Morning View:

Media whispering is what I saw the RBA’s ‘tactic’ described as today, so lets go with that.

Peter Martin, the Economics Editor at the Age/Sydney Morning Herald published an article last night titled “Reserve Bank to cut interest rates in May in face of weak economy”. Now I don’t have a problem with opinion pieces. Everyone online has an opinion on absolutely everything, and monetary policy is no different.

What I do have a problem with, is major newspapers publishing opinions as if they are fact to a mainstream audience.

Well, is it just an opinion?

It doesn’t even matter if it is or it isn’t. It’s done the job that Stevens wanted and dumped the Aussie over 100 pips from the time the article was released (while the USDX was dumped alongside it mind you, showing the merit the Aussie move had).

If Stevens actually is giving under the table ‘whispers’ on monetary policy to the odd journalist who asks nicely, it’s not right. Trust is already completely gone from the RBA after multiple obvious leaks before the official release.

This is just the Terry McCrann circus re-branded and not the right way to conduct monetary policy decisions.

On the Calendar Today:

A whole raft of bank holidays across Asia and Europe today in observance of Labor Day. There is still tier 1 Manufacturing PMI data out of China and of course the Greek headlines wont stop once the European session rolls around.

We end the week with ISM Manufacturing PMI out of the US and of course as always, watch out for any end of week/month flows.

Friday:

CNY Bank Holiday

CNY Manufacturing PMI

AUD PPI

EUR Bank Holidays

GBP Manufacturing PMI

USD ISM Manufacturing PMI

Chart of the Day:

I spoke yesterday on Twitter about NZD/USD being in play following dovish comments out of the RBNZ. I never got a chance to post any charts to Twitter so I explain what I’m looking at below.

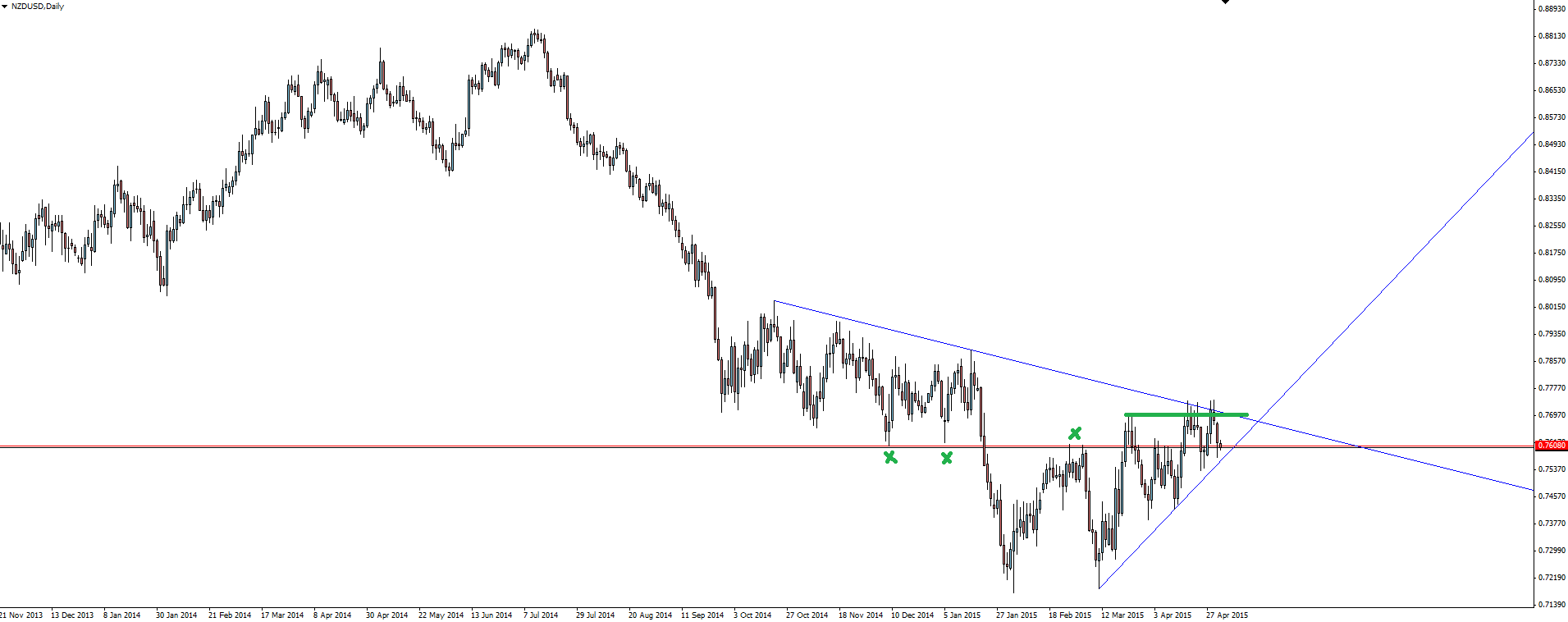

NZD/USD Daily:

Price is trapped in a triangle pattern while consolidating around the key 0.7608 weekly level. I really like how price re-tested the highs, taking some stops above them while still trapped inside the triangle, before getting smashed down on the RBNZ comments.

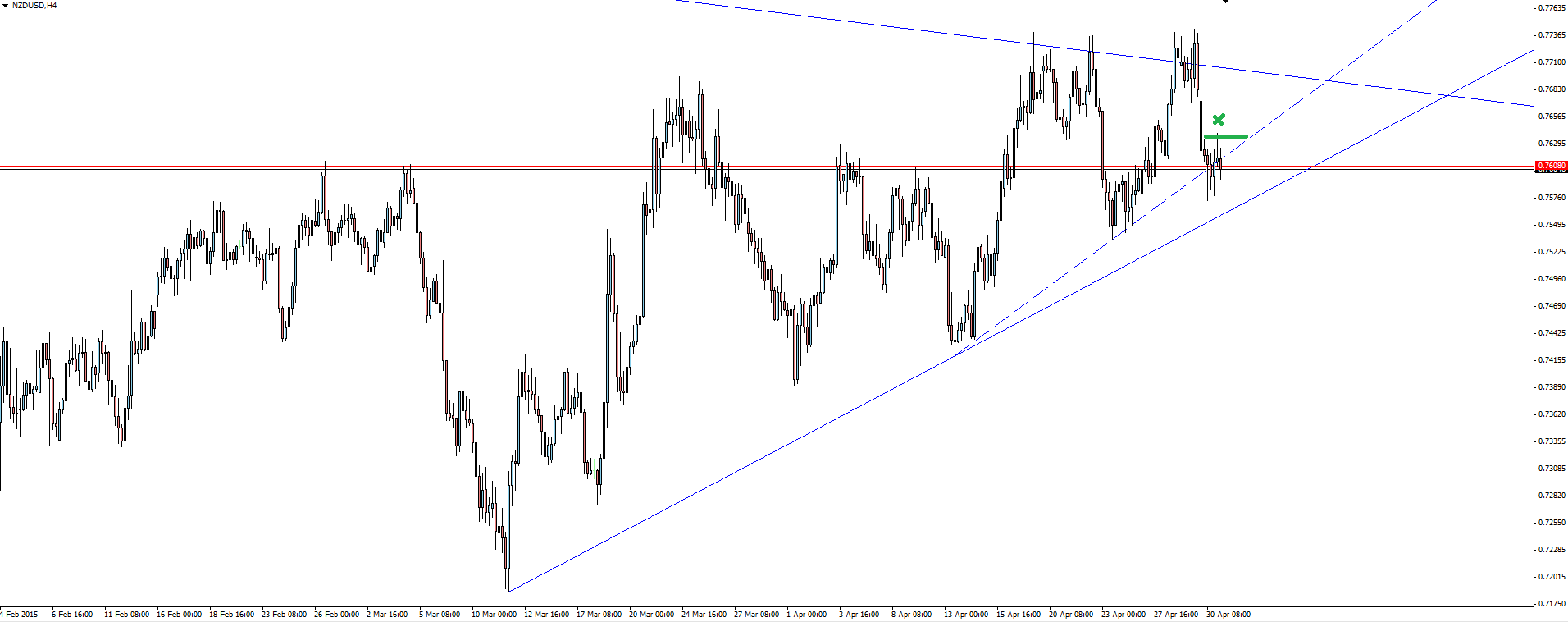

NZD/USD 4 Hourly:

Price has now come to short term trend line support, pushing through it yesterday before retesting the previous days but again being sold off them.

This is a good place to look to get short as the demand is absorbed, playing for a proper break down through the bottom of the triangle either tonight or next week.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.