Market Brief

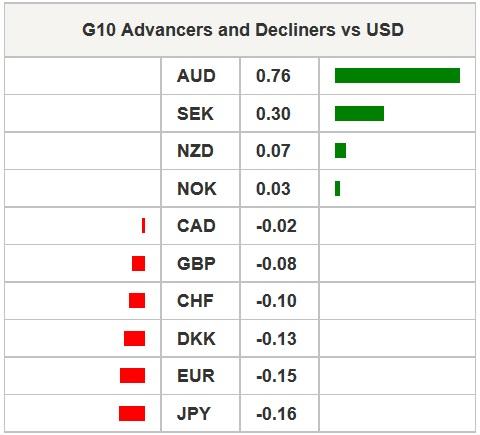

As expected the ECB meeting yesterday was indeed a non-event. Even the protester, who disturbed the press conference, didn’t manage to wake traders up. As a result, EUR/USD traded range-bound during the US session. US Industrial Production was released below expectation to -0.6% verse -0.3% expected, while the Empire Manufacturing missed widely expectations as it came in at -1.19 verse 7.17 expected. In Canada, the Loonie appreciated sharply as high as CAD 1.2251 for 1 dollar after the BoC decided to maintain interest rate unchanged at 0.75%, even though the “Canadian Economy is estimated to have stalled in the first quarter”. However the Bank expect the impact of oil shock on growth to dissipate as real GDP should grow by 1.9% in 2015. In Tokyo, USD/CAD erased previous gains and is currently trading around 1.23.

During the Asian session, the employment numbers from Australia surprised traders as the economy managed to create 37,700 jobs in March while the market expected an increase of only 15,000 jobs. As a result the AUD jumped as high as 0.7782 Aussie for 1 dollar and gained more than 1% against the Yen. Unemployment rate therefore came in at 6.1% verse 6.3% expected. This strong jobs report may challenge potential rate hike in May by the RBA, future economic data reads will be highly watched. On the equity side, the ASX 200 jumped instantly by 1.05% to 5,970 before consolidating slightly lower. In China, the Shanghai Comp is up more than 2%, the Nikkei is flat while the Hang Seng edge up by 0.10%.

Crude oil is on fire as WTI reached $56 a barrel while its counterpart from the North Sea was up more than 6.5% after data showed US crude oil inventories grew by 1,294K barrel verse 3,540K expected, their slowest pace since January. In total US crude oil inventories are at the highest level this year at 483.7mn barrels.

GBP/USD finally broke the 1.48 resistance (multiple low and Fib 23.6% on Feb-Mar sell-off) to trade higher up to 1.4880. The sterling is currently heading back and will try to convert this level into a support. On the upside, the next key resistance stands at 1.50 (multiple high and psychological level); the pair will need fresh boost to break that resistance and it may come from the US this afternoon as the Initial Jobless Claims and Housing Starts are due, a lower read could send the sterling higher. On the downside, a strong resistance stands at 1.4566 (low from April 13).

EUR/USD finally broke the 1.0685 resistance (Fib 38.2% on March rally) and tested the next one at 1.0755 (Fib 50%). However the euro didn’t find the strength to stay above as the single currency is now trading around 1.0665. It will be a quiet day in Europe vis-à-vis the lack of economic data, on the other hand it will be a busy day in the US with the release of the Housing Starts, Initial Jobless Claims, Bloomberg Consumer Comfort and Economic Expectations and Philadelphia Fed Business Outlook. We may face some erratic movements this afternoon.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.