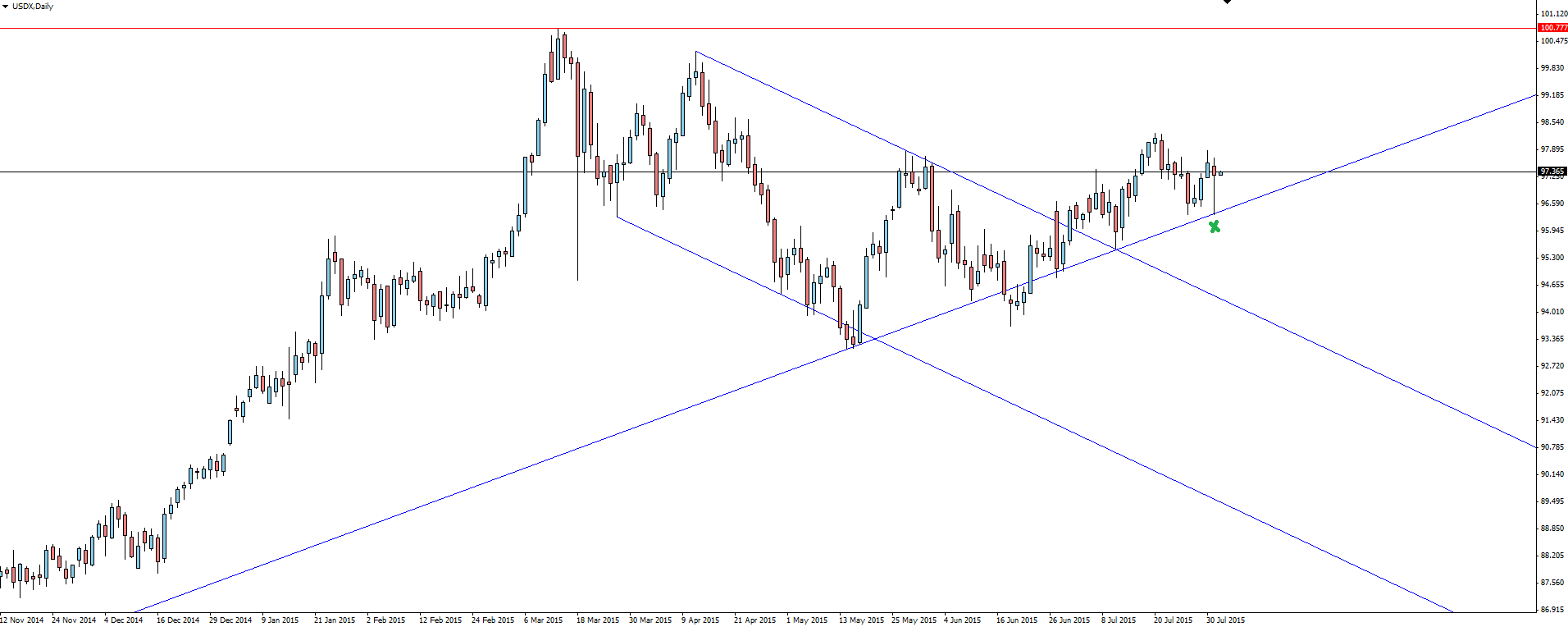

USDX Daily:

USDX Hourly:

St Louis Fed President James Bullard was also the first Fed official to give his thoughts on rates since last week’s FOMC meeting.

“We’re in good shape to lift rates in September.”

Bullard went on to speak about the 2nd quarter GDP data miss, saying that even though the Fed had taken a wait and see approach, the number didn’t deviate their opinion on growth. All sounding very positive!

Asian View:

Markets got drip fed a bit of news out of Asia during the weekend with Chinese Manufacturing PMI data and some good old fashioned jawboning from the Bank of Japan’s Kuroda.

Once again, take the Chinese data with a grain of salt but it is being reported that the fall in manufacturing came on the back of some of China’s major companies in the sector experiencing an unexpected drop in demand both home and abroad.

“CNY Manufacturing PMI (50.0 v 50.2 expected).”

China’s solution to all its problems seems to be artificial propping / stimulus, and market analysts are already calling for more.

Speaking of stimulus… With a bit of market chatter around the topic of the BOJ expanding its own stimulus program, in an interview with the Japan News on the weekend, Bank of Japan Governor Kuroda reinforced the central bank’s current policy of QE. Kuroda once again has said that expansion was not on the table and that monetary policy aimed at lifting the economy out of deflation was in fact working as expected.

“At this point, I do not see a need for additional easing.”

“The underlying trend for prices is steadily improving.” he said.”

Once again, a positive in terms of stability and current USD/JPY market direction. Something we will be looking at on Twitter through the week.

Athens Stock Exchange:

Finally, the Athens Stock Exchange reopens for the first time in 5 weeks today, with analysts expecting a volatile day’s trade almost unanimously in the one direction (just a hint, it’s not up).

Takis Zamanis, chief trader at Beta Securities sums it up for me:

“The possibility of seeing even a single share rise in tomorrow’s session is almost zero.”

The resumption of trading in Greek stocks will be the latest step back towards economic normality. Just keep the lead up to the August 20 deadline on your calendar with some EUR/USD twists and volatility from here a certainty.

On the Calendar Monday:

AUD Bank Holiday

“New South Wales has a “Bank Holiday” on the first Monday in August — for bank employees only.”

AUD ANZ Job Advertisements

CNY Caixin Final Manufacturing PMI

EUR Manufacturing PMI’s

GBP Manufacturing PMI

CAD Bank Holiday

“Civic Holiday is the most widely used name for a public holiday celebrated in most of Canada on the first Monday in August.”

USD ISM Manufacturing PMI

USD FOMC Member Powell Speaks

Chart of the Day:

Today’s EUR/USD chart of the day ties in perfectly with the USDX chart above. Looks almost perfectly inverted, showing even through all the Greek turmoil, just how much of a driver Fed policy has been.

EUR/USD Daily:

I’ve marked Friday’s long wicked candle at trend line resistance to show just how much the US Dollar drives movements in EUR/USD. Compare this chart to the USDX chart above which puts in a long wick this time at trend line support.

Markets don’t care about Greece or the Euro. They care about the US Dollar and its main driver, the Fed.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.