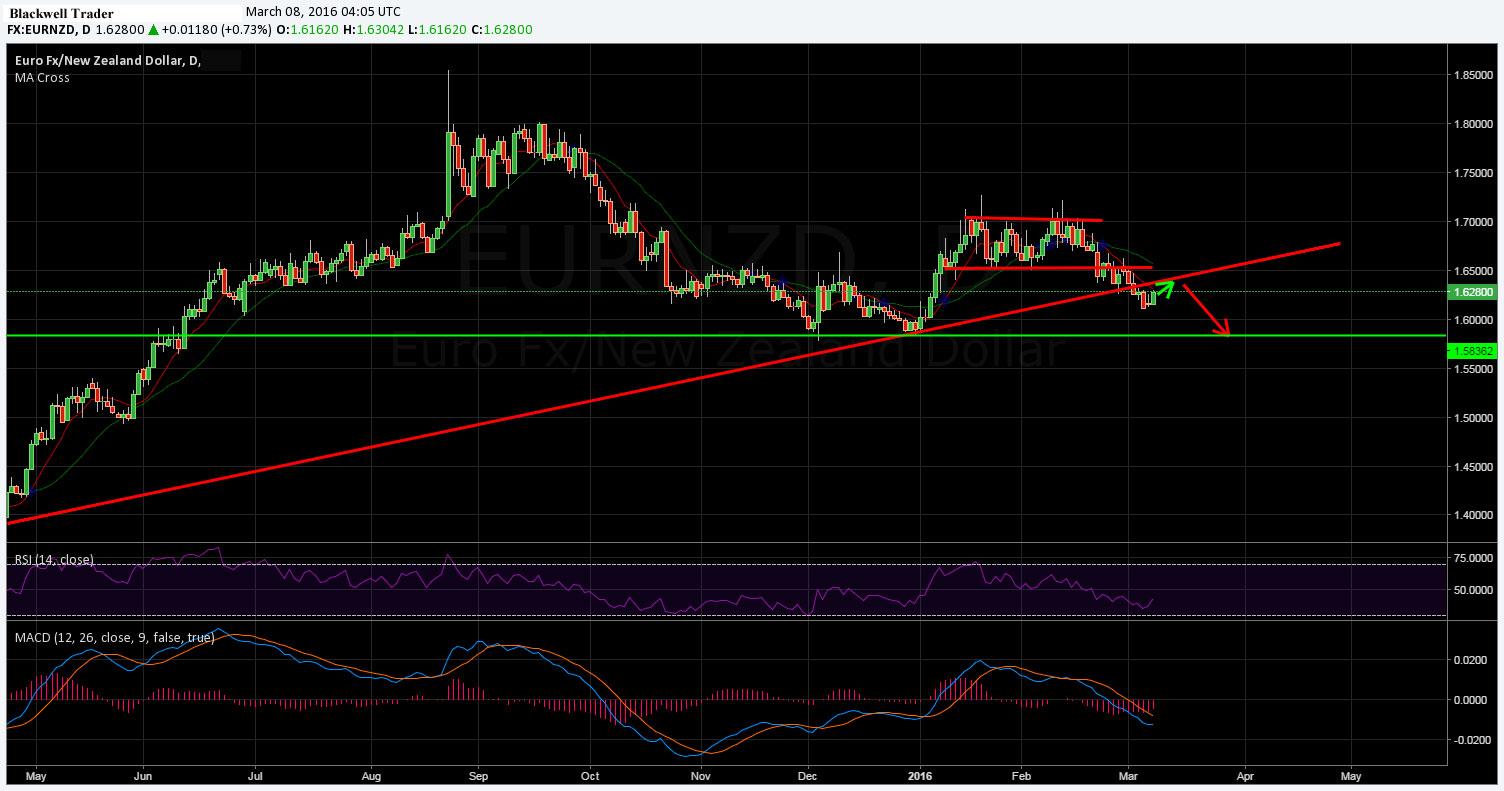

The Euro-NZD currency pair has been relatively quiet of late as price action has been constrained by a corrective structure. However, early March saw the structure break down, as price dropped rapidly through both the channel and the bullish trend line. Subsequently, there is a real chance that price will continue to break down in the coming days, thereby lending itself to short selling.

Taking a look at the pair’s technical indicators demonstrates a currency which is highly biased to the short side. The 12 and 30 EMA’s are both indicating bearishness as they rapidly decline, in line with the price action. In fact, the end of February actually saw both price action and the EMA’s declining sharply below the 100-day moving average.

The strongest signal of a short play in progress is the breakdown of the long run bullish trend line. Last week saw prices convincingly breach the bullish trend line from April of 2015 which strongly predisposes the currency for further downside moves. Given price action’s current location, a move towards the next major support level at 1.5834 is therefore likely in the coming week.

However, it should be noted that the RSI Oscillator appears to have reached relatively low within neutral territory and may require a small retracement to provide room for any large short pushes. Subsequently, look for price to retrace back towards the trend line, and the 12 EMA, before recommencing a tumble towards our target around the 1.5834 level.

Ultimately, given the strong risk/reward percentage, any potential short play in the EURNZD could reap significant benefits for keen traders. However, do monitor the EUR GDP figures, due shortly, as a surprise result could buoy the currency.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.