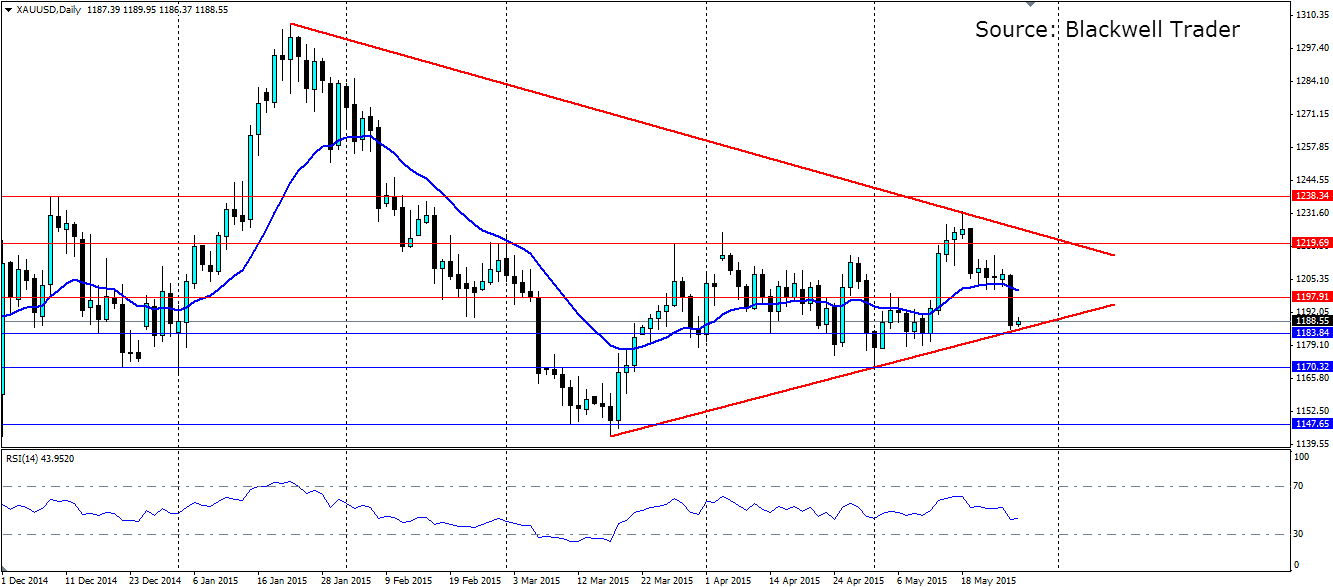

Gold was sold off heavily yesterday, pushing the metal back below the $1200 an ounce mark as India announced a ‘Monetisation Programme’. Gold now sits along the bullish trend line at the bottom of a consolidation shape that will provide dynamic support and could see the metal retrace higher.

India announced a plan to unlock the wealth stored in some 20,000 tons ($767 billion worth) of gold that is currently lying idle in Indian households. The plan is to encourage banks to take deposits of gold in the form of bullion and jewellery that will pay interest to the owner. This gold would then be sold on the open market to try and satisfy local demand. Currently India imports 1,000 tons of gold per year and this is putting a huge drain on foreign reserves.

This plan could go some way to reduce those imports with locally sourced gold. Depositors will not receive back the specific gold they deposit, which will put off a lot of people from depositing jewellery. But for holders of bullion it will be a good way to receive a return on their investment. Whether it is successful and reduces imports remains to be seen.

Gold traders responded by selling off the precious metal from $1,206.72 an ounce, down to $1,188.51. The rampant US dollar certainly would have helped by adding to the bearish pressure. The bullish trend line that has been in play since the lows hit in mid-March has once again been brought back into the picture.

Gold has fallen back into a liquidity zone that has seen plenty of raging and reversing, so it’s likely we will see this act, along with the dynamic support along the trend line, to reverse gold once again and see it push higher towards the recent highs, or at least the bearish trend line that forms the top of the pennant shape that gold is currently consolidating within.

Either way look for a rejection and a bounce off the bullish trend in the short term. Resistance will be found at 1197.91, 1219.69 and 1238.34 with the bearish trend line acting as dynamic resistance. If we see the bullish trend line fail, look for support at 1183.84, 1170.32 and 1147.65.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD declines toward 1.0850 after US data

EUR/USD extends its downward correction toward 1.0850 in the American session. The US Department of Labor reported that there were 222,000 first-time application for unemployment benefits last week, helping the USD hold its ground and causing the pair to stretch lower.

GBP/USD corrects to 1.2650 area on modest USD recovery

After touching its highest level in over a month at 1.2700, GBP/USD reversed its direction and declined toward 1.2650 on Thursday. The modest USD rebound seen following Wednesday's sharp decline makes it difficult for the pair to regain its traction.

Gold finds resistance near $2,400, retreats below $2,380

Gold advanced toward $2,400 on Wednesday as US Treasury bond yields pushed lower following the April inflation data. The recovery in US yields combined with the US Dollar's resilience after Jobless Claims data, however, causes XAU/USD to retreat toward $2,370 on Thursday.

Is the crypto bull run back? Premium

Bitcoin’s ascent to $65,000 seems to have breathed hope into the choppy crypto markets. Some altcoins have shot up 10% to 20% due to BTC’s comeback. Investors wonder if this is the resumption of the crypto bull run.

BRICS, the West and the rest – global trade hubs and de-dollarization

World trade is fragmenting into opposing blocks, warns the IMF. The BRICS and their allies are distancing themselves from the West. BRICS are attempting to de-dollarize and replace SWIFT to circumvent the threat of sanctions.