Market Brief

Chinese GDP grew 7.3% y/y in Q3, slightly beating 7.2% expected (vs. 7.5% in Q2). The retail sales and fixed assets (ex-rural) expanded at marginally slower pace, while the industrial production accelerated 8.0% on year to September (vs. 7.5% exp. & 6.9% last). The economic data was overall supportive of Yuan longs. USD/CNY retreated to 6.1195 (below 6.12 for the first time since March 7th), decent option barriers trail up from 6.1150/6.1250 to 6.18 for today expiry and should cap the upside attempts. Despite better-than-expected data, the World Bank CEO Sri Mulyani urges structural reforms in China to maintain growth at 7.0%.

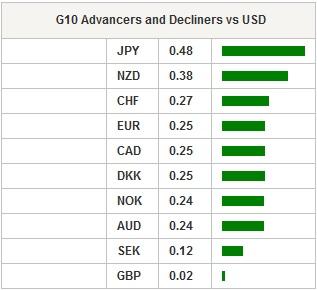

AUD and NZD were better bid on good Chinese news. NZD/USD cleared 0.80 offers for the first time over a month and rallied to 0.8034. Trend and momentum indicators are comfortably bullish. We see room for further upside correction. Resistance is seen at 0.8052 (former year-low) then 0.8134/40 (50-dma/Fib 38.2% on Jul-Oct sell-off). Option bids are building at 0.7950/0.8000 to give support to bullish try. AUD/USD traded ranged, the enthusiasm on Chinese data was partially tempered by RBA minutes, re-insisting on moderate improvement in labor market, over-valued AUD and the importance of rate stability. On falling commodity prices, the RBA said most Australian iron ore mines remain profitable despite low prices, while the softer Chinese property markets continue weighing on steel demand. The AUD/USD rallies find sellers; offers are seen pre-0.8900.

USD/JPY and JPY crosses were mostly offered in Tokyo, as Nikkei stocks pared yesterday gains (-2.03%). USD/JPY traded down to 106.25 (crossing below the Ichimoku tenkan line), technicals remain solidly negative suggesting the extension of weakness towards the daily Ichimoku cloud cover (104.23/105.39). Weak US yields are supportive of lower USD/JPY. US 10-years retreated to 2.1337% in Asia.

EUR/USD advanced to 1.2835 in Asia on risk-on flows. However the sentiment in EUR/USD remains fragile. Eurostat publishes the Euro-zone’s government debt ratio in 2013 (as % GDP). In 2012, the total EZ government debt reached 92.60% of the GDP (vs. 66.2% in 2007). The release may revive discussions on whether the EZ countries should further tighten their belts - a scenario Draghi is not favorable for.

The risk-on environment pushed GBP/USD above the 21-dma (1.6148). Despite strengthening momentum, GBP-bulls remain sidelined before BoE minutes due tomorrow, expectations are somewhat dovish. Option barriers are placed at 1.6175/1.6200 for today expiry.

The economic calendar of the day: Swiss September Trade Balance, Exports & Imports m/m, Swiss September M3 Money Supply y/y, UK September Public Finances, Euro-zone 2013 government debt-to-GDP ratio, US September Existing Home Sales m/m.

Swissquote Sqore Trade Ideas:

www.swissquote.com/fx/news/sqore

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

These cryptocurrencies could face selling pressure according to an analyst: STRK, ENA, OMNI, JUP, ONDO

Thor Hartvigsen, investor at Heartcore Capital and a crypto analyst has identified a list of cryptocurrencies that are expected to see a massive increase in their supply. Typically, an increase in selling pressure negatively impacts an asset’s price.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.