Market Brief

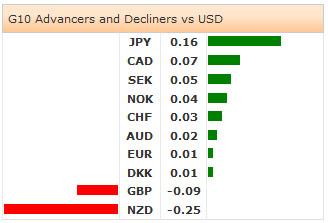

In the second day of her semi-annual testimony, FOMC Chair Yellen faced the Financial Services Committee. Yellen said that the economic recovery should lead to the end of the QE program in October, and yet declined to specify timing for the main Fed fund rate hike. The main exit tool would be the IOER (interest on excess reserves) rise, with limited flexibility on use of RRP to insure financial stability. She insisted on the fact that no mathematical formulas should be set to conduct Fed’s policy as such rules would be a “grave mistake” and would only limit Fed’s independence. In addition, Fed Fisher said that the rate hike may come by next year or sooner, adding that he doesn’t see interest rates rising sufficiently to damage Fed’s portfolio. USD rally slowed, DXY index consolidates gains at about 80.500 – a month high levels, while the US 10-year yields seem little convinced, unable to break above 50/100-dma at 2.5668/70 respectively. USD/JPY couldn’t make it higher than its 21-dma (101.71), technicals are perfectly neutral waiting for fresh direction.

EUR/USD extended losses to 1.3521 post-Yellen and remained tight ranged in Asia. If the pair holds ground above yesterday and the Asian session low (1.3521), the formation of tweezer bottom should signal a minor bullish reversal. Yet the bias is clearly negative. The key support zone stands at 1.3477/1.3503 (2014 low/June 5th ECB reaction low). Decent option barriers are seen pre- 1.3550/80 for today expiry. Euro-Zone releases final inflation report in June and the expectations remain soft. EUR/GBP cleared support at 0.79000 and legged down to 0.78888 overnight. Short term technicals signal the end of the upside correction. Decent option barriers trail above 0.79000 for today and Friday expiries.

In UK, the unemployment rate improved to 6.5% in May, while the earnings growth disappointed over the same month. GBP/USD’s bullish momentum cooled down in London yesterday. The pair is still in June-July ascending channel, bids are seen at 1.7096/7100 (21-dma / optionality). No barriers are eyed on the upside. Resistance are placed at 1.7180/92 (year high levels) and then 1.7270 (uptrend top & 30-day upper Bollinger band).

Offers in AUD/USD remain solid pre-0.9400 (21-dma/optionality), light stops are eyed above. The key short-term support is at 0.9330/39 (June 16th low / Fib 61.8% on Oct’13 – Jan’14 pullback). AUD/NZD breaks above 1.0751 (Fib 76.4% on Oct’13 – Jan’14 drop) mainly due to selling pressures in NZD. The short-term technicals are now positive suggesting deeper upside correction to 1.0820/23 July highs. NZD/USD extends weakness to 0.8683 despite 5.7% increase in jobs advertisement in month to June. Dip-buyers are still willing to stay given the rate expectations. The RBNZ gives verdict next week.

As widely expected, the BOC kept the bank rate unchanged at 1.00%. USD/CAD rallied to 1.0794 for the first time since June 20th, as the Canadian policy makers said that the latest inflation pick-up should remain temporary. The BoC Governor Poloz aims to keep the CAD weak to maintain favorable conditions for stronger exports and business investments. USD/CAD trades within our key 1.0550/1.0800 range, with solid offers on the upper end and stops eyed above 1.0800. Option bids are eyed at 1.0750/75 for today expiry.

The economic calendar of the day: Eu27 June New Car Registrations, Euro-Zone May Construction Output m/m & y/y, Euro-Zone June (Final) CPI m/m & y/y, Italian May Current Account Balance, Canadian May International Securities Transactions, US June Housing Starts and Building Permits m/m, US July 12th Initial Jobless Claims and July 5th Continuing Claims and Philadelphia Fed July Business Outlook.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold price struggles for a firm intraday direction, hover above $2,300

Gold price fails to lure buyers amid a fresh leg up in the US bond yields, modest USD uptick. A positive risk tone also contributes to capping the upside for the safe-haven precious metal. Traders, however, might prefer to wait for the US NFP report before placing aggressive bets.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.