Market Brief

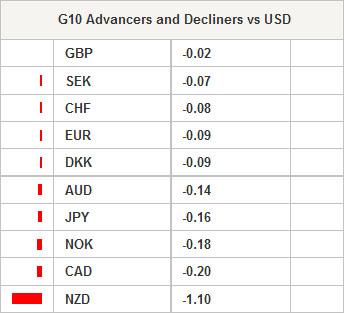

The USD is broadly in demand after the Ottawa attack yesterday, the DXY index advances to 1-week high. Released yesterday, the US September CPI has been marginally better than the market estimates. Both the CPI and the core CPI remained unchanged at 1.7% on year to September (vs. 1.6% & 1.7% exp. respectively). The soft advance in consumer price gives time to Fed before its first fund rate hike. The US 10-year yields recovered to 2.24% in New York, yet failed to move higher. The uncertainties on monetary policy will likely keep the US rates subdued for some more time.

Wednesday has been an event-full day for Canada. The Ottawa attack combined to BoC verdict lifted up the volatilities in CAD-complex. The BoC maintained the bank rate unchanged at 1.0% in line with expectations, yet stepped away from its “neutral” stance and the use of “forward guidance” to our surprise. The signs of cool-off in September CPI and the low oil prices were rather proper for a dovish tone. USD/CAD spiked down to 1.1184 (over a week low), bids below 21-dma (1.1203) pushed the pair back to this week’s 1.12-1.13 range as the Ottawa attack and lower oil prices offset the BoC verdict. USD/CAD bias turns marginally negative; resistance zone is seen at 1.1296/1.1325 (week high / MACD pivot).

In Japan, the MoF data showed decreasing Japanese interest in foreign bonds on week to October 17th. Japanese investors were net short of 1’169.1 billion yen of foreign bonds (vs. + 796.0bn yen a week ago), foreign interest in Japan stocks decreased by an additional 412.6 billion yen. On broad based USD strength, USD/JPY advanced to 107.38. The bearish momentum slows, yet decent option barriers at 107.50+ challenge the upside attempts. We see consolidation towards the daily Ichimoku cloud cover (105.01/106.24). On EUR/JPY, the formation of tweezer bottom should trigger a minor bullish reversal if 135.44 (yesterday low) holds through the day.

The strength in GBP/USD halted as BoE minutes highlighted “mounting evidence of loss of momentum in the euro area […] increasing risks to the durability of the UK expansion in the long term”. Resistance remains solid at 1.6116/86 (21-dma / Fib 23.6% on Jul-Oct sell-off).

NZD recorded the largest losses versus USD overnight as 3Q inflation decelerated faster than expected (0.3% q/q vs. 0.5% exp.). The CPI y/y fell to 1.0% (from 1.6% previously). NZD/USD wrote-off a figure as RBNZ-doves jumped in. Further weakness is expected with resistance building pre-0.7975/0.8000 (Fib 23.6% on Jul-Oct drop / optionality). The key support stands at 0.7709 (Sep 29th low).

Today, Norges Bank gives policy verdict and is expected to maintain the deposit rates unchanged at 1.50%. Today’s economic calendar is heavy: French October Business Survey, Own-company Production Outlook, Production Indicator, Business and Consumer Confidence, Spanish 3Q Unemployment Rate, French, German and Euro-zone October (Prelim) Manufacturing, Services and Composite PMIs, Swedish September Unemployment Rate, UK September Retail Sales m/m & y/y/, UK September BBA Loans for House Purchase, Euro Area 2Q Government Debt and Deficit, UK October CBI Trends Total Orders , Selling Prices and Business Optimism, US October 18th Initial Jobless Claims & October 11th Continuing Claims, US October (Prelim) Manufacturing PMI, Euro-zone October (Advance) Consumer Confidence, Chicago Fed September National Activity Index, Kansas City Fed October Manufacturing Activity Index and US September leading index.

Swissquote SQORE Trade Idea

G10 Currency Trend Model: Sell EURUSD at 1.2646

For trade details or more great trade ideas, visit Swissquote SQORE platform: sqore.swissquote.com

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.