The S&P 500 is the one to watch as of late, as earnings season comes about and the markets become very bullish. Markets were led in part strongly by Apple today, which saw a boost to its earnings and its forecast over the Christmas season, as it seeks to boost revenues and margins via its new phones which we have all seen and heard about.

I don’t normally talk about companies at all, but apple takes up 3.3% of the weighting of the S&P 500, and so any positive move for them will impact the confidence of investors who are holed up in equity indexes in the US market.

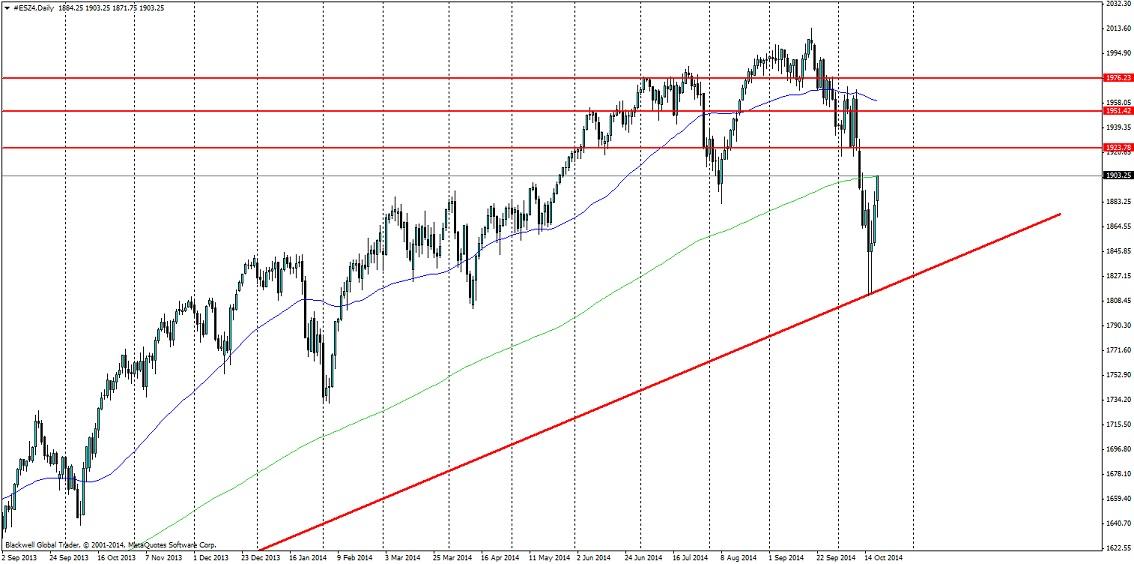

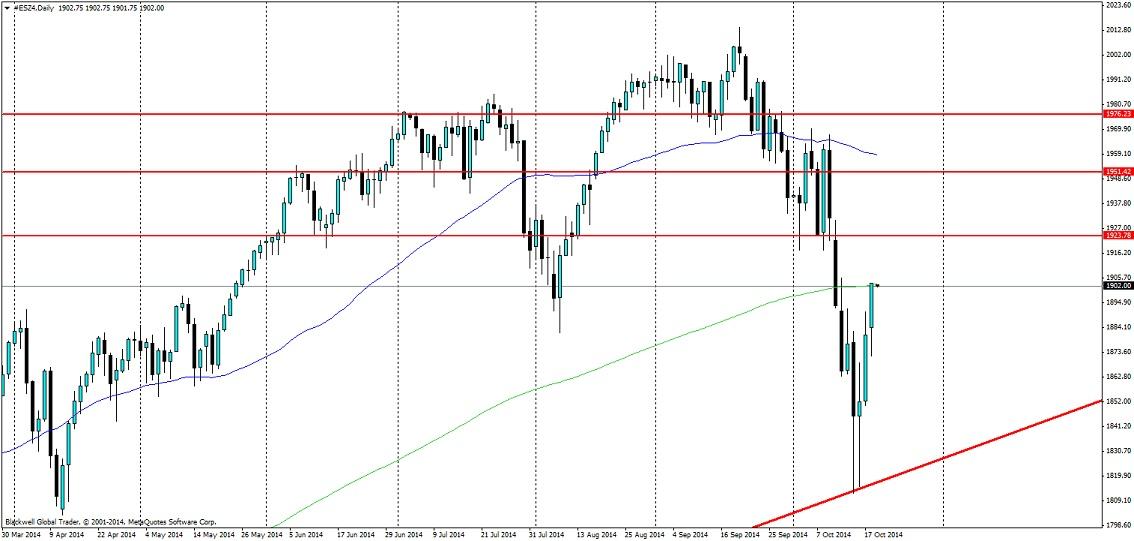

Looking at the S&P 500 on the charts, it’s clear to see that the bulls have taken control of movements higher, after the recent touches on the long term trend line from the 2011 dip. For a while, the market was quite bearish on the touch, but has since rallied back quite strongly.

Resistance levels are looking strong, but the S&P 500 ignored a strong level as it rallied higher. However, it’s worth paying attention to them at present and they can be found at 1923.78, 1951.42 and 1976.23.

Another key area which traders should take notice of is the 200 day moving average. I know a lot of people ignore moving averages when trading, but they shouldn’t as they provide a lot of information, and markets from time to time will play of them quite happily.

As we can see the market has rushed up in aftermarket hours and touched the moving average and is now using it temporarily as resistance. A solid breakthrough here would be bullish up until 1923, however, we will likely have to see momentum through the moving average and a confirmation of further bullish trending.

Overall, the S&P 500 is looking solid, after the recent market correction. But the US economy is still ticking along and low oil prices will likely lead to a boost for company's future earnings prospects as well. Perhaps the bulls are still alive and well in the market, and they’re now here to catch the falling knife and put things right.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.