Market Brief

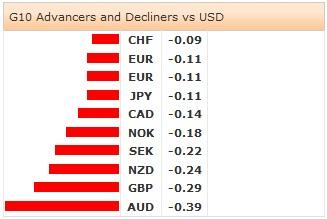

Nothing much has happened overnight. The risk sentiment remains contained as markets are awaiting the outcome of this week’s key events. The two-day FOMC meeting starts today. The market expectations are decidedly favoring the USD-buy side; investors are positioned for a hawkish shift in Fed’s forward guidance. However we believe that there is room for some disappointment on Wednesday. Released yesterday, the US industrial production and the capacity utilization remained weak in August, thus confirming our doubts that the Fed will likely keep the tone balanced and trigger some short-run deception among the USD-hawks. We stand ready for rectification in USD and US yields.

Elsewhere, the jitters continue in the GBP-complex as Scottish referendum approaches (Sep 18th). In New Zealand, the national elections are due on September 20th and should also keep the political pressures tight on the Kiwi.

USD/JPY and JPY crosses traded in tight ranges as Tokyo came back from holidays. USD/JPY remained tight between 106.93/107.30. Cautious short-term positions due to Fed and Japanese exporter offers keep USD/JPY offered below 107.50. Stops are mixed above. EUR/JPY remains above its daily Ichimoku cloud cover (137.06/91). 200-dma resistance (139.83) is likely limit the upside attempts as uncertainties continue. The tweezer top formation warns of a potential bearish reversal at these levels. Technicals are however at the second plan this week due to heavy eco-political schedule.

On a similar pattern, we see bearish harami formation on USD/CAD daily chart. Resistance is building pre- 1.1100, while option bids will be activated above.

EUR/USD trades in wait-and-see mode. Resistance remains solid at 1.2980/1.3000 pre-Fed. The pair is expected to range-bound between 1.2860/1.2980, a breakout will be defined by how hawkish the Fed will sound on Wednesday.

In UK, the Scots vote occupies the headlines. GBP/USD trades in the sidelines; the event risk keeps traders from taking significant positions on one side or the other. GBP-complex remains too sensitive to news/polls on Scottish referendum; the short-term moves are sharp and unpredictable. We stay in the sidelines. Regarding the option strikes, 1.6300 seems the pivot level of the week. Offers trail below, bids dominate above this level.

The economic calendar of the day consists of Spanish 2Q Labor Costs y/y, UK August CPI, RPI and PPI m/m & y/y, ZEW Survey for German Current Situation and Expectations in September, ZEW Survey for Euro-Zone Expectations in September, Euro-Zone 2Q Labor Costs, US August PPI m/m & y/y, Canadian July Manufacturing Sales m/m, US July Net Long-term TIC Flows and Total Net TIC Flows.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.