The Kiwi dollar has lost its shine recently as milk prices have continually been falling and the result is a touch of the trend line against the Euro. We should see a bounce lower off it and the carry trade on the interest differential will provide a second avenue for traders to profit from.

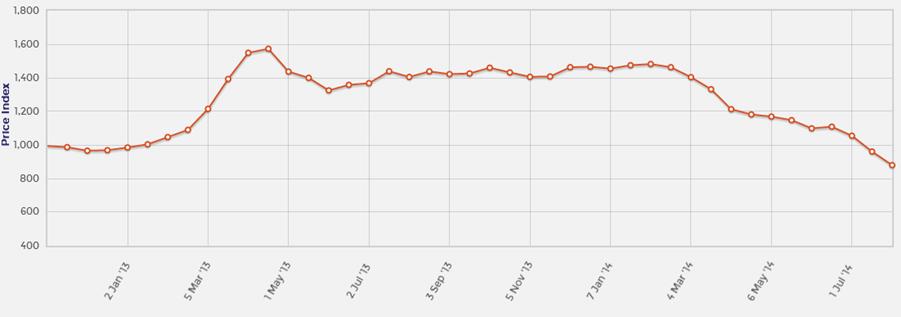

The Dairy price index has fallen a long way over the course of the year,-40.6% since Feb 4th to be precise, however, the kiwi has only really felt the strain in the last month. The Reserve Bank of New Zealand said it would pause and assess the situation before raising interest rates any further. They have raised rates a full 100 basis points since March to bring the rate to 3.50%.

By contrast the Euro has taken a pummelling in every market since the European Central Bank (ECB) said it would enact stimulus. A dangerously low inflation rate,at just 0.4% at present, means we could see another round of stimulus from the ECB. At the end of last week they held interest rates at their historic lows of just 0.15% for loans and -0.10% for deposits. At the press conference ECB president Mario Draghi said he is pleased with how much the Euro has fallen and said the fundamentals support this.

The Euro could fall further with German CPI figures due out this week, which are expected to show inflation at just 0.3%. German economic sentiment is due this week and is expected to fall from 27.1 to 17.6. Also this week Germany and France are reporting GDP figures which are expected to show Germany contracting at -0.1% and just 0.1% growth in France in the last quarter. These figures could weigh heavily on the Euro. The Kiwi has a relatively quiet week ahead with just retail sales on Wednesday to note.

The Carry trade between the two of these is another aspect that is drawing in the bears. With the interest rate differential, taking the Euro short against the Kiwi will earn a very nice swap. The outlook for the carry trade is a very favourable one; with the possibility the RBNZ will resume raising interest rates with a ‘neutral rate target’ of 4.5%. The ECB is unlikely to begin to raise interest rates in the medium to long term. In fact, it could be years before we see any upward risk to EU interest rates.

The trend line is what makes this trade an opportune one. The price has twice tested the bearish trend line in the last couple of days and it appears at this stage to be holding firm. An entry can be taken below the current support to catch the downward momentum. A tight stop loss can be set for this setup because the price is so close to the trend line. A stop loss can be put in at 1.5869 to mitigate any losses from a breakout.

The longer target for this play would be the support at the low around 1.5410. This may be a little ambitious for the short term traders out there so other likely targets can be found at previous support levels such as 1.5695, 1.5613 and 1.5456.

The EURNZD pair is looking likely for a bounce off the trend line and a movement lower. The carry trade will also provide an extra earner for anyone bearish on this pair.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.