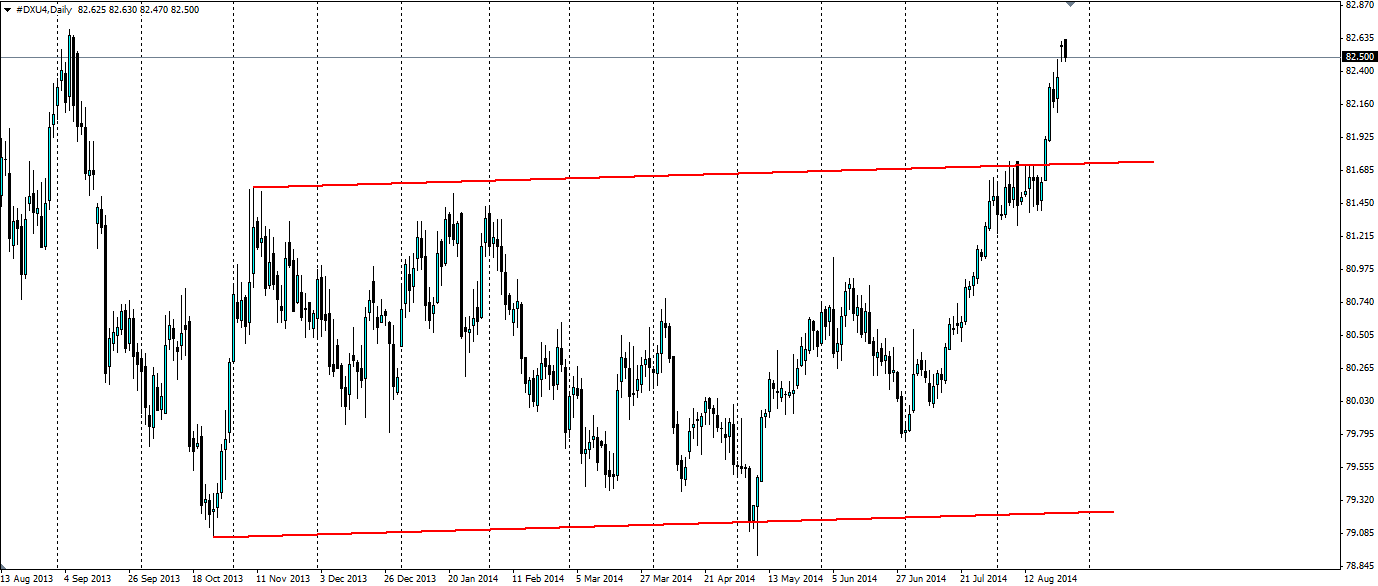

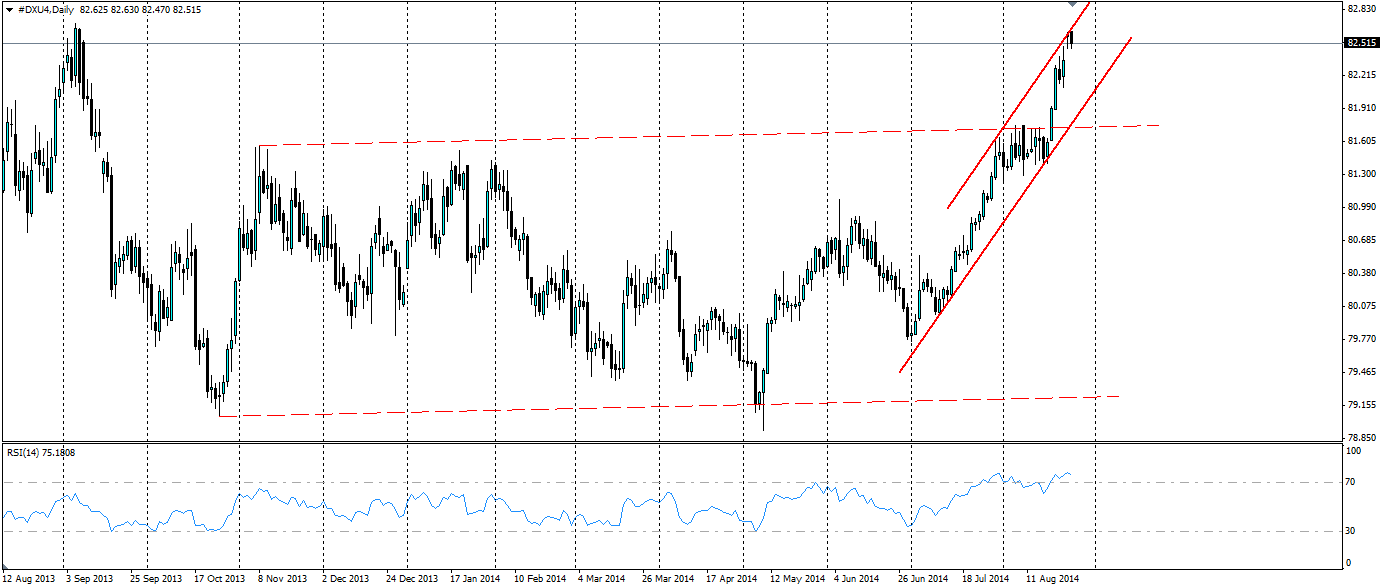

The US dollar has made a remarkable turnaround over the last five months as expected monetary policies diverge amongst some of the largest central banks. Optimism has returned along with the dollar bulls as the US recovery looks more robust and the EU continues to look shaky.

The effect the US Federal Reserve has on the markets is profound and much larger than any single news item and the hints they give can send the markets into a frenzy. Friday was no different as the world’s most powerful central bankers converged on Jackson Hole, Wyoming. US Federal Reserve Chairwoman Janet Yellen’s speech was much less dovish than the market is used to, suggesting that the federal funds rate may increase sooner than the Federal Reserve Open Market Committee (FOMC) currently expects.

This comment had an immediate effect on the US dollar as the bulls bid it higher. Yellen balanced the hawkish comments by warning that there is still significant slack in the labour market, but it is recovering well. If wage growth picks up, this could lead to inflation, which the Fed will combat by raising interest rates. Yellen summed it up by saying “Monetary policy is not on a pre-set path. The Committee will be closely monitoring incoming information on the labour market and inflation in determining the appropriate stance of monetary policy.”

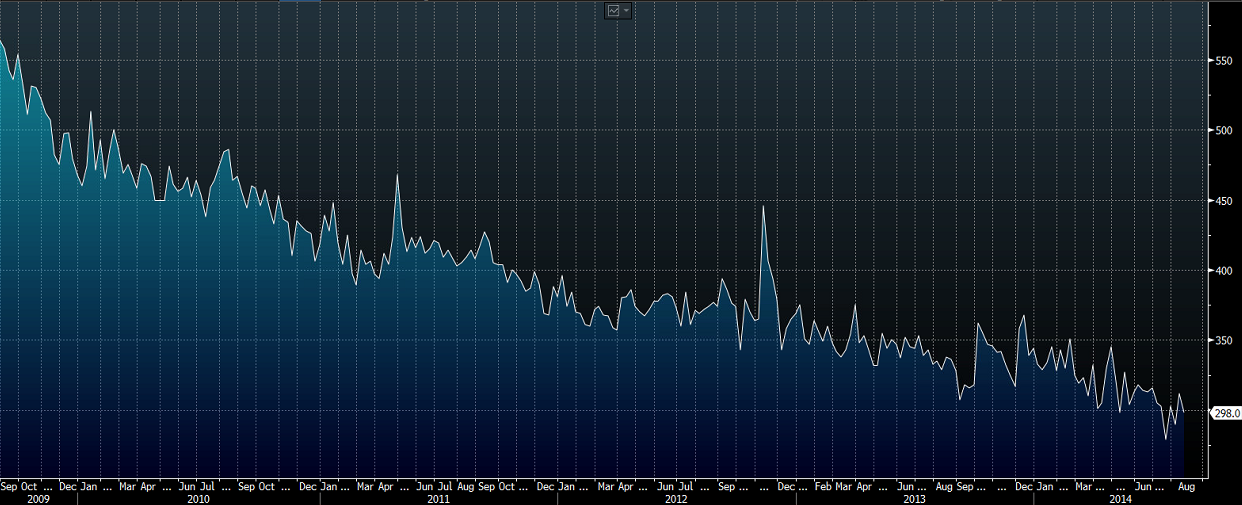

Clearly labour markets are a big talking point at the US Federal Reserve and this week will see US Unemployment Claims released on Thursday with Personal Income figures on Friday. Last week the Unemployment Claims figure surprised the market with 298k vs 302k expected. It has shown an encouraging trend over the course of the last five years as per the chart below.

The speech by the European Central Bank’s President Mario Draghi was a stark contrast to the speech given by the FED’s top banker. Mr Draghi said the ECB “stands ready to adjust our policy stance further” as they fight a stubbornly low inflation rate. The market now speculates the ECB will follow through and release another round of stimulus. This has helped drive the dollar index almost to a one year high and given the outlook, we could see it continue.

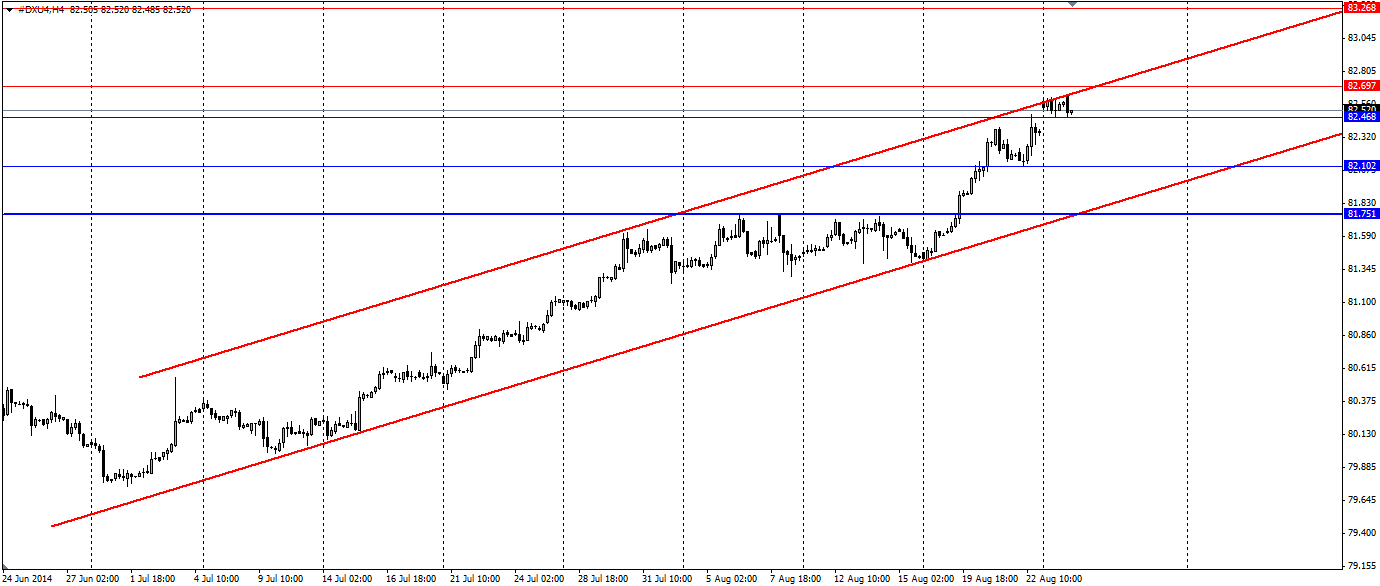

Looking at the dollar index on the Daily chart, it is clear that the ranging channel has now broken down with the bullish breakout, forming a new bullish channel at a very steep angle. We may see a slight pull back from the current price level after such an impulsive bullish run. The RSI is showing heavily overbought conditions, in fact the RSI reading from yesterday at 77.76 is the highest the RSI has been all year. It is likely we will see a consolidation towards the lower bullish trend line before using that as dynamic support for a movement higher.

Further support can be found at 82.468, 82.102 and 81.751 with the latter acting as solid support give the number of times it was tested as resistance on the way up. As stated above the bullish trend line will act as dynamic support and is likely to come into play at some stage as the price moves off the upper level of the channel. Resistance for a movement higher is found at 82.697 and 83.268 with the channel acting as dynamic resistance.

The US dollar index is on a strong bullish run fuelled by the prospect of the Fed raising interest rates and optimistic data. The pain being felt in the EU is aiding the dollar and the formation of the bullish channel makes this index one to watch.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.