Market Brief

The first batch of economic data from the US were roughly in line with market’s expectations. Traders will therefore have to wait Friday’s NFPs to have a little more clarity on the timing of the first rate hike by the Federal Reserve. Personal income (s.a.) edged down to 0.3%m/m in August, lower than median estimates of 0.4% and revised increase of 0.5% in July. Personal spending rose 0.4%m/m, beating market expectations of 0.3%. On the inflation front, core personal consumption expenditure improved slightly in August, easing some of the Fed’s worries. The gauge moved back to 1.3%y/y from 1.2% a month earlier. However, this is not good enough in our opinion as the gauge is still far below the 2% threshold. Finally, pending home sales contracted -1.4%m/m in August versus 0.4% median forecast and 0.5% in July while the Dallas Fed manufacturing outlook stayed in negative territory, printing at -9.5 in August, from -15.8 in the previous month.

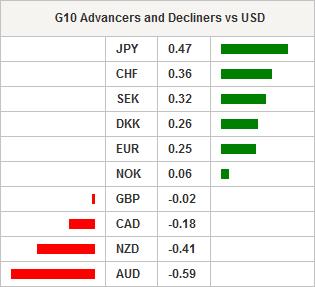

All in all, the data failed to provide support to the greenback as Fed’s Dudley recalled that the US central bank’s policy remains data dependent. The dollar index lost 0.70% since yesterday and continues to move lower as I write. EUR/USD is heading back towards the next resistance standing at 1.1296 (high from September 24th) as dollar bulls remain on the sideline. On the downside, the low from September 3rd at 1.1087 will continue to act as a strong support.

In Asia, the equity sell-off continues as concerns about global growth persist. The Shanghai Composite fell -2.54% while the Shenzhen Composite retreated -2.29%. Japanese shares erased all their gains for the year: the Nikkei is down -4.01% while the broader Topix index fell -4.39%. In Hong Kong the Hang Seng is down 3.37% while in Australia the local gauge is down 3.82%. European futures are no exception this morning. The DAX is down -0.76%, the CAC 40 -1.06%, the Euro Stoxx 50 -1.09% and the SMI -1.12%.

As expected, the respite for the Brazilian real has been proven short lived. The BRL fell 3.26% against the greenback in Sao Paulo yesterday with the USD/BRL back above the BRL4.00 threshold as investors await concrete steps from Brazilian lawmakers to shore up the fiscal deficit.

Yesterday in Switzerland, the SNB’s weekly report indicated that sight deposits continues to increase at a steady pace. Total sight deposits increased at an average pace of Sfr432mn per week during the month of September, reaching a total of Sfr465.6bn in the week ending September 25th, up from Sfr464.9bn in the previous week. Foreign and other deposits on sight continued fell substantially in September at a weekly pace of Sfr1.8bn, reaching Sfr60.5bn, the lowest level since February as foreign institutions withdraw funds. EUR/CHF holds ground slightly below the 1.10 threshold while USD/CHF moves lower due to a dollar weakness.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 16938.27 | -4.01 |

| Hang Seng Index | 20471.89 | -3.37 |

| Shanghai Index | 3022.06 | -2.54 |

| FTSE futures | 5870 | -1.09 |

| DAX futures | 9418 | -0.76 |

| SMI Futures | 8269 | -1.12 |

| S&P future | 1864.3 | -0.42 |

| Global Indexes | Current Level | % Change |

| Gold | 1127.35 | -0.41 |

| Silver | 14.53 | -0.43 |

| VIX | 27.63 | 16.98 |

| Crude wti | 44.43 | 0 |

| USD Index | 95.77 | -0.28 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| GE Sep CPI Saxony YoY | - | 0.20% | EUR/07:00 |

| GE Sep CPI Saxony MoM | - | -0.10% | EUR/07:00 |

| SP Aug Retail Sales YoY | 3.20% | 4.20% | EUR/07:00 |

| SP Aug Retail Sales SA YoY | 3.20% | 4.10% | EUR/07:00 |

| SW IMF Report on Sweden | - | - | SEK/07:00 |

| SP Sep P CPI EU Harmonised MoM | 1.00% | -0.40% | EUR/07:00 |

| SP Sep P CPI EU Harmonised YoY | -0.70% | -0.50% | EUR/07:00 |

| SP Sep P CPI MoM | 0.10% | -0.30% | EUR/07:00 |

| SP Sep P CPI YoY | -0.50% | -0.40% | EUR/07:00 |

| NO Aug Retail Sales W/Auto Fuel MoM | 0.30% | 0.50% | NOK/08:00 |

| GE Sep CPI Brandenburg MoM | - | -0.20% | EUR/08:00 |

| GE Sep CPI Brandenburg YoY | - | -0.10% | EUR/08:00 |

| GE Sep CPI Hesse MoM | - | 0.00% | EUR/08:00 |

| GE Sep CPI Hesse YoY | - | 0.40% | EUR/08:00 |

| GE Sep CPI Bavaria MoM | - | 0.10% | EUR/08:00 |

| GE Sep CPI Bavaria YoY | - | 0.30% | EUR/08:00 |

| TU Aug Foreign Tourist Arrivals YoY | - | 5.10% | TRY/08:00 |

| UK Aug Net Consumer Credit | 1.2b | 1.2b | GBP/08:30 |

| UK Aug Net Lending Sec. on Dwellings | 2.9b | 2.7b | GBP/08:30 |

| UK Aug Mortgage Approvals | 69.8k | 68.8k | GBP/08:30 |

| UK Aug Money Supply M4 MoM | - | 1.00% | GBP/08:30 |

| UK Aug M4 Money Supply YoY | - | 0.60% | GBP/08:30 |

| UK Aug M4 Ex IOFCs 3M Annualised | 3.90% | 3.70% | GBP/08:30 |

| GE Sep CPI North Rhine Westphalia MoM | - | 0.10% | EUR/08:30 |

| GE Sep CPI North Rhine Westphalia YoY | - | 0.20% | EUR/08:30 |

| EC Sep Economic Confidence | 104.1 | 104.2 | EUR/09:00 |

| EC Sep Business Climate Indicator | 0.21 | 0.21 | EUR/09:00 |

| EC Sep Industrial Confidence | -3.8 | -3.7 | EUR/09:00 |

| EC Sep Services Confidence | 10 | 10.2 | EUR/09:00 |

| EC Sep F Consumer Confidence | -7.1 | -7.1 | EUR/09:00 |

| SA 2Q Non-Farm Payrolls QoQ | - | -0.50% | ZAR/09:30 |

| SA 2Q Non-Farm Payrolls YoY | - | -0.50% | ZAR/09:30 |

| UK Sep CBI Reported Sales | 28 | 24 | GBP/10:00 |

| EC ECB's Coene Speaks in Dublin | - | - | EUR/10:30 |

| BZ Sep FGV Inflation IGPM MoM | 0.80% | 0.28% | BRL/11:00 |

| BZ Sep FGV Inflation IGPM YoY | 8.20% | 7.55% | BRL/11:00 |

| BZ Jul National Unemployment Rate | 8.50% | 8.30% | BRL/12:00 |

| GE Sep P CPI MoM | -0.10% | 0.00% | EUR/12:00 |

| GE Sep P CPI YoY | 0.10% | 0.20% | EUR/12:00 |

| GE Sep P CPI EU Harmonized MoM | -0.10% | 0.00% | EUR/12:00 |

| GE Sep P CPI EU Harmonized YoY | 0.00% | 0.10% | EUR/12:00 |

| CA Aug Industrial Product Price MoM | -0.50% | 0.70% | CAD/12:30 |

| CA Aug Raw Materials Price Index MoM | -7.50% | -5.90% | CAD/12:30 |

| US Jul S&P/CS 20 City MoM SA | 0.10% | -0.12% | USD/13:00 |

| US Jul S&P/CS Composite-20 YoY | 5.15% | 4.97% | USD/13:00 |

| US Jul S&P/CaseShiller 20-City Index NSA | 182.64 | 180.88 | USD/13:00 |

| US Jul S&P/Case-Shiller US HPI MoM | - | 0.09% | USD/13:00 |

| US Jul S&P/Case-Shiller US HPI YoY | - | 4.49% | USD/13:00 |

| US Jul S&P/Case-Shiller US HPI NSA | - | 173.84 | USD/13:00 |

| US Sep Consumer Confidence Index | 97 | 101.5 | USD/14:00 |

| EC ECB's Weidmann Speaks in Wiesbaden, Germany | - | - | EUR/17:00 |

| BZ Aug Central Govt Budget Balance | -10.7b | -7.2b | BRL/17:30 |

| UK Bank of England Governor Mark Carney speaks in London | - | - | GBP/19:15 |

| SK Oct Business Survey Manufacturing | - | 71 | KRW/21:00 |

| SK Oct Business Survey Non-Manufacturing | - | 73 | KRW/21:00 |

| NZ Aug Building Permits MoM | - | 20.40% | NZD/21:45 |

| IN Aug Eight Infrastructure Industries | - | 1.10% | INR/22:00 |

Currency Tech

EURUSDR 2: 1.1561

R 1: 1.1330

CURRENT: 1.1268

S 1: 1.1017

S 2: 1.0809

GBPUSD

R 2: 1.5659

R 1: 1.5383

CURRENT: 1.5173

S 1: 1.5136

S 2: 1.5089

USDJPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.40

S 1: 118.61

S 2: 116.18

USDCHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9705

S 1: 0.9513

S 2: 0.9259

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.