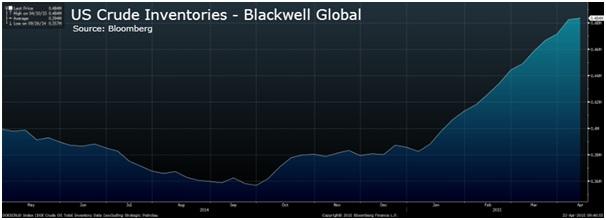

Crude oil prices have continued to appreciate again this week despite concerns over capacity constraints at the Cushing storage facility. Despite statistics released by the EIA, forecasting shale oil production to fall by 45,000 barrels to 4.98 million/bpd in May, markets continue to remain concerned by the increasing stockpile.

Crude oil inventory capacity remains a significant concern to traders and some analysts have suggested that Cushing, in particular, is nearing full storage capacity. Commodities research, released by Goldman Sachs, takes a different view and suggests that, although there is uncertainty over the total capacity constraints, the risk of running out of US crude storage is a low probability event. In fact, their analysis of the EIA data suggests, that there likely remains enough crude capacity to support higher alternative production paths for some time.

Goldman’s modelling of U.S crude production has also highlighted their belief that April represents the peak month for domestic oil production and that May through August will see inventory figures decline. These forecasted falls, based on rig shutdowns and increasing refinery activity will likely last until October when scheduled refinery downtimes will impact the movement of crude through the supply chain. The modelling further points to US domestic production as increasing by 170kb/d through Q4, 2015 thereby continuing to grow inventories moving into 2016.

However, lacklustre domestic demand and increased productivity within shale oil production is definitely impacting the U.S crude inventories and causing a significant domestic oil glut. Considering the levels of domestic crude production, many are now questioning the sense in restricting US crude exports solely to appease the domestic refining industry.

The oil export constraint directly impinges upon the markets ability to clear the excess supply and also impacts US GDP in the range of 22b/year. Even in light of the recent US rig stand-downs, it is likely that 2016 will bring further over supply within the domestic industry fuelling the case for a review of the ban. Failure to address the future of crude export is only likely to lead to further supply imbalances leading in to 2016.

Our forecasting suggests that WTI crude in Q1 will be under pressure to move towards establishing a base at $48/bbl, in spite of the large reduction in capex and well shuttering occurring. This stands in contrast to Goldman’s original projections at WTI $65/bbl which is likely under risk.

Pressure from the private sector is also building for a review of the prohibition especially considering the export revenues that are foregone by the current ban. Senator Lisa Murkowski, of Alaska, has publicly stated her intent to introduce legislation to repeal the export restriction that has been in place since the oil crisis of the 70’s. Murkowski presents a credible advocate for the change considering her position as Chairperson of the U.S Senate Energy and Natural Resources Committee. Considering Thursday’s crude inventory figure is, yet again, likely to be positive, the pressure from advocates for change continues to grow.

Any subsequent legislative change or relief from the export constraint is likely to see light sweet crude prices heading higher as the market is able to clear the excess inventory. Such a move would also help to protect the domestic shale oil industry by allowing crude prices to stabilise, which are more in-line with shale producers cost structures.

Ultimately, rebalancing crude supply is a process which has a significant lead time and is complicated by restrictive legislation within the U.S domestic market. It begs the question, at what point does the U.S administration see the upside of ending a program that only benefits refineries and fails to support the fledging shale oil market.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.