Market Brief

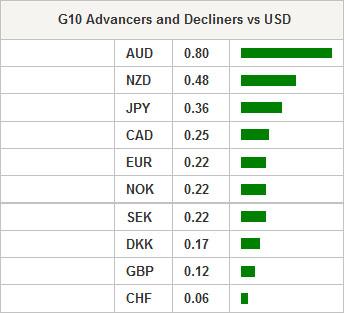

Unexpectedly, the RBA kept its cash rate target unchanged at 2.25% citing that policy easing may still be appropriate in the future and further AUD depreciation should help balancing the growth (seen below trend). The Australian current account balance narrowed faster-than-expected to AUD -9.6bn from AUD -12.1bn (revised) in 4Q. The RBA is seemingly in effort to keep margin for future maneuver, closely monitoring the inflation, housing and commodity prices. The surprise inaction from the RBA is certainly a strategic “move”, aiming to inject the uncertainty needed in the Australian money markets so that business owners are not pushed to wait for lower rates to boost their activity. AUD/USD hiked to 0.7842 post-announcement (a stone’s throw below yesterday high 0.7845). While the short term trend indicators continue pointing for an upside bias, offers are presumed strong at 0.7955/0.8000 (50-dma/Oct’14 – Feb’15 downtrend channel top & optionality). We keep our mid-term target unchanged at 75 cents verse USD.

Japan monetary base expanded to 278.9 trillion yen end of February. USD/JPY and JPY crosses were mixed. USD/JPY remained limited by offers at 120+ as PM advisor Honda said the BoJ should not overheat the economy. The rise in AUD/JPY post-RBA helped keeping the USD/JPY supported above 119.57. The key short-term resistance is seen solid at 120.47/48 (February 11/12 double top).

In Switzerland, the GDP growth remained stable in 4Q at 0.6% q/q and 1.9% y/y despite expectations for an economic slowdown. The fourth quarter has certainly been the beginning of a challenging period for the Swiss economy, with the first negative rates introduced in December (effective in Jan 22nd). The most expected economic results are those of Q1, amid the SNB decided to remove the EUR/CHF floor. Therefore, the market reaction remains skeptical to 4Q figures given that the damages caused by the free-float EUR/CHF will be visible only from Q1 data. EUR/CHF sees choppy trading between 1.05/1.10 area on business owners and households’ cautious stance vis-à-vis the fragile appreciation in EUR, especially with the persisting uncertainties regarding the Greek situation.

EUR/USD consolidates weakness before Thursday’s ECB meeting. The bias remains on the downside as traders look to sell the rebounds. The persistent risks on Greek solvability weighs on the EUR-complex while the Greek FinMin Varoufakis said to be confident that Greece will service its March obligations. EUR/USD offers remain thick at 1.1340/1.1445 (21-dma / Fibonacci 23.6% on Dec’14-Jan’15 sell-off).

USD/CAD trades ranged before the GDP read due later today. The fourth quarter GDP is expected to have fallen from 2.8% to 2.0% annualized, while some improvement must have been occurred through December according to optimistic market expectations. USD/CAD hovers around the 21-dma (1.2504) mostly in short-term bearish consolidation zone amid the pair hit 1.2799 on Jan 30th. Key support to consolidation is placed at 1.2395 (ascending baseline building since Jan 22nd) as oil prices have hard time to pick up in the short-run. The WTI tests $50.20/50 (21 & 50 dma).

Today’s economic calendar consists of Swiss 4Q GDP q/Q & y/y, German January Retail Sales m/m & y/y, Spanish February Unemployment, UK’s February Construction PMI, Euro-zone January PPI m/m & y/y, Canadian 4Q quarterly GDP Annualized and December GDP m/m & y/y, Canadian January Industrial and Raw Materials Price Index m/m and ISM New York in February.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.