Market Brief

After a very volatile week, equity returns are mixed in Asia as traders adjust their positions ahead of next week FOMC meeting. Chinese mainland shares are in red this morning. However, the Shanghai Composite is on the cusp of ending the week in positive territory after falling almost 5% between Monday and Tuesday. It is up 0.43% on Friday while the Shenzhen Composite edges lower by 1.06%. The People’s Bank of China lowered the USD/CNY fixing to 3.3719 from 6.3772 while, in the meantime, Huang Yiping, Chinese central bank’s member, declared at the WEF in Dalian that “There will be no excessive depreciation (of the yuan)” and added “The most important thing is to stabilise the economy”. Further devaluation of the yuan is less likely as Beijing still has plenty of room for regular monetary easing, such as RRR adjustments and interest rate cuts.

Elsewhere, the Japanese Nikkei slid 0.19%, the Topix index edged slightly higher by 0.05%. South Korean Kospi retreated 1.06% while in Hong Kong the Hang Seng gained 0.43%. Further south, Australian shares continue erasing gains for the week and retreat 0.47% while in Wellington shares are down 0.40%.

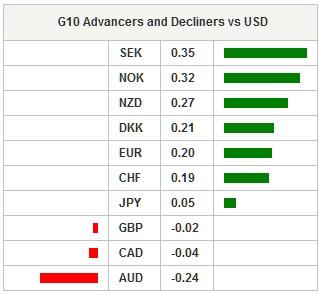

It was a quiet Asian session in the FX market. The US dollar weakened against most majors. In New Zealand, the kiwi is gaining ground against the greenback as traders digest the recent rate cut from the Reserve Bank of New Zealand. NZD/USD is up 0.93% since yesterday, back above $0.63, as business manufacturing PMI expanded to 55 in August from 53.7 a month earlier. Separately, food prices contracted -0.5%m/m in after increasing 0.6% in July.

Yesterday the Brazilian real fell 1.80% against the US dollar and 2.35% against the euro as traders priced in Brazil’s downgrade to junk status by Standard & Poor’s. Besides, consumer prices rose 9.53%y/y in August, slightly below market expectations of 9.54%. On a month-over-month basis, inflation rose only by 0.22% versus 0.23% median forecast and 0.62% in July. In the US, the last batch of economic data indicate that import prices remained under pressure in August due to low commodity prices and a strong dollar. Import price index fell 1.8%m/m versus -1.06% consensus and -0.9% previous month. EUR/USD continues to move higher and validated a break of the resistance lying at 1.1262 (Fibonacci 50% on July-August debasement), maintaining a strong short-term bullish bias. On the upside, the closest resistances stand at 1.1368 (Fibo 38.2%) and then 1.1714 (high from August 24th) while on the downside, the previous resistance standing at 1.1155 (Fibo 61.8%) is now support.

In the equity market, futures are trading in positive territory prior to the European open. The Xetra Dax is up +0.30%, CAC +0.54%, Footsie +0.25% and SMI +0.42%. EUR/CHF is testing the strong resistance at 1.10 and will need fresh boost to reach a breakthrough. USD/CHF is taking a breather and consolidates below 0.98. The dollar rose more than 5% against the Swiss franc in 2 weeks.

Today traders will be watching unemployment rate and Q2 GDP final estimate from Sweden; industrial production from Italy and India; PPI and Michigan sentiment index from the US.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.