Market Brief

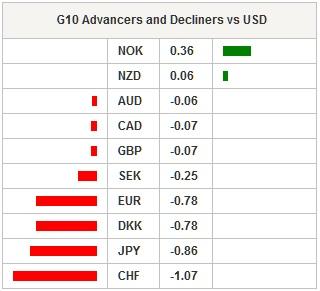

The last batch of data from the US came in mostly on the soft side yesterday. Ahead of Friday’s Non-farm payrolls, ADP indicated that the private sector added 190k in August, slightly below consensus estimates of 200k but up from July’s revised 177k increase. Factory orders grew 0.4%m/m (s.a.), below median forecast of 0.9% and down from June revised 2.2% expansion. Yesterday as well, the Fed’s Beige Book report indicated that “Most districts reported modest to moderate growth in labour demand,” and that “this tightening of labour markets was said to be pushing wages up slightly”. Overall, the report found that “economic activity continued expanding across most regions and sectors” in July and August. The US dollar strengthen against its main counterparts, especially against low yielding currencies such as the Swiss franc, the Danish krone, the Japanese yen and the euro. The dollar index had risen 0.60% yesterday and is currently grinding lower ahead of the London session.

In China, stock markets are closed due to World War II anniversary. In Japan, the Nikkei edges up 0.48% while the broader Topix index gains 0.61%. USD/JPY response to better-than-expected Nikkei PMI was muted. August’s services PMI printed at 53.7 verse 51.2 consensus while Composite PMI came in at 52.9 versus 51.5 median forecast. The dollar is trading at Y120.40 at the moment with a positive bias.

In Australia, the trade deficit narrowed to AUD 2460mn in July, above consensus estimates of AUD 3160mn but up from July’s revised deficit of AUD 3050mn. In August, retail sales declined 0.1% compared to July as consumers cut spending in household goods and cafés and restaurants expenses. Australian shares paid the bill and dropped 1.44% in Sydney. AUD/USD dropped another 0.70% on the headlines and is gaining negative momentum. The Aussie lost around 3.70% against the US dollar since the beginning of the month and we see no reason for the Aussie to reverse the trend as bad news keep piling up.

Unsurprisingly, Brazil’s Central Bank left the Selic rate unchanged at 14.25% as the Copom kept the same statement of the July meeting. Meanwhile, industrial production contracted - for 16th straight month - by 8.9%y/y in July, well below median forecast of -6.3%y/y and previous read revised to -2.8%. The Brazilian real keeps sinking and lost another 1.60% yesterday against the US dollar and is heading toward the next key resistance standing at 3.8225 (high from December 2002 !).

In Europe, equity futures are trading in positive territory this morning with the Footsie up 0.55%, the DAX 0.65%, the CAC 0.79% and the SMI 0.44%.

Today traders will be watching Markit PMI from Italy, France, Germany, United Kingdom and Euro zone; the ECB staff macroeconomic projections and ECB main refinancing rate; initial jobless claims, trade balance, Markit composite and service PMI, ISM non-manf. Composite from the US.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.