Market Brief

The geopolitical tensions in Israel/Gaza and Ukraine/Russia continue occupying the headlines. The UN Security Council called for immediate end of conflict in Gaza. The gold remains in demand; XAU/USD holds ground above $1,300 with most investors thinking it is not the right time to play short. Another critical resistance stand at $1,285/86 (June 16th high/200-dma).

In Japan, USD/JPY and JPY crosses traded soggy as Nikkei was closed. USD/JPY traded in the tight range of 101.20/39. Trend and momentum indicators remain marginally bearish. Support is seen pre-101.00, then 100.76 (2014 low). Decent option barriers are eyed at 101.50 up to 102.00. EUR/JPY tests 136.75 (Fibonacci 38.2%% on Nov-Dec’14 rally). The key support zone is placed at 136.00/23 (March-July downtrend channel bottom/2014 low).

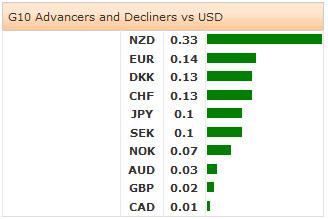

EUR/USD made a bullish start to the week after trading down to 1.3491 in New York last Friday. The pair broke below 1.3503 for the first time since June 5th ECB meeting; bids at 1.3477/1.3503 lifted the pair to 1.3524 before the closing bell. Trend and momentum indicators remain comfortably bearish; with July 15th CFTC data confirming the extension of speculative short EUR positions. Resistance is seen solid at 1.3550/1.3600. EUR/GBP corrects last week weakness (down to 0.78888); we remain sellers on rallies as long as resistance at 21-dma (0.79564) holds.

The Cable is in the bearish consolidation zone, deeper correction is eyed with technicals pointing downwards. Option bids are seen above 1.7075, offers dominate below 1.7050 (30-day mid-Bollinger band). The critical support zone stands at 1.6875/1.6950 (year-to-date uptrend bottom/50-dma).

NZD/USD traded back to 0.8720 (July 17th high) on thin volumes. The RBNZ verdict is due on July 24th, markets expect additional 25 bp hike. However the speculations on less hawkish accompanying statement keep the appetite limited. AUD/USD tests 0.9400 resistance, option bets for today expiry are mixed at this area, offers are solid pre -0.9505 (year-to-date high).

Released on Friday, the Canadian inflation accelerated at the faster pace of 2.4% year-to-June (vs. 2.3% expected & last). The faster growing consumer prices revived BoC-hawks, questioning how true Poloz’s lower inflation outlook is. USD/CAD sold-off to 1.0721 as knee-jerk reaction, resistance should now strengthen pre- 1.0800/20 region (optionality/200-dma) and keep the Loonie ranged within 1.0550/1.0800 band.

The economic calendar of the day is light, traders watch German June PPI m/m & y/y, Swiss June M3 Money Supply, Italian May Industrial Sales and Orders m/m & y/y and Chicago Fed June National Activity Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

The EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 on Monday during the early Asian trading hours. The softer US Dollar provides some support to the major pair.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.