Market Brief

The US equities traded aggressively down in New York. The S&P500 dropped 2.10%, Dow Jones lost 1.62%, while Nasdaq slid 3.10%. Asian equities took over the bearish sentiment. The Nikkei stocks fell sharp from 14,027.80 to 13,885.11 at Tokyo opening and closed this Friday 2.38% lower. The Nikkei share average hit the 6-month low. Hang Seng and Shanghai’s Composite retreated 0.63% and 0.09% at the time of writing. China CPI accelerated 2.4% in March as expected (vs. 2.0% in Feb), while the producer prices contracted at the faster pace of -2.3% (vs. -2.0% in Feb).

USD/JPY dipped down to 101.33 (week low & Feb-Mar up-trending channel floor) and bounced back towards 102.00 as Europe walked in. The post-BoJ bearish momentum strengthens while the BoJ minutes showed that the economic recovery and prices move in line with BoJ’s expectations. Released overnight, the domestic corporate good prices improved on m/m basis from -0.2% to 0.0% in March; the CGPI y/y retreated from 1.8% to 1.7%. USD/JPY is likely to close the week below its daily Ichimoku cloud cover (102.37-103.10). Option bets are negatively skewed pre-102.00, more option related offers trail below 101.50 for today’s expiry. EUR/JPY rallied to 141.56 in European opening. Given the EUR strength, we see support building at the daily cloud cover (140.65/104.96).

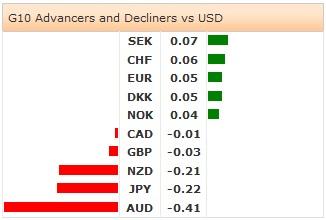

EUR/USD extends gains to 1.3900 regardless of discussions around a potential QE. Markets fully price out the easing threats from the ECB; any action is priced in as highly unlikely in the foreseeable future. The bullish momentum strengthens on EUR/USD, reinforced by stronger appetite for EZ peripheral bonds. The next key support stands at 1.3967 (March 13th high). EUR/GBP tests the 50-dma (0.82840) on the upside. Trend and momentum indicators are less bearish, a close above the 21-dma (0.83091) suggests further gains. The key resistance is placed at 0.83650 (Jul’13- Mar’14 downtrend top).

The overall risk-off pulled Antipodeans lower overnight. AUD/USD fell to 0.9363. Decent option bids are to keep the downside safe above 0.9300 this Friday. NZD/USD retreated to 0.8624, the bullish momentum fully failed to gain pace. Light option bids are placed at 0.8655 to expiry pre-weekend, more support should jump in the game at 21-dma (0.8607).

Else, the BoE kept the bank rate stable at the historical low of 0.50% and the asset purchases target stable at GBP 375bn as widely expected. The FX markets showed little reaction to BoE decision. GBP/USD eased below 1.6800 from 1.6820 (slightly lower than yearly high of 1.6823 as of Mar 17th).

Moody’s revised down Turkey’s government bond rating from Baa3 stable to negative.

This Friday, the release of Euro-zone inflation reports continues with German and Spanish March Final CPI m/m & y/y. Traders also watch French February Current Account Balance, Norwegian 1Q Existing Home Sales q/q, UK February Construction Output SA m/m & y/y, US March PPI m/m & y/y and University of Michigan’s April (Prelim) Confidence Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.