Gold surprised markets recently as it managed to claw back up the charts before hitting strong resistance in the market place. This was in part led by the recent volatility, which has occurred in the market place, but I believe that gold has lost a lot of its lustre in recent times, and that it may not be the metal you think it is anymore.

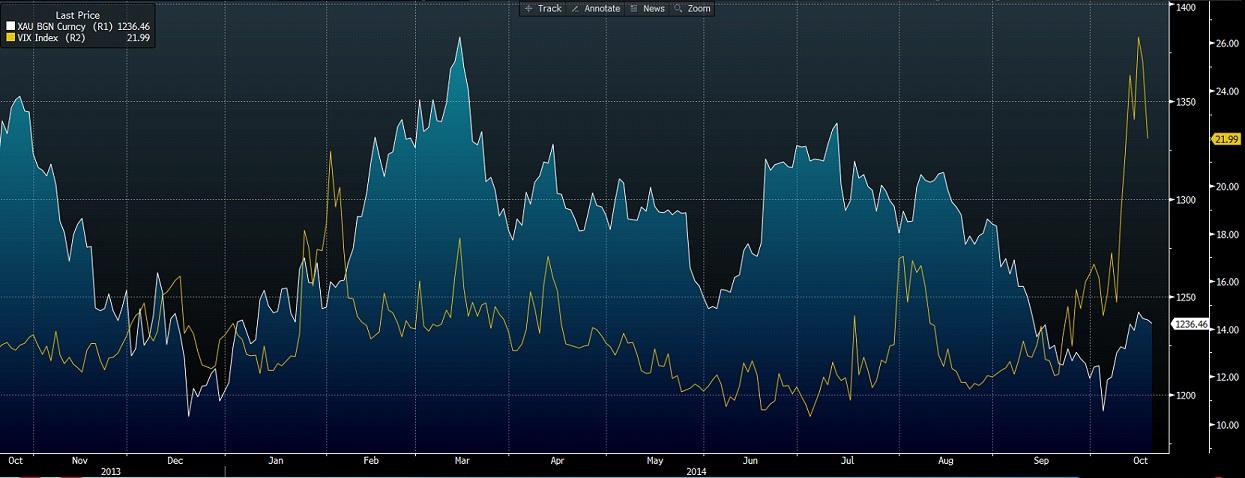

A quick comparison to the VIX index reveals what the majority of market participants already know, and that is that gold is not reacting with the VIX index. People primarily use it as a hedge for inflation -- during the GFC it was for hyper-inflation – which never occurred -- in the US market.

People have instead looked to other traditional safe havens, and the heavy appreciation of the Japanese Yen during the equity turmoil should come as no surprise in the market place, as it always has been the financial market safe haven in troubling times.

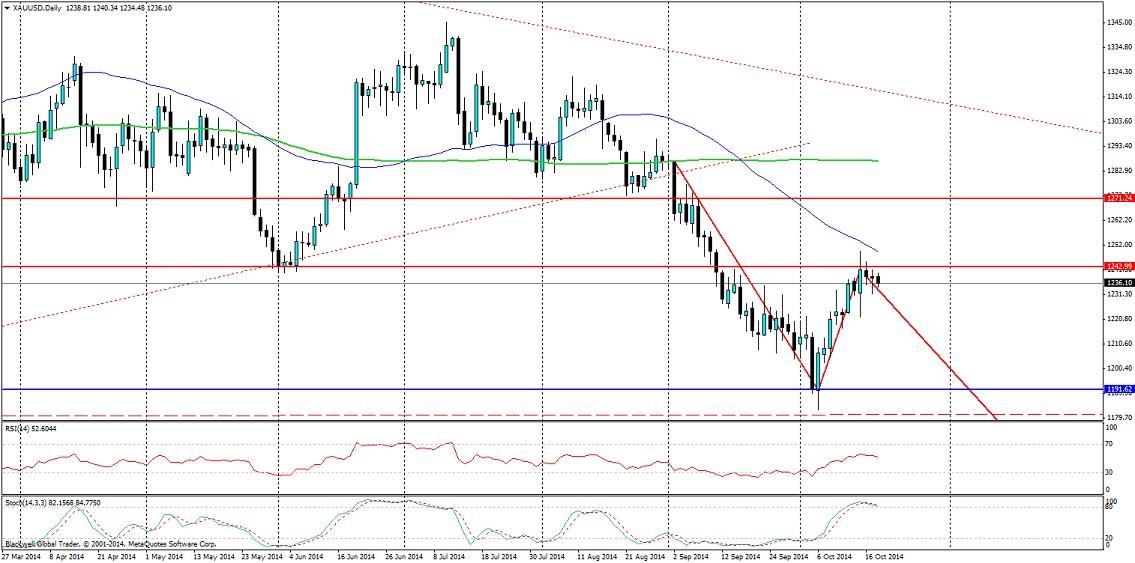

What can be seen on the charts when concerning gold is the strong ceiling at 1242.00 as gold has hit resistance here and started to trend back downwards. It looks likely that this will continue from a technical perspective, as currently stoch has shown a cross over and it looks to be trending lower right now, in line with the market movement.

Also, when you consider the fundamental aspect you have to take into consideration the labour market at present in the US. Which so far has been very robust, even unemployment claims came in at a record 264k last week, which is the lowest result in 14 years! The 10 year average is 385k which is quite abnormal given the GFC which impairs the data.

This strong labour market, coupled with the now falling oil prices enables the US economy to pick up the pace more than people realise. It’s likely we will see further falls and even the strong possibility of Yellen talking up interest rates, which in turn will lead to gold falling sharply again. Further compounding the prospect of US growth was the most recent Michigan consumer sentiment survey: which found consumers were upbeat about the economy and this bodes well for the economy as a whole.

Overall, the US recovery is ticking along and gold as we have seen does not have the momentum to go higher, even when volatility and worry returns to the market. Expect gold to continue to trend lower in the short-medium term unless we see some sort of catastrophe out of the European markets.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.