Market Brief

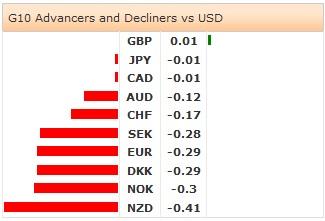

The week starts with escalating tensions in Ukraine, broadly higher USD and ECB’s efforts to cap the strength in EUR. The UN Security Council met in an emergency meeting last night. The Ruble opened the session downbeat and dropped more than 1% against USD at the time of writing. XAU/USD rallied to $1,330 on decent safe haven demand.

EUR-complex gap started the week amid ECB officials voiced concrete QE plans to stop the undesired EUR rally. ECB President Draghi said that stronger EUR will trigger looser monetary policy (source: MNI) while low interest rates could have financial stability implications. ECB’s Noyer and Coeure made similar comments. EUR/USD opened the week at 1.3843 (Friday close at 1.3885), EUR/JPY at 140.71 (Friday close at 141.13). EUR/GBP rapidly sold-off below the 50-dma (0.82838). Event risk in EUR remains.

In UK, the Rightmove house prices increased at the faster pace of 7.3% y/y in April release (vs. 6.8% a month ago). GBP/USD rebounded from 1.6706. Trend and momentum indicators remain in the green zone yet the enthusiasm is limited before CPI release due on Tuesday. The market expectations are soft. The first line of support is seen at 21 & 50 dma (1.6624/16 resexctively). On the upside, the key resistance stands at the year high of 1.6823 (Feb 17th). EUR/GBP crossed below its 50-dma early in the session, the global EUR sell-off being the main trigger. Technicals remain bearish, the pair is still offered below the 21-dma (0.83060).

USD/JPY consolidated weakness at 101.42/72 in Tokyo. Trend and momentum indicators are negative as BoJ refrained from adding more stimulus in its policy meeting last week. There are talks on PM Abe being unhappy about BoJ’s decisions. The sentiment remains heavy in JPY-crosses. USD/JPY trades below the daily Ichimoku cloud cover (102.37/103.10), more option related offers wait to be tipped below 101.00. The key support is 100.76 (2014 high). EUR/JPY sees resistance at 21-dma (141.45). With mounting reaction against EUR-strength, we expect limited upside.

AUD made a flat start to the week. Trend and momentum indicators remain steadily bullish, the next key resistance stands at 0.9499/0.9500 (Fib 76.4% on Nov’13 – Jan’14 pullback & psychological level). Option bets are mixed at 0.9370/0.9425 area with bias on the upside. AUD/NZD consolidates gains in the bullish consolidation zone. Option bids favor the upside for the week ahead despite RBA/RBNZ divergence in favor of the Kiwi leg.

Traders start the week with Italian March(Final) CPI m/m & y/y, Euro-Zone February Industrial Production m/m & y/y, US March Retail Sales m/m, Canadian Teranet & National Bank House Price Index m/m & y/y and US February Business Inventories.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.