Market Brief

The JPY crosses rallied to fresh highs as Japanese trade balance deficit narrowed from 958.3 billion to 710.0 billion yen in October (vs. -1,027bn exp.). USD/JPY tests 119.00 as European traders jump in. The bullish trend gains pace, large vanilla calls from 117.50/75 to 118.00 should give support today. Key resistance is placed at 120.00. EUR/JPY surged to 149.14. Deep overbought conditions (RSI at 81%) should lead to profit taking into 150.00/152.00 zone.

The heavy EUR/JPY demand keeps the EUR/USD well bid. Trend and momentum indicators are marginally positive. Offers stand at 1.2577/78 (Nov 4th & 17th highs). More resistance is eyed at 1.2722/44 (daily Ichimoku cloud base/Fib 23.6% on May—Nov sell-off). EUR/GBP holds ground at 0.80, tests 200-dma (0.80538). Strong resistance is seen at this level as it has been more than a year the EUR/GBP has not traded above its 200-dma. EUR/CHF trades at 1.2010/15 despite new election polls on Gold referendum showed significant shift to “no” camp.

The Cable advanced to 1.5721 amid the BoE minutes were less dovish than expected. The UK retail sales (at 09:30 GMT) should determine whether the GBP/USD will push for deeper short-term correction clearing 1.5700-1.5800 option barriers or the 1.55 target will remain up to date.

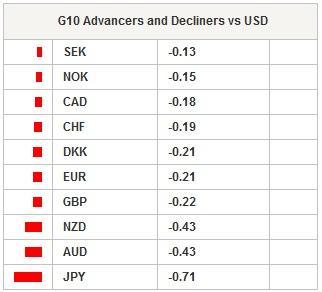

Released yesterday, Fed minutes pushed USD higher against all G10 and EM currencies. Minutes mentioned that the weak economic outlook in Euro-zone, China and Japan should have little impact on the US recovery. Some members were concerned that the inflation may remain below the target for some more time. The US October CPI is due today (13:30 GMT), the CPI is expected to decelerate by 0.1% on month. Any positive surprise should push for further USD gains. The US 10-year yields remain below 2.40%, the DXY index resists pre-88.000.

USD/CAD mostly traded above the 21-dma (1.1305) yesterday following US Senate rejection to construct TransCanada’s Keystone XL oil pipeline earlier this week. The next vote is eyed in January and is given higher chances of success as four Democrats opposing the project should be replaced by Republicans, in favor of the project due to large amount of jobs at key. USD/CAD advanced to 1.1369. The pair is still in the bearish consolidation zone. A close above 21-dma should keep the bias on the upside.

Else, the Brazil mid-November inflation figures surprised on the downside. USD/BRL legged down to 2.5660. A close below 2.57 will push MACD in the red zone suggesting extension of gains for the BRL. Option bids trail above 2.5180/2.5200+ for today expiry. We remain cautious as political risks should abruptly halt BRL recovery.

Today’s economic calendar: Swiss October Trade Balance, Exports & Imports m/m, German October PPI m/m & y/y, French, German and Euro-zone November (prelim) Manufacturing, Services and Composite PMI, Euro-zone November (Advance) Consumer Confidence, Italian September Industrial Sales & Orders m/m & y/y, Norwegian 3Q GDP q/q, UK October Retail Sales m/m & y/y, US October CPI m/m & y/y, US November 15th Initial Jobless Claims & November 8th Continuing Claims, US November (Prelim) Manufacturing PMI, Philadelphia Fed November Business Outlook, US October Existing Home Sales m/m and Leading Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.