-

USD (USDIndex 93.70) rallies a whole number and more from 93.47), Claims at new pandemic low, Housing data, and Earnings were strong. Overnight – AUD & JPY PMI data better than expected & UK Retail sales big miss (-0.2% vs +0.6%).

-

Evergrande (+5.4%) The $83.5m payment appears to have been met, avoiding immediate default, next payments due Oct 29. – Ease contagion fears in China – rally in Chinese property stocks.

-

Yields stronger again (10yr hits 1.705) and now 1.677% – still heading for a weekly rise as markets position for a turn at central banks.

-

Equities, reached ATH’s (Nikkei +0.7%), with USA500 at 4551 (NASDAQ shed its losses quickly and finished with a 0.62% gain at 15,215, just shy of its record of 15,374 from September 7) – Big movers – Snap -22% & Intel -9%, AT&T -0.58%, Netflix +4%, Tesla +3.5%)- VIX contract is at 18.82. GER30 and UK100 futures are still higher on the day.

-

UK retail sales dropped for a second month in September.

-

Japan’s headline inflation rate lifted out of the negative territory for the first time in 18 months.

-

US Oil is down to $80.81 following a US National Oceanic and Atmospheric Administration which is calling for warmer than average winter temperatures this winter.

-

Gold holds at 4-day highs – $1793.

-

FX markets – CAD, AUD, and NZD gained, while USD and JPY were steady to lower, leaving USDJPY at 113.98. – EURUSD 1.1635, Cable down to 1.3781.

European Open: The December 10-year Bund future is down 13 ticks at 168.12, underperforming versus US futures, although the 30-year future has rallied sharply. In cash markets the 10-year Treasury yield is down -2.4% at 1.677%, still heading for a weekly rise as markets position for a turn at central banks. DAX and FTSE 100 futures are currently up 0.24% and 0.27% respectively, while US futures are in the red, with a -0.5% decline in the NASDAQ future leading the way. Earnings and company reports remain in focus and while news that Evergrande paid the coupon on a USD bond ahead of the default deadline helped to ease contagion fears in China, other company reports weighed on the NASDAQ.

Today – Earnings will remain in focus today, but markets will also watch scheduled comments from Fed’s Powell, while preliminary PMI reports for the Eurozone and the UK and US are in focus. The earnings calendar features reports from Honeywell, American Express, HCA Healthcare, Roper Technologies, Schlumberger, Barclays, V.F. Corp., Regions Financial, Seagate Technology, and Cleveland Cliffs.

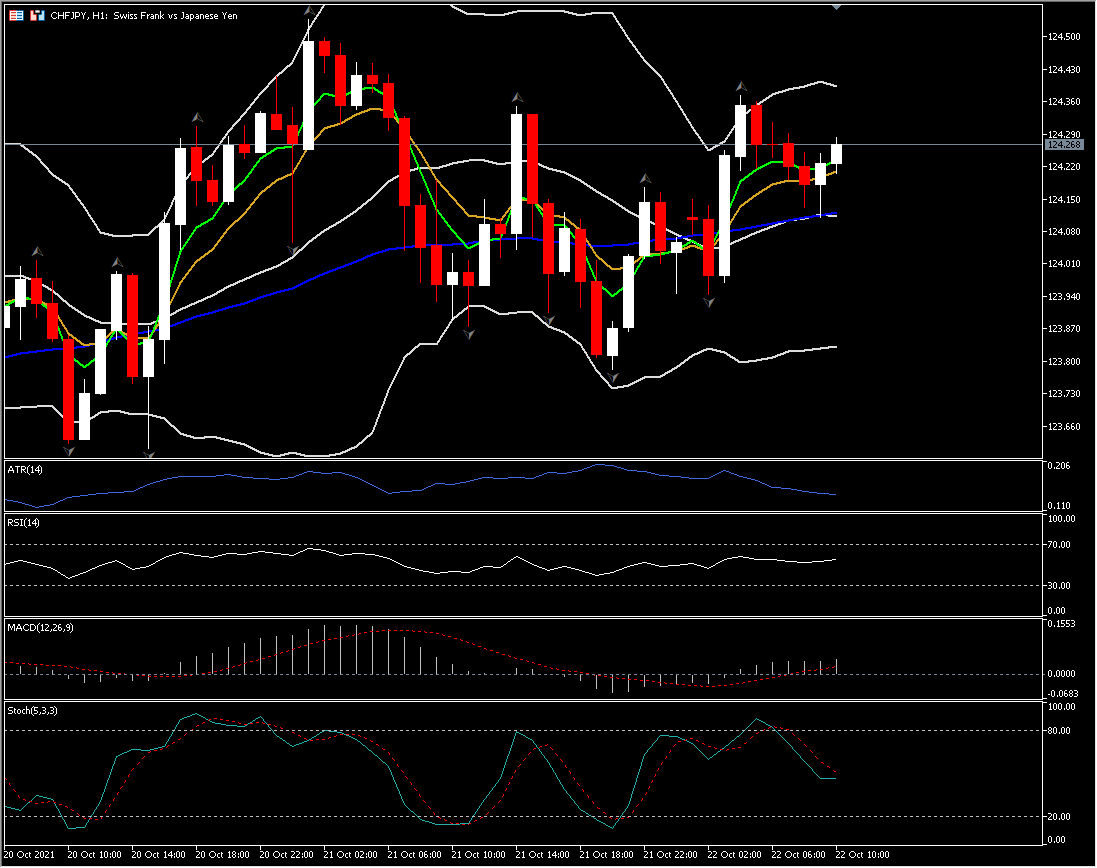

Biggest FX Mover @ (06:30 GMT) CHFJPY (+0.34%) Rebound of 124. 10 (PP & 20- & 50-period SMA) this morning. Faster MAs aligned higher, MACD signal lines rise, and RSI 57.00 as Stochastic post a bullish cross. H1 ATR 0.139, Daily ATR 0.745.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.