The Cable was extremely volatile last week thanks to some mixed data out of the UK, combined with bullish US dollar sentiment. 200+ pip swings were the norm as UK CPI disappointed, but Retail Sales surged ahead two days later. The liquidity zone certainly played its hand in leading the pound lower, and that could continue thanks to some failed support.

The Cable was much more volatile than many had expected with the dollar bullish bias of the market making any moves higher a tough ask. UK CPI dipped to -0.1% y/y which led to the first aggressive swing lower, but that was halted as Core Retail Sales jumped up by 1.2% m/m.

The US Core CPI ticking higher led to the second aggressive swing downwards as the market was gagging for anything dollar bullish. Fed Chair Janet Yellen added to the dollar's resurgence by saying the Fed remains committed to raising interest rates this year.

The calendar for the week ahead is not exactly brimming with events on the UK side. CBI Realised Sales, Consumer Confidence and Preliminary GDP are the standout items. The US side is certainly busier and will likely provide direction.

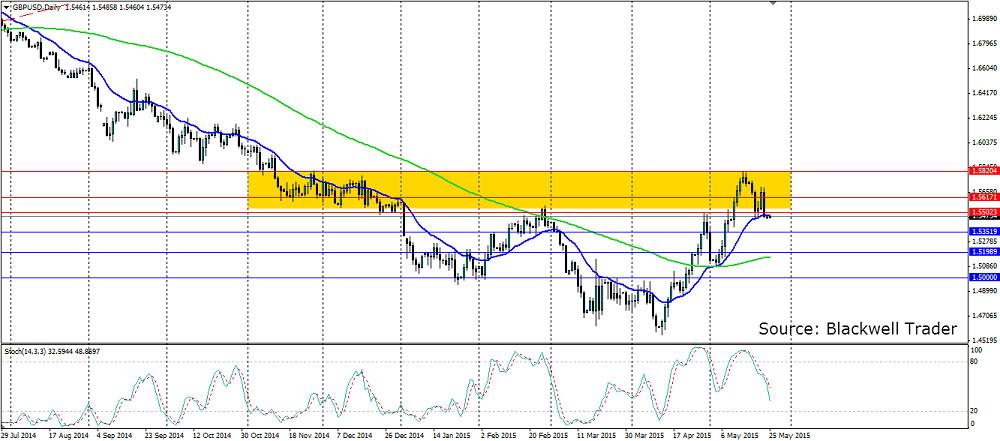

Technicals point to a bearish week ahead for the Cable with a lower high meaning the bears are winning as they push the pair out of the liquidity zone. The pair has broken under support levels and the 20 EMA which puts the 100 day MA is sight.

The Stochastic Oscillator is looking extremely bearish and the markets insatiable appetite for dollar buying will likely dominate. Resistance is found at 1.5502, 1.5617 and 1.5820 while support is found at 1.5351, 1.5198 and 1.5000.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.