Market Brief

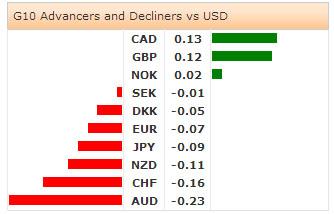

The FX traders remain on the sidelines before the Fed policy announcement today and the Scottish independence referendum tomorrow.

The FOMC is expected to reduce its monthly asset purchases by additional 10 billion dollars and continue purchasing 10bn dollar treasury and 5bn dollar MBS monthly. As we approach the end of the asset purchases program, the jitters on the timing of the first Fed rate hike escalate. Despite FOMC Chair Yellen’s former warnings that the Fed will keep interest rates at low levels for “considerable time” after the end of the QE, the hawkish expectations drive the markets pre-FOMC decision. Traders continue favoring the USD-buy side. Markets are positioned for a hawkish shift in Fed’s forward guidance, thus leaving room for disappointment later today. More-balanced-than-expected Fed stance may trigger some short-run frustration for USD-hawks. We stand ready for rectification in USD and US yields.

EUR/USD advanced to 1.2995 as some traders shift to more balanced positions in US session yesterday, considering the risk of a softer Fed tone. Up trending US yields kept EUR/USD offered pre-1.3000. We expect consolidation pre-Fed. A dovish FOMC stance should power the EUR-bulls back towards 1.3110-50, pre- September 4th ECB meeting levels.

In UK, the tensions on Scottish vote continue. Scotland will vote tomorrow to decide whether to stay in the UK or to leave. The uncertainties persist as the poll results are tight. The economic and political implications of Scottish independence are very important. GBP/USD tests offers at 1.6300+, option bids trail above this level especially to take advantage from a potential post-Fed rally later in the day. Upside attempts should however remain vulnerable. We shall see the clear short (and even long)-term direction as the Scottish situation gets more clarity. In the morning, the BoE will release meeting minutes; we expect little price action as the focus remains on Scotland.

EUR/GBP trades in the tight range of 0.79483/697. Trend and momentum indicators are perfectly flat. A close above 0.79650/75 (21-dma & MACD pivot) should keep the bias on the upside.

There is a morning start formation on the AUD/USD daily chart. Our candle pattern monitor qualifies the formation as high conviction given the low trading levels over the past two sessions. The technical picture suggests a short-term bullish reversal, yet the Fed will likely say the last word. Key resistance is seen at 0.9182/0.9200 (200-dma & optionality).

The economic calendar of the day: UK August Claimant Count Rate and Jobless Claims Change, UK July Unemployment Rate (3-months) and Average Weekly Earnings, Italian July Trade Balance, Euro-Zone July (Final) CPI m/m & y/y, Credit Suisse ZEW Survey on September Expectations in Switzerland, US September 12th MBA Mortgage Applications, US August CPI m/m & y/y, US 2Q Current Account Balance, US September NAHB Housing Market Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.