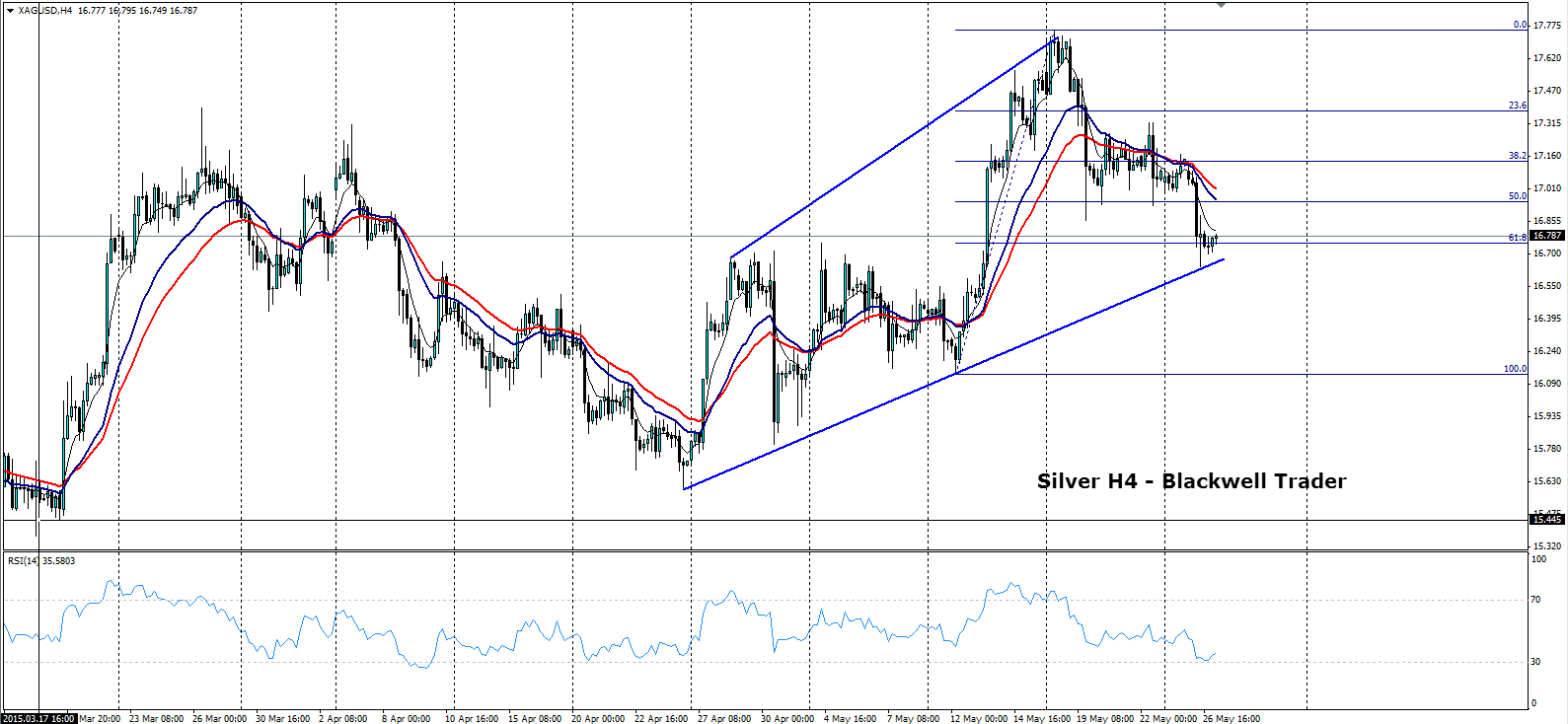

Silver fell strongly overnight, breaching a key psychological level at 17.10, to rest upon support at 16.75. The metal now sits upon a bullish trend-line that is providing plenty of support and may see the commodity retrace within the coming days.

The precious metal currently trades around 16.75, which also represents the 61.8% Fibonacci retracement level. The bearish push to this level seemed to stall at a key convergence of the dynamic trend-line and the 61.8% retracement level. Subsequently, this area of support provides an excellent base from which a retracement can occur.

Taking a look at an oscillator shows relative strength as having touched upon the oversold range before flattening and starting to trend higher. This seems to indicate that any bullish move will have plenty of room to move on the upside.

In the near term, silver will need to surmount resistance at 17.10, the 38.2% Fibonacci level, to confirm a move higher. Any subsequent breach of this key level could see the commodity moving sharply to test resistance at 17.31.

Either way, any bounce or retracement from the dynamic trend-line is likely to provide plenty of trading opportunities in the coming days. Resistance can be found at 17.10, 17.35, and 17.56, whilst any breach of the bullish trend-line will find support at, 16.41, and 16.12.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.