Market Brief

Today’s key event is the much expected ECB meeting. The ECB is expected to announce a full blown QE and the expectations are running quite high. The consensus is the announcement of a package worth 500 billion euros, while with a risk-sharing framework, markets will be looking for a 750 billion to 1 trillion euro operation. Details on the operation, including distribution of purchases, duration, conditions etc. will determine the EUR direction today, decent price action is on the wire. EUR/USD advanced to 1.1641 in New York yesterday until Dow Jones reported the ECB could propose 50 billion euro QE per month. Not only that the news had no official confirmation/background what-so-ever, but in addition, the number is roughly in line with official expectations. This proves how tense the EUR market is before the ECB meeting. We remain vigilant as high, two-sided volatilities should dominate the EUR-complex today. Option offers on EUR/USD trail below 1.1500, light bids are seen above1.1700/50.

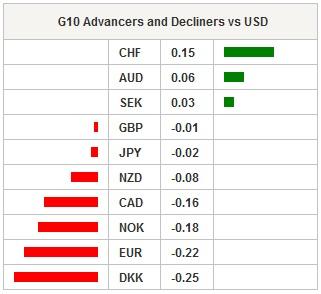

The BoC unexpectedly cut the bank rate from 1.0% to 0.75% as oil shock is expected to further boost the inflation downwards while increasing risks on financial stability. USD/CAD rallied aggressively to 1.2394 and stabilized at 1.2326/73 area in Asia. Despite the deeply oversold conditions (RSI at 85%, 30-day upper Bollinger band at 1.2220), the unexpected dovish shift from the BoC is expected to keep the selling pressures tight on the Loonie. We see support forming at 1.2205 (Fibonacci 76.4% level on 2009-2011 sell-off). The key mid-run technical resistance stands at 1.2734 (2005 high), then 1.3065 (2009 high). EUR/CAD pulled out 21, 50 and 100-dma yesterday. Strong resistance stands at the 200-dma (1.44431) as EUR negative pressures persist pre-ECB.

JPY crosses traded mixed in Tokyo, Nikkei stocks gained 0.28%. Foreign investors stepped away from Japanese stocks and bonds on week to January 16th, Japanese investor bought 657.4 billion yen worth foreign stocks while unwinding 397.2 billion worth foreign bonds. The net interest in Japan assets was negative. USD/JPY advanced to the Ichimoku base line (118.35). Offers are still aligned above the daily cloud top (118.65), with conversion line trending negative. As the negative momentum loses pace, option bids at 118.00+ will soon call for a trend reversal. However the pressures on the EUR/JPY will be important from today. Should the EUR sales accelerate, the impact on JPY crosses will be somewhat negative.

In China, the PBoC injected 50 billion yuan via 7-day reverse repo to meet seasonal demand before the Lunar New Year. USD/CNY rebounded from the 21-dma (6.2088), key support stands at 200-dma (6.1818) given expectations of additional monetary stimulus to further boost the economic activity.

NZD/USD sales accelerated yesterday, the pair drilled below our 0.7548 target (Oct-Jan downtrend base) and traded to 0.7514 for the first time since June 2012. We see deeper downside potential as the bearish momentum strengthens. The next support stands at 0.7457 (2012 double bottom), then 0.7343 (Fibonacci 61.8% on 2009-2011 uplift).

The negative rates in Swiss franc are effective starting today. USD/CHF holds ground above 0.8500, while EUR/CHF stabilizes around 1.00. The ECB decision should give fresh direction to EUR/CHF amid last week’s historical drop.

Besides the ECB decision and Mario Draghi’s speech, traders will keep an eye on Spanish 4Q Unemployment Rate, Swedish December Unemployment Rate, Italian November Industrial Orders and Sales m/m & y/y, UK December Public Finances and Public Sector Borrowing, Euro area 3Q Government Debt, Italian November Retail Sales, UK January CI Trends Total Orders and Selling Prices, US January 17th Initial Jobless and January 10th Continuing Claims, Euro-Zone January (Prelim) Consumer Confidence and Kansas City Fed Manufacturing Activity in January.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.